Bank of New York Mellon Corp bought a new stake in shares of Sociedad Química y Minera de Chile S.A. (NYSE:SQM - Free Report) in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor bought 10,819 shares of the basic materials company's stock, valued at approximately $393,000.

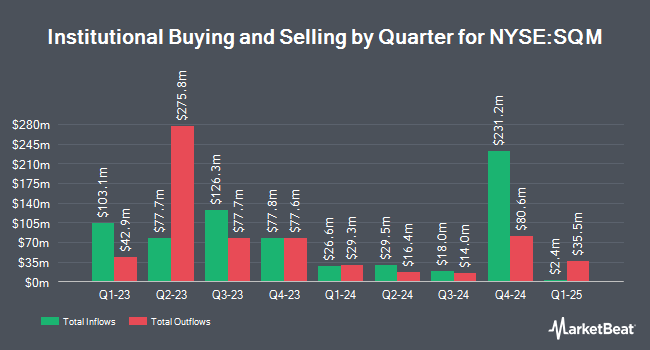

Other hedge funds have also recently added to or reduced their stakes in the company. Bank of Montreal Can lifted its stake in shares of Sociedad Química y Minera de Chile by 19.7% in the 3rd quarter. Bank of Montreal Can now owns 109,286 shares of the basic materials company's stock valued at $4,555,000 after purchasing an additional 18,001 shares during the period. The Manufacturers Life Insurance Company lifted its stake in Sociedad Química y Minera de Chile by 19.3% in the third quarter. The Manufacturers Life Insurance Company now owns 13,148 shares of the basic materials company's stock valued at $548,000 after buying an additional 2,128 shares during the period. FMR LLC boosted its holdings in shares of Sociedad Química y Minera de Chile by 1,076.3% during the 3rd quarter. FMR LLC now owns 18,726 shares of the basic materials company's stock worth $781,000 after buying an additional 17,134 shares in the last quarter. BNP Paribas Financial Markets grew its position in shares of Sociedad Química y Minera de Chile by 15.7% during the 3rd quarter. BNP Paribas Financial Markets now owns 152,048 shares of the basic materials company's stock worth $6,337,000 after buying an additional 20,616 shares during the period. Finally, Zurcher Kantonalbank Zurich Cantonalbank increased its stake in shares of Sociedad Química y Minera de Chile by 5.0% in the 3rd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 99,854 shares of the basic materials company's stock valued at $4,162,000 after acquiring an additional 4,743 shares in the last quarter. Institutional investors own 12.41% of the company's stock.

Sociedad Química y Minera de Chile Stock Down 0.5 %

NYSE SQM traded down $0.21 on Wednesday, hitting $39.84. 452,275 shares of the company were exchanged, compared to its average volume of 1,065,541. The company has a current ratio of 2.94, a quick ratio of 2.05 and a debt-to-equity ratio of 0.74. The company has a market cap of $11.38 billion, a PE ratio of -35.89, a PEG ratio of 5.00 and a beta of 1.08. The stock has a fifty day moving average of $40.40 and a 200-day moving average of $39.53. Sociedad Química y Minera de Chile S.A. has a 12 month low of $32.24 and a 12 month high of $51.90.

Sociedad Química y Minera de Chile (NYSE:SQM - Get Free Report) last released its quarterly earnings data on Tuesday, March 4th. The basic materials company reported $0.42 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.52 by ($0.10). Sociedad Química y Minera de Chile had a positive return on equity of 16.12% and a negative net margin of 6.74%. The company had revenue of $1.07 billion for the quarter, compared to the consensus estimate of $1.01 billion. As a group, analysts forecast that Sociedad Química y Minera de Chile S.A. will post -1.31 earnings per share for the current year.

Sociedad Química y Minera de Chile Company Profile

(

Free Report)

Sociedad Química y Minera de Chile SA operates as a mining company worldwide. The company offers specialty plant nutrients, including sodium potassium nitrate, specialty blends, and other specialty fertilizers under Ultrasol, Qrop, Speedfol, Allganic, Ultrasoline, ProP, and Prohydric brands. It also provides iodine and its derivatives for use in medical, agricultural, industrial, and human and animal nutrition products comprising x-ray contrast media, biocides, antiseptics and disinfectants, pharmaceutical intermediates, polarizing films for LCD and LED screens, chemicals, organic compounds, and pigments, as well as added to edible salt to prevent iodine deficiency disorders.

See Also

Before you consider Sociedad Química y Minera de Chile, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sociedad Química y Minera de Chile wasn't on the list.

While Sociedad Química y Minera de Chile currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.