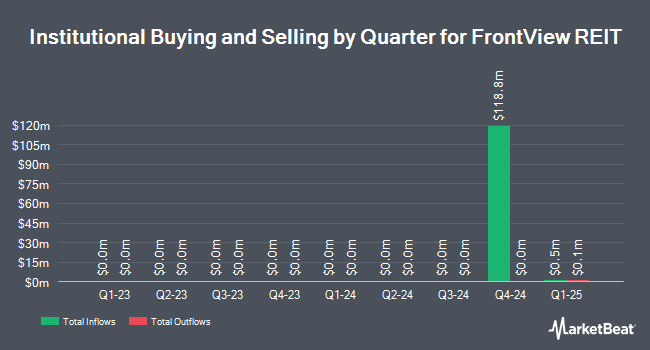

Bank of New York Mellon Corp bought a new position in shares of FrontView REIT, Inc. (NYSE:FVR - Free Report) in the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm bought 31,080 shares of the company's stock, valued at approximately $563,000. Bank of New York Mellon Corp owned about 0.19% of FrontView REIT as of its most recent filing with the Securities and Exchange Commission.

Other hedge funds and other institutional investors have also modified their holdings of the company. abrdn plc acquired a new position in FrontView REIT in the 4th quarter valued at $7,268,000. State of New Jersey Common Pension Fund D acquired a new position in shares of FrontView REIT in the fourth quarter valued at about $1,632,000. Exchange Traded Concepts LLC acquired a new position in shares of FrontView REIT in the fourth quarter valued at about $535,000. Rhumbline Advisers bought a new position in FrontView REIT during the fourth quarter worth about $295,000. Finally, Asset Management One Co. Ltd. acquired a new stake in FrontView REIT in the 4th quarter worth about $178,000.

FrontView REIT Trading Down 1.2 %

Shares of NYSE:FVR traded down $0.15 during midday trading on Monday, hitting $12.74. The stock had a trading volume of 372,801 shares, compared to its average volume of 268,333. FrontView REIT, Inc. has a fifty-two week low of $12.65 and a fifty-two week high of $19.76. The stock has a 50-day moving average price of $16.22.

FrontView REIT (NYSE:FVR - Get Free Report) last released its earnings results on Wednesday, March 19th. The company reported $0.27 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.29 by ($0.02). The business had revenue of $15.51 million during the quarter, compared to analysts' expectations of $15.45 million. On average, research analysts predict that FrontView REIT, Inc. will post 1.22 EPS for the current fiscal year.

FrontView REIT Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, April 15th. Shareholders of record on Monday, March 31st will be given a $0.215 dividend. The ex-dividend date of this dividend is Monday, March 31st. This represents a $0.86 dividend on an annualized basis and a yield of 6.75%.

Analysts Set New Price Targets

A number of brokerages have issued reports on FVR. Wells Fargo & Company decreased their target price on shares of FrontView REIT from $20.00 to $19.00 and set an "overweight" rating on the stock in a research report on Friday, March 14th. Morgan Stanley reduced their price target on FrontView REIT from $23.00 to $22.00 and set an "overweight" rating on the stock in a research report on Friday, January 3rd. Five research analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the company currently has a consensus rating of "Buy" and an average price target of $21.20.

Check Out Our Latest Research Report on FVR

Insiders Place Their Bets

In related news, CEO Randall Starr bought 3,716 shares of the business's stock in a transaction on Tuesday, March 25th. The shares were purchased at an average cost of $13.34 per share, with a total value of $49,571.44. Following the acquisition, the chief executive officer now owns 3,716 shares of the company's stock, valued at $49,571.44. This represents a ∞ increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink.

About FrontView REIT

(

Free Report)

FrontView REIT specializes in real estate investing.

Featured Stories

Before you consider FrontView REIT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FrontView REIT wasn't on the list.

While FrontView REIT currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.