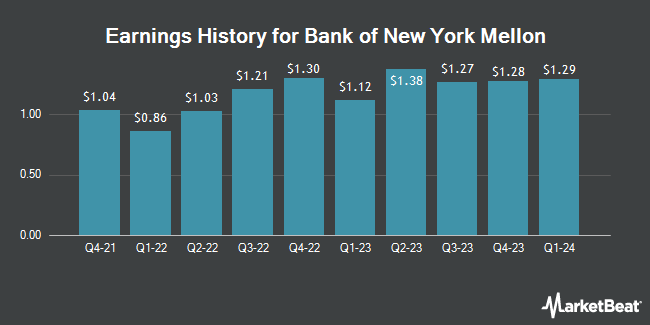

Bank of New York Mellon (NYSE:BK - Get Free Report) released its quarterly earnings results on Wednesday. The bank reported $1.72 EPS for the quarter, topping analysts' consensus estimates of $1.54 by $0.18, RTT News reports. The business had revenue of $4.85 billion for the quarter, compared to analyst estimates of $4.66 billion. Bank of New York Mellon had a net margin of 9.44% and a return on equity of 12.06%. Bank of New York Mellon's revenue for the quarter was up 11.2% compared to the same quarter last year. During the same period last year, the firm earned $1.28 earnings per share.

Bank of New York Mellon Stock Up 7.9 %

Shares of BK stock traded up $6.01 during trading hours on Wednesday, reaching $81.95. The company had a trading volume of 9,273,410 shares, compared to its average volume of 4,370,383. The business has a fifty day simple moving average of $78.58 and a 200-day simple moving average of $71.94. The company has a market cap of $59.58 billion, a price-to-earnings ratio of 17.82, a price-to-earnings-growth ratio of 0.91 and a beta of 1.08. The company has a debt-to-equity ratio of 0.89, a current ratio of 0.70 and a quick ratio of 0.70. Bank of New York Mellon has a 12 month low of $52.64 and a 12 month high of $82.72.

Bank of New York Mellon Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, February 7th. Shareholders of record on Monday, January 27th will be paid a $0.47 dividend. This represents a $1.88 dividend on an annualized basis and a dividend yield of 2.29%. Bank of New York Mellon's dividend payout ratio (DPR) is 40.87%.

Wall Street Analyst Weigh In

Several equities analysts have weighed in on the company. JPMorgan Chase & Co. lifted their price objective on Bank of New York Mellon from $69.00 to $77.00 and gave the company an "overweight" rating in a report on Monday, October 7th. Citigroup boosted their price target on Bank of New York Mellon from $75.00 to $82.00 and gave the company a "neutral" rating in a research note on Monday, November 25th. Keefe, Bruyette & Woods increased their price objective on shares of Bank of New York Mellon from $87.00 to $96.00 and gave the stock an "outperform" rating in a research note on Tuesday, December 3rd. Morgan Stanley decreased their target price on shares of Bank of New York Mellon from $94.00 to $90.00 and set an "overweight" rating on the stock in a report on Friday, January 3rd. Finally, Deutsche Bank Aktiengesellschaft raised their target price on Bank of New York Mellon from $82.00 to $85.00 and gave the company a "buy" rating in a report on Monday, November 11th. Five analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $82.64.

Read Our Latest Stock Analysis on Bank of New York Mellon

About Bank of New York Mellon

(

Get Free Report)

The Bank of New York Mellon Corporation provides a range of financial products and services in the United States and internationally. The company operates through Securities Services, Market and Wealth Services, Investment and Wealth Management, and other segments. The Securities Services segment offers custody, trust and depositary, accounting, exchange-traded funds, middle-office solutions, transfer agency, services for private equity and real estate funds, foreign exchange, securities lending, liquidity/lending services, and data analytics.

See Also

Before you consider Bank of New York Mellon, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of New York Mellon wasn't on the list.

While Bank of New York Mellon currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.