BankPlus Trust Department purchased a new stake in The TJX Companies, Inc. (NYSE:TJX - Free Report) in the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The firm purchased 26,003 shares of the apparel and home fashions retailer's stock, valued at approximately $3,141,000. TJX Companies comprises 1.0% of BankPlus Trust Department's holdings, making the stock its 16th biggest holding.

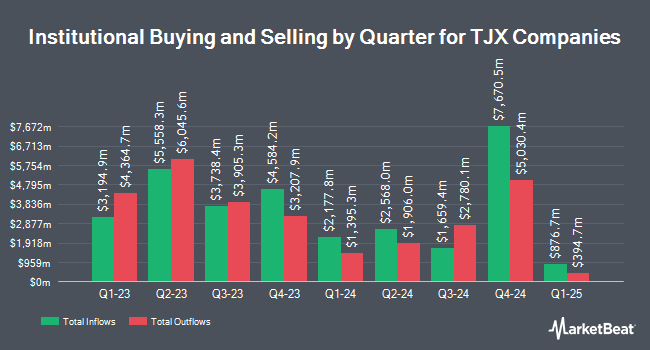

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Provident Trust Co. raised its stake in shares of TJX Companies by 71.3% in the fourth quarter. Provident Trust Co. now owns 2,723,149 shares of the apparel and home fashions retailer's stock worth $328,984,000 after purchasing an additional 1,133,486 shares during the last quarter. Caisse DE Depot ET Placement DU Quebec raised its stake in shares of TJX Companies by 161.3% in the third quarter. Caisse DE Depot ET Placement DU Quebec now owns 1,786,652 shares of the apparel and home fashions retailer's stock worth $210,003,000 after purchasing an additional 1,102,912 shares during the last quarter. Robeco Institutional Asset Management B.V. raised its stake in shares of TJX Companies by 281.6% in the third quarter. Robeco Institutional Asset Management B.V. now owns 1,235,037 shares of the apparel and home fashions retailer's stock worth $145,166,000 after purchasing an additional 911,351 shares during the last quarter. Canoe Financial LP raised its stake in shares of TJX Companies by 564.0% in the fourth quarter. Canoe Financial LP now owns 1,064,217 shares of the apparel and home fashions retailer's stock worth $128,568,000 after purchasing an additional 903,939 shares during the last quarter. Finally, Nordea Investment Management AB raised its stake in shares of TJX Companies by 13.3% in the fourth quarter. Nordea Investment Management AB now owns 7,031,237 shares of the apparel and home fashions retailer's stock worth $850,428,000 after purchasing an additional 827,103 shares during the last quarter. 91.09% of the stock is currently owned by hedge funds and other institutional investors.

TJX Companies Price Performance

TJX traded up $0.24 during trading on Monday, hitting $121.35. The company's stock had a trading volume of 5,292,225 shares, compared to its average volume of 4,350,497. The company has a current ratio of 1.19, a quick ratio of 0.50 and a debt-to-equity ratio of 0.35. The business's fifty day simple moving average is $122.86 and its 200 day simple moving average is $119.64. The firm has a market capitalization of $136.42 billion, a price-to-earnings ratio of 28.55, a P/E/G ratio of 2.75 and a beta of 0.91. The TJX Companies, Inc. has a twelve month low of $92.35 and a twelve month high of $128.00.

TJX Companies Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Thursday, March 6th. Stockholders of record on Thursday, February 13th will be paid a $0.375 dividend. This represents a $1.50 dividend on an annualized basis and a dividend yield of 1.24%. The ex-dividend date of this dividend is Thursday, February 13th. TJX Companies's dividend payout ratio is presently 35.29%.

Analysts Set New Price Targets

TJX has been the subject of several research analyst reports. StockNews.com upgraded TJX Companies from a "hold" rating to a "buy" rating in a research note on Saturday, November 30th. UBS Group raised their price objective on TJX Companies from $148.00 to $151.00 and gave the stock a "buy" rating in a research note on Friday, January 10th. Morgan Stanley raised their target price on TJX Companies from $130.00 to $135.00 and gave the stock an "overweight" rating in a report on Tuesday, January 21st. Robert W. Baird raised their target price on TJX Companies from $133.00 to $138.00 and gave the stock an "outperform" rating in a report on Thursday, December 5th. Finally, Wells Fargo & Company raised their target price on TJX Companies from $115.00 to $120.00 and gave the stock an "equal weight" rating in a report on Friday, January 10th. Two research analysts have rated the stock with a hold rating and sixteen have assigned a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $134.18.

Read Our Latest Stock Report on TJX Companies

About TJX Companies

(

Free Report)

The TJX Companies, Inc, together with its subsidiaries, operates as an off-price apparel and home fashions retailer in the United States, Canada, Europe, and Australia. It operates through four segments: Marmaxx, HomeGoods, TJX Canada, and TJX International. The company sells family apparel, including footwear and accessories; home fashions, such as home basics, furniture, rugs, lighting products, giftware, soft home products, decorative accessories, tabletop, and cookware, as well as expanded pet, and gourmet food departments; jewelry and accessories; and other merchandise.

Featured Articles

Before you consider TJX Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TJX Companies wasn't on the list.

While TJX Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.