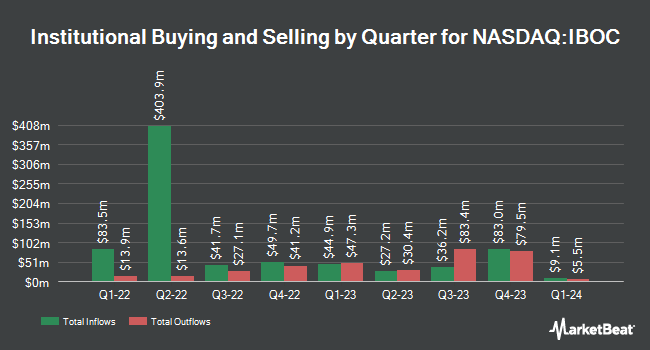

Bank of New York Mellon Corp lessened its position in shares of International Bancshares Co. (NASDAQ:IBOC - Free Report) by 21.2% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 497,450 shares of the bank's stock after selling 133,437 shares during the quarter. Bank of New York Mellon Corp owned approximately 0.80% of International Bancshares worth $31,419,000 as of its most recent filing with the Securities and Exchange Commission.

Other institutional investors and hedge funds have also modified their holdings of the company. Quantinno Capital Management LP raised its position in International Bancshares by 4.3% in the third quarter. Quantinno Capital Management LP now owns 5,465 shares of the bank's stock worth $327,000 after purchasing an additional 223 shares in the last quarter. Hancock Whitney Corp grew its stake in shares of International Bancshares by 1.7% in the 3rd quarter. Hancock Whitney Corp now owns 19,012 shares of the bank's stock valued at $1,137,000 after purchasing an additional 314 shares during the period. State of Alaska Department of Revenue raised its holdings in shares of International Bancshares by 7.3% in the 3rd quarter. State of Alaska Department of Revenue now owns 6,188 shares of the bank's stock worth $369,000 after buying an additional 420 shares in the last quarter. Monument Capital Management lifted its position in shares of International Bancshares by 12.1% during the 4th quarter. Monument Capital Management now owns 3,955 shares of the bank's stock worth $250,000 after buying an additional 427 shares during the period. Finally, Advantage Alpha Capital Partners LP boosted its stake in International Bancshares by 6.8% in the 3rd quarter. Advantage Alpha Capital Partners LP now owns 7,647 shares of the bank's stock valued at $457,000 after buying an additional 487 shares in the last quarter. 65.91% of the stock is currently owned by institutional investors.

International Bancshares Price Performance

NASDAQ:IBOC traded up $0.54 during trading hours on Wednesday, reaching $61.64. The company had a trading volume of 200,101 shares, compared to its average volume of 293,034. The firm has a market capitalization of $3.83 billion, a PE ratio of 9.59 and a beta of 0.88. The stock has a 50-day moving average of $65.03 and a two-hundred day moving average of $64.98. International Bancshares Co. has a one year low of $51.80 and a one year high of $76.91. The company has a quick ratio of 0.72, a current ratio of 0.72 and a debt-to-equity ratio of 0.04.

International Bancshares (NASDAQ:IBOC - Get Free Report) last posted its earnings results on Thursday, February 27th. The bank reported $1.85 earnings per share for the quarter. International Bancshares had a net margin of 38.65% and a return on equity of 15.62%.

International Bancshares Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, February 28th. Stockholders of record on Friday, February 14th were paid a $0.70 dividend. The ex-dividend date was Friday, February 14th. This represents a $2.80 dividend on an annualized basis and a dividend yield of 4.54%. This is a boost from International Bancshares's previous quarterly dividend of $0.27. International Bancshares's payout ratio is 21.31%.

About International Bancshares

(

Free Report)

International Bancshares Corporation, a financial holding company, provides commercial and retail banking services in Texas and the State of Oklahoma. It accepts checking and saving deposits; and offers commercial, real estate, personal, home improvement, automobile, and other installment and term loans.

Further Reading

Before you consider International Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Bancshares wasn't on the list.

While International Bancshares currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.