Bank of New York Mellon Corp trimmed its holdings in Steelcase Inc. (NYSE:SCS - Free Report) by 20.5% in the 4th quarter, according to its most recent disclosure with the SEC. The firm owned 740,836 shares of the business services provider's stock after selling 190,744 shares during the period. Bank of New York Mellon Corp owned approximately 0.65% of Steelcase worth $8,757,000 at the end of the most recent quarter.

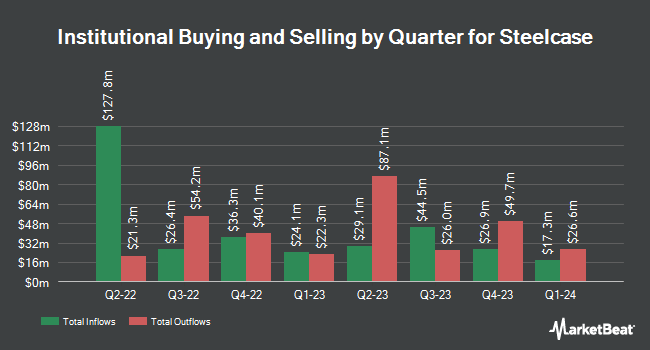

A number of other large investors also recently added to or reduced their stakes in SCS. R Squared Ltd acquired a new stake in shares of Steelcase in the fourth quarter valued at $36,000. Olympiad Research LP acquired a new stake in shares of Steelcase in the fourth quarter valued at $134,000. Centiva Capital LP acquired a new stake in shares of Steelcase in the third quarter valued at $181,000. Ieq Capital LLC acquired a new stake in shares of Steelcase in the fourth quarter valued at $203,000. Finally, Handelsbanken Fonder AB raised its stake in shares of Steelcase by 33.3% in the fourth quarter. Handelsbanken Fonder AB now owns 26,418 shares of the business services provider's stock valued at $312,000 after acquiring an additional 6,600 shares in the last quarter. 92.42% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling at Steelcase

In other Steelcase news, VP Robert G. Krestakos sold 5,000 shares of the firm's stock in a transaction dated Wednesday, January 22nd. The stock was sold at an average price of $11.74, for a total transaction of $58,700.00. Following the transaction, the vice president now owns 114,481 shares of the company's stock, valued at approximately $1,344,006.94. This trade represents a 4.18 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. 12.96% of the stock is owned by insiders.

Steelcase Stock Down 0.9 %

Steelcase stock traded down $0.10 during midday trading on Tuesday, reaching $10.92. The company's stock had a trading volume of 569,996 shares, compared to its average volume of 584,010. Steelcase Inc. has a fifty-two week low of $10.78 and a fifty-two week high of $14.74. The company has a quick ratio of 1.21, a current ratio of 1.57 and a debt-to-equity ratio of 0.48. The company has a market cap of $1.24 billion, a P/E ratio of 11.37, a P/E/G ratio of 1.25 and a beta of 1.33. The business has a 50-day simple moving average of $11.68 and a 200-day simple moving average of $12.51.

Steelcase (NYSE:SCS - Get Free Report) last posted its quarterly earnings results on Wednesday, December 18th. The business services provider reported $0.30 earnings per share for the quarter, beating analysts' consensus estimates of $0.23 by $0.07. Steelcase had a return on equity of 14.20% and a net margin of 3.63%. The company had revenue of $794.90 million for the quarter, compared to analysts' expectations of $796.58 million. During the same period last year, the firm earned $0.30 earnings per share. Steelcase's quarterly revenue was up 2.2% on a year-over-year basis. On average, research analysts expect that Steelcase Inc. will post 1 earnings per share for the current fiscal year.

Steelcase Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Monday, January 13th. Shareholders of record on Monday, December 30th were paid a $0.10 dividend. This represents a $0.40 dividend on an annualized basis and a yield of 3.66%. The ex-dividend date was Monday, December 30th. Steelcase's dividend payout ratio is presently 41.67%.

Steelcase Company Profile

(

Free Report)

Steelcase Inc provides a portfolio of furniture and architectural products and services in the United States and internationally. It operates through Americas and International segments. The company's furniture portfolio includes furniture systems, seating, storage, fixed and height-adjustable desks, benches, and tables, as well as complementary products, such as work accessories, lighting, mobile power, and screens.

Featured Articles

Before you consider Steelcase, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Steelcase wasn't on the list.

While Steelcase currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.