Bank of New York Mellon Corp lessened its stake in shares of Advance Auto Parts, Inc. (NYSE:AAP - Free Report) by 8.7% during the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 368,489 shares of the company's stock after selling 35,003 shares during the period. Bank of New York Mellon Corp owned 0.62% of Advance Auto Parts worth $17,426,000 at the end of the most recent reporting period.

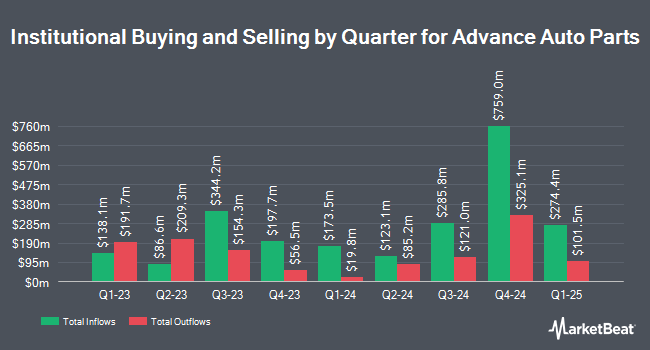

Other hedge funds and other institutional investors have also bought and sold shares of the company. Connor Clark & Lunn Investment Management Ltd. bought a new stake in Advance Auto Parts during the 3rd quarter valued at $14,684,000. Wolverine Asset Management LLC increased its stake in Advance Auto Parts by 212.4% during the 3rd quarter. Wolverine Asset Management LLC now owns 31,357 shares of the company's stock valued at $1,223,000 after purchasing an additional 21,320 shares in the last quarter. Blue Trust Inc. increased its stake in Advance Auto Parts by 75.9% during the 4th quarter. Blue Trust Inc. now owns 2,119 shares of the company's stock valued at $100,000 after purchasing an additional 914 shares in the last quarter. Quest Partners LLC bought a new stake in Advance Auto Parts during the 3rd quarter valued at $579,000. Finally, Moody National Bank Trust Division bought a new stake in Advance Auto Parts during the 4th quarter valued at $1,196,000. Institutional investors own 88.75% of the company's stock.

Insider Buying and Selling at Advance Auto Parts

In other news, Director Eugene I. Lee, Jr. purchased 14,640 shares of the stock in a transaction dated Thursday, March 6th. The shares were purchased at an average cost of $34.15 per share, with a total value of $499,956.00. Following the completion of the acquisition, the director now owns 34,070 shares in the company, valued at $1,163,490.50. This represents a 75.35 % increase in their position. The transaction was disclosed in a filing with the SEC, which is available through this hyperlink. Insiders own 0.35% of the company's stock.

Analysts Set New Price Targets

A number of brokerages have commented on AAP. DA Davidson restated a "neutral" rating and set a $45.00 price target on shares of Advance Auto Parts in a research note on Friday, November 15th. Wedbush reiterated an "outperform" rating and issued a $55.00 target price on shares of Advance Auto Parts in a research note on Monday, March 3rd. Truist Financial reduced their target price on shares of Advance Auto Parts from $39.00 to $34.00 and set a "hold" rating for the company in a research note on Thursday, February 27th. Evercore ISI reduced their target price on shares of Advance Auto Parts from $37.00 to $35.00 and set an "in-line" rating for the company in a research note on Tuesday. Finally, BMO Capital Markets reduced their target price on shares of Advance Auto Parts from $45.00 to $40.00 and set a "market perform" rating for the company in a research note on Thursday, February 27th. One equities research analyst has rated the stock with a sell rating, sixteen have given a hold rating and one has assigned a buy rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Hold" and an average target price of $45.13.

View Our Latest Stock Report on Advance Auto Parts

Advance Auto Parts Price Performance

NYSE AAP opened at $36.53 on Wednesday. The company has a market cap of $2.18 billion, a PE ratio of 50.04, a price-to-earnings-growth ratio of 1.98 and a beta of 1.27. Advance Auto Parts, Inc. has a 52 week low of $33.08 and a 52 week high of $88.56. The company has a quick ratio of 0.62, a current ratio of 1.34 and a debt-to-equity ratio of 0.69. The firm's 50-day simple moving average is $44.78 and its two-hundred day simple moving average is $42.45.

Advance Auto Parts Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, April 25th. Shareholders of record on Friday, April 11th will be issued a dividend of $0.25 per share. This represents a $1.00 annualized dividend and a yield of 2.74%. The ex-dividend date is Friday, April 11th. Advance Auto Parts's dividend payout ratio (DPR) is presently -17.86%.

About Advance Auto Parts

(

Free Report)

Advance Auto Parts, Inc provides automotive replacement parts, accessories, batteries, and maintenance items for domestic and imported cars, vans, sport utility vehicles, and light and heavy duty trucks. The company offers battery accessories; belts and hoses; brakes and brake pads; chassis and climate control parts; clutches and drive shafts; engines and engine parts; exhaust systems and parts; hub assemblies; ignition components and wires; radiators and cooling parts; starters and alternators; and steering and alignment parts.

Featured Articles

Want to see what other hedge funds are holding AAP? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Advance Auto Parts, Inc. (NYSE:AAP - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Advance Auto Parts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advance Auto Parts wasn't on the list.

While Advance Auto Parts currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.