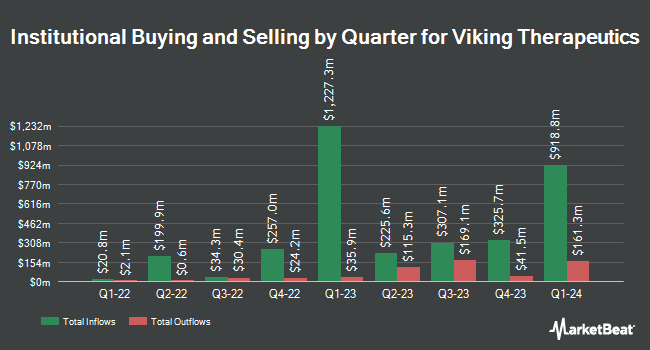

Bank of New York Mellon Corp boosted its stake in Viking Therapeutics, Inc. (NASDAQ:VKTX - Free Report) by 9.8% in the fourth quarter, according to the company in its most recent disclosure with the SEC. The firm owned 462,964 shares of the biotechnology company's stock after purchasing an additional 41,400 shares during the quarter. Bank of New York Mellon Corp owned about 0.42% of Viking Therapeutics worth $18,630,000 as of its most recent filing with the SEC.

Other institutional investors have also recently bought and sold shares of the company. Blue Trust Inc. grew its holdings in Viking Therapeutics by 75.9% in the fourth quarter. Blue Trust Inc. now owns 716 shares of the biotechnology company's stock valued at $29,000 after purchasing an additional 309 shares during the period. Stone House Investment Management LLC lifted its position in Viking Therapeutics by 66.7% during the third quarter. Stone House Investment Management LLC now owns 500 shares of the biotechnology company's stock valued at $32,000 after buying an additional 200 shares in the last quarter. YANKCOM Partnership acquired a new position in Viking Therapeutics during the fourth quarter valued at approximately $33,000. S.A. Mason LLC lifted its position in Viking Therapeutics by 20.0% during the fourth quarter. S.A. Mason LLC now owns 1,800 shares of the biotechnology company's stock valued at $72,000 after buying an additional 300 shares in the last quarter. Finally, Wolff Wiese Magana LLC acquired a new position in Viking Therapeutics during the fourth quarter valued at approximately $75,000. 76.03% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

A number of research analysts have weighed in on the stock. Scotiabank assumed coverage on shares of Viking Therapeutics in a research report on Thursday, February 13th. They set a "sector outperform" rating and a $102.00 price target on the stock. B. Riley reaffirmed a "buy" rating and set a $96.00 price target (down from $109.00) on shares of Viking Therapeutics in a research report on Friday, February 7th. Piper Sandler decreased their target price on shares of Viking Therapeutics from $74.00 to $71.00 and set an "overweight" rating for the company in a research note on Thursday, February 6th. Raymond James upped their target price on shares of Viking Therapeutics from $122.00 to $125.00 and gave the company a "strong-buy" rating in a research note on Thursday, February 6th. Finally, Citigroup began coverage on shares of Viking Therapeutics in a research note on Friday, February 7th. They issued a "neutral" rating and a $38.00 target price for the company. One analyst has rated the stock with a sell rating, one has assigned a hold rating, twelve have assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $96.31.

Check Out Our Latest Stock Report on VKTX

Viking Therapeutics Trading Down 5.2 %

Viking Therapeutics stock opened at $26.52 on Wednesday. The business has a 50-day moving average of $32.88 and a 200-day moving average of $49.33. Viking Therapeutics, Inc. has a 1 year low of $24.41 and a 1 year high of $89.10. The firm has a market capitalization of $2.98 billion, a P/E ratio of -26.52 and a beta of 0.90.

Viking Therapeutics (NASDAQ:VKTX - Get Free Report) last issued its quarterly earnings data on Wednesday, February 5th. The biotechnology company reported ($0.32) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.27) by ($0.05). During the same quarter last year, the business posted ($0.25) earnings per share. Research analysts anticipate that Viking Therapeutics, Inc. will post -1.56 EPS for the current fiscal year.

Insider Transactions at Viking Therapeutics

In other Viking Therapeutics news, COO Marianna Mancini sold 54,215 shares of the stock in a transaction on Monday, January 6th. The stock was sold at an average price of $42.75, for a total transaction of $2,317,691.25. Following the transaction, the chief operating officer now owns 374,134 shares in the company, valued at $15,994,228.50. This trade represents a 12.66 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CFO Greg Zante sold 50,309 shares of the stock in a transaction on Monday, January 6th. The stock was sold at an average price of $42.75, for a total value of $2,150,709.75. Following the transaction, the chief financial officer now owns 165,259 shares in the company, valued at $7,064,822.25. The trade was a 23.34 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 299,014 shares of company stock worth $12,782,849 in the last 90 days. Corporate insiders own 4.70% of the company's stock.

Viking Therapeutics Company Profile

(

Free Report)

Viking Therapeutics, Inc, a clinical-stage biopharmaceutical company, focuses on the development of novel therapies for metabolic and endocrine disorders. The company's lead drug candidate is VK2809, an orally available tissue and receptor-subtype selective agonist of the thyroid hormone receptor beta (TRß), which is in Phase IIb clinical trials to treat patients with biopsy-confirmed non-alcoholic steatohepatitis, as well as NAFLD.

Featured Articles

Want to see what other hedge funds are holding VKTX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Viking Therapeutics, Inc. (NASDAQ:VKTX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Viking Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viking Therapeutics wasn't on the list.

While Viking Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.