Banque Cantonale Vaudoise decreased its holdings in shares of The Allstate Co. (NYSE:ALL - Free Report) by 52.5% in the 3rd quarter, according to its most recent 13F filing with the SEC. The fund owned 5,955 shares of the insurance provider's stock after selling 6,593 shares during the period. Banque Cantonale Vaudoise's holdings in Allstate were worth $1,129,000 at the end of the most recent reporting period.

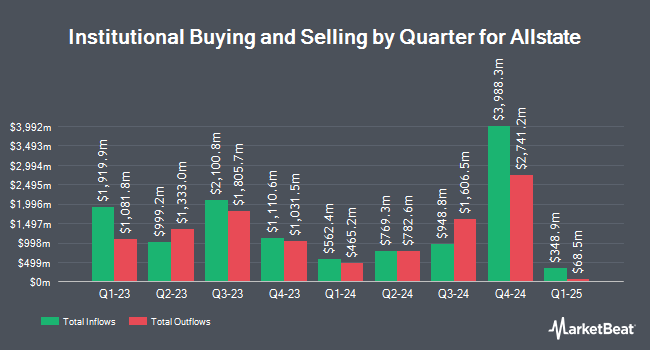

Other hedge funds and other institutional investors have also made changes to their positions in the company. Pathway Financial Advisers LLC boosted its holdings in Allstate by 18,472.5% during the third quarter. Pathway Financial Advisers LLC now owns 1,052,687 shares of the insurance provider's stock worth $199,642,000 after buying an additional 1,047,019 shares during the last quarter. Allspring Global Investments Holdings LLC boosted its stake in Allstate by 18.7% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 3,000,866 shares of the insurance provider's stock worth $569,114,000 after acquiring an additional 472,040 shares during the last quarter. AQR Capital Management LLC grew its holdings in Allstate by 181.6% during the second quarter. AQR Capital Management LLC now owns 719,997 shares of the insurance provider's stock valued at $114,955,000 after purchasing an additional 464,337 shares during the period. TimesSquare Capital Management LLC bought a new stake in Allstate in the third quarter valued at approximately $77,819,000. Finally, Acadian Asset Management LLC raised its holdings in Allstate by 3,839.0% in the second quarter. Acadian Asset Management LLC now owns 416,117 shares of the insurance provider's stock worth $66,417,000 after purchasing an additional 405,553 shares during the period. 76.47% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

ALL has been the subject of a number of recent analyst reports. Jefferies Financial Group upped their price objective on shares of Allstate from $231.00 to $267.00 and gave the company a "buy" rating in a research report on Friday, November 8th. Bank of America lifted their price objective on Allstate from $216.00 to $233.00 and gave the company a "buy" rating in a report on Friday, October 18th. Keefe, Bruyette & Woods increased their target price on Allstate from $222.00 to $225.00 and gave the stock an "outperform" rating in a research note on Wednesday, November 6th. Barclays upped their price target on shares of Allstate from $175.00 to $187.00 and gave the company an "underweight" rating in a report on Thursday, October 31st. Finally, UBS Group raised their price objective on shares of Allstate from $216.00 to $225.00 and gave the stock a "buy" rating in a report on Monday, November 4th. One equities research analyst has rated the stock with a sell rating, two have assigned a hold rating, thirteen have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, Allstate currently has a consensus rating of "Moderate Buy" and a consensus target price of $214.19.

Check Out Our Latest Research Report on Allstate

Allstate Trading Up 0.4 %

ALL stock opened at $197.29 on Thursday. The stock has a market cap of $52.24 billion, a price-to-earnings ratio of 12.78, a price-to-earnings-growth ratio of 1.76 and a beta of 0.48. The company has a fifty day moving average price of $190.76 and a two-hundred day moving average price of $177.36. The Allstate Co. has a one year low of $134.17 and a one year high of $201.00. The company has a debt-to-equity ratio of 0.43, a current ratio of 0.40 and a quick ratio of 0.40.

Allstate (NYSE:ALL - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The insurance provider reported $3.91 earnings per share for the quarter, beating the consensus estimate of $2.20 by $1.71. Allstate had a net margin of 6.77% and a return on equity of 26.67%. The firm had revenue of $16.63 billion for the quarter, compared to analysts' expectations of $14.57 billion. During the same period in the prior year, the firm earned $0.81 EPS. The business's revenue was up 14.7% on a year-over-year basis. Equities analysts anticipate that The Allstate Co. will post 16.01 EPS for the current year.

Allstate Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, January 2nd. Shareholders of record on Friday, November 29th will be given a dividend of $0.92 per share. This represents a $3.68 annualized dividend and a yield of 1.87%. The ex-dividend date is Friday, November 29th. Allstate's payout ratio is 23.83%.

Insiders Place Their Bets

In related news, insider John E. Dugenske sold 36,367 shares of the stock in a transaction that occurred on Friday, September 20th. The stock was sold at an average price of $191.38, for a total transaction of $6,959,916.46. Following the sale, the insider now owns 27,364 shares of the company's stock, valued at $5,236,922.32. This represents a 57.06 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Corporate insiders own 1.80% of the company's stock.

Allstate Company Profile

(

Free Report)

The Allstate Corporation, together with its subsidiaries, provides property and casualty, and other insurance products in the United States and Canada. It operates in five segments: Allstate Protection; Protection Services; Allstate Health and Benefits; Run-off Property-Liability; and Corporate and Other segments.

Further Reading

Before you consider Allstate, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allstate wasn't on the list.

While Allstate currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.