Bank of New York Mellon Corp reduced its stake in Tootsie Roll Industries, Inc. (NYSE:TR - Free Report) by 13.0% in the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 140,207 shares of the company's stock after selling 20,998 shares during the quarter. Bank of New York Mellon Corp owned approximately 0.20% of Tootsie Roll Industries worth $4,533,000 at the end of the most recent quarter.

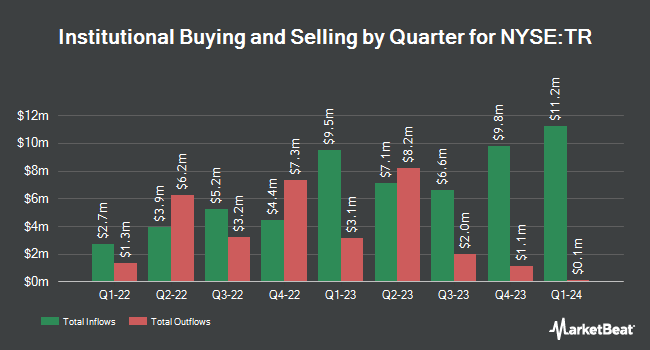

Other hedge funds have also recently modified their holdings of the company. Byrne Asset Management LLC acquired a new stake in Tootsie Roll Industries in the 4th quarter valued at about $27,000. GAMMA Investing LLC lifted its position in Tootsie Roll Industries by 133.5% in the fourth quarter. GAMMA Investing LLC now owns 1,807 shares of the company's stock valued at $58,000 after acquiring an additional 1,033 shares during the last quarter. Wilmington Savings Fund Society FSB acquired a new stake in shares of Tootsie Roll Industries in the 3rd quarter valued at about $96,000. Barclays PLC grew its position in shares of Tootsie Roll Industries by 227.2% during the third quarter. Barclays PLC now owns 5,566 shares of the company's stock worth $171,000 after acquiring an additional 3,865 shares during the last quarter. Finally, Pacer Advisors Inc. acquired a new position in Tootsie Roll Industries in the fourth quarter valued at $176,000. Hedge funds and other institutional investors own 14.28% of the company's stock.

Tootsie Roll Industries Stock Performance

Tootsie Roll Industries stock traded down $0.07 during trading hours on Friday, reaching $31.39. 65,286 shares of the stock were exchanged, compared to its average volume of 159,287. The firm's 50 day moving average is $31.27 and its 200 day moving average is $31.40. Tootsie Roll Industries, Inc. has a 52-week low of $26.78 and a 52-week high of $33.22. The stock has a market cap of $2.25 billion, a P/E ratio of 25.73 and a beta of 0.19.

Tootsie Roll Industries Increases Dividend

The company also recently declared a -- dividend, which will be paid on Thursday, March 27th. Stockholders of record on Wednesday, March 5th will be given a $3.00 dividend. The ex-dividend date of this dividend is Wednesday, March 5th. This represents a dividend yield of 1.1%. This is a boost from Tootsie Roll Industries's previous -- dividend of $0.09. Tootsie Roll Industries's dividend payout ratio (DPR) is currently 30.51%.

Tootsie Roll Industries Company Profile

(

Free Report)

Tootsie Roll Industries, Inc, together with its subsidiaries, engages in the manufacture and sale of confectionery products in the United States, Canada, Mexico, and internationally. It sells its products under the Tootsie Roll, Tootsie Fruit Rolls, Frooties, Tootsie Pops, Tootsie Mini Pops, Child's Play, Caramel Apple Pops, Charms, Blow-Pop, Charms Mini Pops, Cella's, Dots, Junior Mints, Charleston Chew, Sugar Daddy, Sugar Babies, Andes, Fluffy Stuff, Dubble Bubble, Razzles, Cry Baby, NIK-L-NIP, and Tutsi Pop trademarks.

Recommended Stories

Before you consider Tootsie Roll Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tootsie Roll Industries wasn't on the list.

While Tootsie Roll Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.