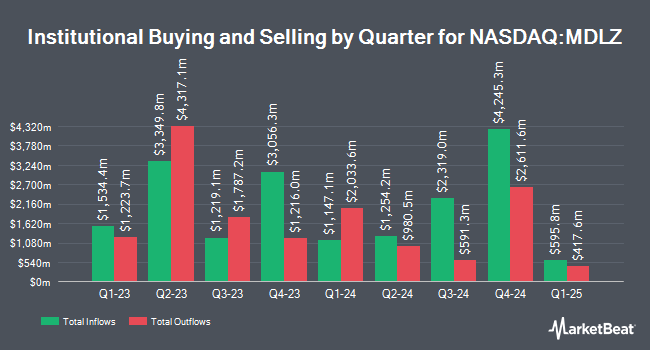

Bank of Nova Scotia increased its holdings in shares of Mondelez International, Inc. (NASDAQ:MDLZ - Free Report) by 331.9% during the 4th quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 1,394,430 shares of the company's stock after acquiring an additional 1,071,596 shares during the period. Bank of Nova Scotia owned about 0.10% of Mondelez International worth $83,289,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds have also added to or reduced their stakes in the business. Marshall Investment Management LLC acquired a new position in Mondelez International in the fourth quarter worth $26,000. Hager Investment Management Services LLC acquired a new position in shares of Mondelez International during the fourth quarter worth approximately $27,000. Kohmann Bosshard Financial Services LLC bought a new stake in shares of Mondelez International during the fourth quarter valued at approximately $31,000. McClarren Financial Advisors Inc. acquired a new position in Mondelez International during the 4th quarter worth $32,000. Finally, Sierra Ocean LLC bought a new position in Mondelez International in the 4th quarter valued at $32,000. Institutional investors own 78.32% of the company's stock.

Mondelez International Stock Performance

Mondelez International stock traded up $1.07 during midday trading on Friday, hitting $67.05. The company's stock had a trading volume of 8,840,632 shares, compared to its average volume of 8,046,489. The company has a 50-day moving average price of $64.38 and a two-hundred day moving average price of $64.18. Mondelez International, Inc. has a 1-year low of $53.95 and a 1-year high of $76.06. The company has a market cap of $86.73 billion, a price-to-earnings ratio of 19.61, a PEG ratio of 4.34 and a beta of 0.47. The company has a debt-to-equity ratio of 0.58, a current ratio of 0.68 and a quick ratio of 0.48.

Mondelez International (NASDAQ:MDLZ - Get Free Report) last released its earnings results on Tuesday, February 4th. The company reported $0.65 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.66 by ($0.01). Mondelez International had a return on equity of 16.75% and a net margin of 12.68%. As a group, sell-side analysts predict that Mondelez International, Inc. will post 2.9 earnings per share for the current year.

Mondelez International Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Monday, April 14th. Stockholders of record on Monday, March 31st will be paid a $0.47 dividend. The ex-dividend date of this dividend is Monday, March 31st. This represents a $1.88 annualized dividend and a dividend yield of 2.80%. Mondelez International's payout ratio is 54.97%.

Analyst Ratings Changes

Several equities analysts recently issued reports on MDLZ shares. Royal Bank of Canada decreased their price target on Mondelez International from $75.00 to $69.00 and set an "outperform" rating on the stock in a report on Thursday, February 6th. Morgan Stanley started coverage on Mondelez International in a research note on Monday, March 24th. They issued an "overweight" rating and a $69.00 price target for the company. The Goldman Sachs Group cut their price target on shares of Mondelez International from $68.00 to $60.00 and set a "buy" rating on the stock in a research report on Thursday, February 6th. Deutsche Bank Aktiengesellschaft decreased their price objective on shares of Mondelez International from $67.00 to $62.00 and set a "hold" rating for the company in a report on Wednesday, January 22nd. Finally, Wells Fargo & Company increased their target price on shares of Mondelez International from $64.00 to $68.00 and gave the stock an "equal weight" rating in a report on Wednesday, April 2nd. One investment analyst has rated the stock with a sell rating, seven have given a hold rating and fourteen have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus price target of $70.50.

Read Our Latest Research Report on Mondelez International

Mondelez International Company Profile

(

Free Report)

Mondelez International, Inc, through its subsidiaries, manufactures, markets, and sells snack food and beverage products in the Latin America, North America, Asia, the Middle East, Africa, and Europe. It provides biscuits and baked snacks, including cookies, crackers, salted snacks, snack bars, and cakes and pastries; chocolates; and gums and candies, as well as various cheese and grocery, and powdered beverage products.

Further Reading

Before you consider Mondelez International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mondelez International wasn't on the list.

While Mondelez International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.