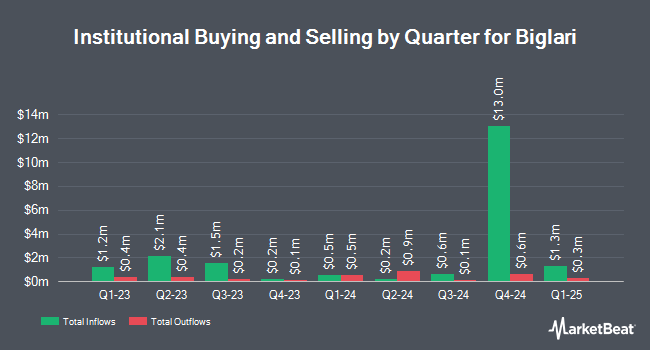

Bank of New York Mellon Corp cut its holdings in shares of Biglari Holdings Inc. (NYSE:BH - Free Report) by 45.6% during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,828 shares of the restaurant operator's stock after selling 1,530 shares during the period. Bank of New York Mellon Corp owned approximately 0.08% of Biglari worth $465,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in BH. Rhumbline Advisers lifted its stake in Biglari by 10.0% in the fourth quarter. Rhumbline Advisers now owns 1,139 shares of the restaurant operator's stock valued at $290,000 after buying an additional 104 shares in the last quarter. Peapod Lane Capital LLC bought a new stake in Biglari in the 4th quarter valued at $3,705,000. Allspring Global Investments Holdings LLC acquired a new position in Biglari in the 4th quarter worth $680,000. Empowered Funds LLC increased its holdings in Biglari by 1.6% during the 4th quarter. Empowered Funds LLC now owns 9,268 shares of the restaurant operator's stock worth $2,357,000 after purchasing an additional 150 shares in the last quarter. Finally, Atticus Wealth Management LLC acquired a new stake in shares of Biglari in the 4th quarter valued at about $25,000. 74.30% of the stock is owned by institutional investors and hedge funds.

Biglari Stock Up 0.3 %

Shares of BH traded up $0.65 during mid-day trading on Monday, hitting $216.79. 19,453 shares of the company's stock were exchanged, compared to its average volume of 4,689. The company has a debt-to-equity ratio of 0.17, a current ratio of 1.47 and a quick ratio of 1.44. Biglari Holdings Inc. has a 52 week low of $159.69 and a 52 week high of $271.35. The company has a market cap of $493.42 million, a PE ratio of 1.23 and a beta of 0.69. The company has a 50-day simple moving average of $227.84 and a 200 day simple moving average of $211.76.

Biglari (NYSE:BH - Get Free Report) last released its earnings results on Saturday, March 1st. The restaurant operator reported ($36.60) earnings per share for the quarter. Biglari had a net margin of 14.14% and a return on equity of 16.03%. The business had revenue of $91.12 million during the quarter.

Analyst Upgrades and Downgrades

Separately, StockNews.com cut Biglari from a "buy" rating to a "hold" rating in a research report on Tuesday, March 4th.

Check Out Our Latest Stock Analysis on BH

Biglari Company Profile

(

Free Report)

Biglari Holdings Inc, through its subsidiaries, primarily operates and franchises restaurants in the United States. It owns, operates, and franchises restaurants under the Steak n Shake and Western Sizzlin names. The company also engages in underwriting commercial trucking insurance; selling physical damage and non-trucking liability insurance to truckers; and providing property and casualty insurance.

Featured Stories

Before you consider Biglari, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Biglari wasn't on the list.

While Biglari currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.