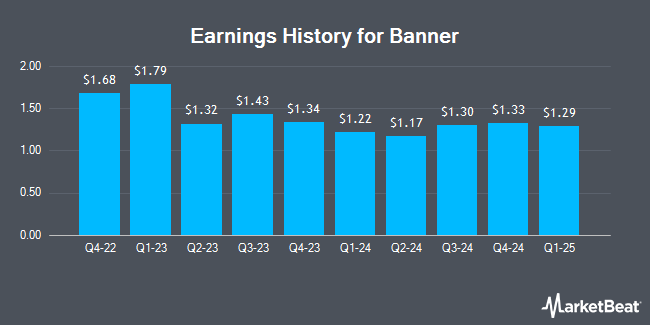

Banner (NASDAQ:BANR - Get Free Report) posted its earnings results on Wednesday. The financial services provider reported $1.33 EPS for the quarter, topping the consensus estimate of $1.22 by $0.11, Zacks reports. Banner had a net margin of 20.28% and a return on equity of 10.22%.

Banner Price Performance

Shares of NASDAQ:BANR traded down $0.50 during midday trading on Wednesday, reaching $70.17. 314,471 shares of the company's stock were exchanged, compared to its average volume of 253,271. The company has a debt-to-equity ratio of 0.30, a quick ratio of 0.84 and a current ratio of 0.85. The company's 50 day simple moving average is $70.49 and its two-hundred day simple moving average is $63.51. Banner has a 12 month low of $42.00 and a 12 month high of $78.05. The firm has a market capitalization of $2.42 billion, a PE ratio of 14.68 and a beta of 1.09.

Banner Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, November 15th. Stockholders of record on Tuesday, November 5th were paid a $0.48 dividend. This represents a $1.92 dividend on an annualized basis and a dividend yield of 2.74%. The ex-dividend date was Tuesday, November 5th. Banner's dividend payout ratio is 40.17%.

Insider Activity at Banner

In other Banner news, VP James P.G. Mclean sold 1,500 shares of the company's stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $75.63, for a total value of $113,445.00. Following the sale, the vice president now directly owns 21,868 shares in the company, valued at $1,653,876.84. This represents a 6.42 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. 1.60% of the stock is currently owned by insiders.

Analyst Upgrades and Downgrades

A number of research firms have issued reports on BANR. DA Davidson upped their price target on shares of Banner from $60.00 to $69.00 and gave the company a "neutral" rating in a report on Friday, October 18th. Raymond James raised their target price on Banner from $62.00 to $65.00 and gave the company an "outperform" rating in a report on Wednesday, October 2nd. Piper Sandler set a $67.00 price target on Banner in a report on Thursday, October 17th. Finally, Keefe, Bruyette & Woods raised their price objective on shares of Banner from $69.00 to $81.00 and gave the stock a "market perform" rating in a research note on Wednesday, December 4th. One equities research analyst has rated the stock with a sell rating, three have given a hold rating and three have issued a buy rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Hold" and a consensus price target of $67.00.

Get Our Latest Research Report on Banner

Banner Company Profile

(

Get Free Report)

Banner Corporation operates as the bank holding company for Banner Bank that engages in the provision of commercial banking and financial products and services to individuals, businesses, and public sector entities in the United States. It accepts various deposit instruments, including interest-bearing and non-interest-bearing checking accounts, money market deposit accounts, regular savings accounts, and certificates of deposit, as well as treasury management services and retirement savings plans.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Banner, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Banner wasn't on the list.

While Banner currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.