Bank of Nova Scotia trimmed its holdings in shares of Colgate-Palmolive (NYSE:CL - Free Report) by 38.3% during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 218,305 shares of the company's stock after selling 135,340 shares during the quarter. Bank of Nova Scotia's holdings in Colgate-Palmolive were worth $19,846,000 as of its most recent filing with the SEC.

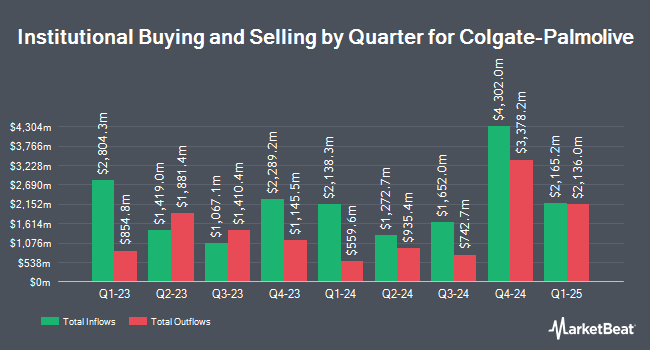

Several other hedge funds and other institutional investors have also bought and sold shares of the business. MML Investors Services LLC increased its stake in Colgate-Palmolive by 117.6% in the third quarter. MML Investors Services LLC now owns 83,184 shares of the company's stock valued at $8,635,000 after acquiring an additional 44,954 shares during the last quarter. Continuum Advisory LLC raised its holdings in shares of Colgate-Palmolive by 93.4% during the 3rd quarter. Continuum Advisory LLC now owns 762 shares of the company's stock worth $79,000 after buying an additional 368 shares in the last quarter. Barclays PLC lifted its position in shares of Colgate-Palmolive by 38.7% during the 3rd quarter. Barclays PLC now owns 7,644,189 shares of the company's stock worth $793,542,000 after buying an additional 2,132,747 shares during the last quarter. M&T Bank Corp boosted its stake in Colgate-Palmolive by 8.2% in the third quarter. M&T Bank Corp now owns 288,050 shares of the company's stock valued at $29,903,000 after buying an additional 21,862 shares in the last quarter. Finally, Coldstream Capital Management Inc. grew its position in Colgate-Palmolive by 9.2% in the third quarter. Coldstream Capital Management Inc. now owns 11,699 shares of the company's stock valued at $1,202,000 after acquiring an additional 990 shares during the last quarter. Institutional investors and hedge funds own 80.41% of the company's stock.

Analysts Set New Price Targets

A number of research analysts have recently commented on the stock. Stifel Nicolaus dropped their target price on shares of Colgate-Palmolive from $95.00 to $93.00 and set a "hold" rating for the company in a report on Monday, February 3rd. Morgan Stanley decreased their target price on shares of Colgate-Palmolive from $111.00 to $104.00 and set an "overweight" rating on the stock in a research note on Monday, February 3rd. Royal Bank of Canada reiterated a "sector perform" rating and set a $101.00 price target on shares of Colgate-Palmolive in a report on Wednesday, January 29th. Piper Sandler reduced their price objective on Colgate-Palmolive from $108.00 to $107.00 and set an "overweight" rating on the stock in a research report on Monday, March 31st. Finally, UBS Group dropped their target price on Colgate-Palmolive from $104.00 to $100.00 and set a "buy" rating for the company in a research report on Monday, February 3rd. One investment analyst has rated the stock with a sell rating, nine have issued a hold rating and twelve have issued a buy rating to the company's stock. According to data from MarketBeat, Colgate-Palmolive currently has an average rating of "Moderate Buy" and a consensus target price of $101.67.

Read Our Latest Research Report on Colgate-Palmolive

Colgate-Palmolive Stock Up 0.1 %

Colgate-Palmolive stock traded up $0.08 during midday trading on Tuesday, reaching $95.06. The stock had a trading volume of 1,025,468 shares, compared to its average volume of 5,248,743. The company has a current ratio of 0.92, a quick ratio of 0.58 and a debt-to-equity ratio of 13.40. Colgate-Palmolive has a 12 month low of $85.32 and a 12 month high of $109.30. The company has a fifty day moving average price of $90.65 and a two-hundred day moving average price of $92.51. The company has a market capitalization of $77.10 billion, a P/E ratio of 27.01, a PEG ratio of 4.20 and a beta of 0.40.

Colgate-Palmolive (NYSE:CL - Get Free Report) last posted its quarterly earnings results on Friday, January 31st. The company reported $0.91 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.90 by $0.01. Colgate-Palmolive had a net margin of 14.38% and a return on equity of 477.77%. During the same period in the prior year, the company posted $0.87 earnings per share. As a group, equities analysts expect that Colgate-Palmolive will post 3.75 EPS for the current fiscal year.

Colgate-Palmolive Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Thursday, May 15th. Stockholders of record on Thursday, April 17th will be issued a $0.52 dividend. This represents a $2.08 dividend on an annualized basis and a dividend yield of 2.19%. The ex-dividend date of this dividend is Thursday, April 17th. This is a positive change from Colgate-Palmolive's previous quarterly dividend of $0.50. Colgate-Palmolive's dividend payout ratio (DPR) is currently 59.09%.

Colgate-Palmolive announced that its board has initiated a stock buyback program on Thursday, March 20th that permits the company to repurchase $5.00 billion in shares. This repurchase authorization permits the company to buy up to 6.8% of its stock through open market purchases. Stock repurchase programs are generally an indication that the company's board of directors believes its stock is undervalued.

About Colgate-Palmolive

(

Free Report)

Colgate-Palmolive Company, together with its subsidiaries, manufactures and sells consumer products in the United States and internationally. It operates through two segments: Oral, Personal and Home Care; and Pet Nutrition. The Oral, Personal and Home Care segment offers toothpaste, toothbrushes, mouthwash, bar and liquid hand soaps, shower gels, shampoos, conditioners, deodorants and antiperspirants, skin health products, dishwashing detergents, fabric conditioners, household cleaners, and other related items.

Featured Articles

Before you consider Colgate-Palmolive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Colgate-Palmolive wasn't on the list.

While Colgate-Palmolive currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.