Banque Cantonale Vaudoise increased its stake in Verizon Communications Inc. (NYSE:VZ - Free Report) by 21.5% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 344,367 shares of the cell phone carrier's stock after purchasing an additional 61,051 shares during the period. Verizon Communications makes up 0.6% of Banque Cantonale Vaudoise's holdings, making the stock its 22nd biggest holding. Banque Cantonale Vaudoise's holdings in Verizon Communications were worth $15,464,000 as of its most recent filing with the SEC.

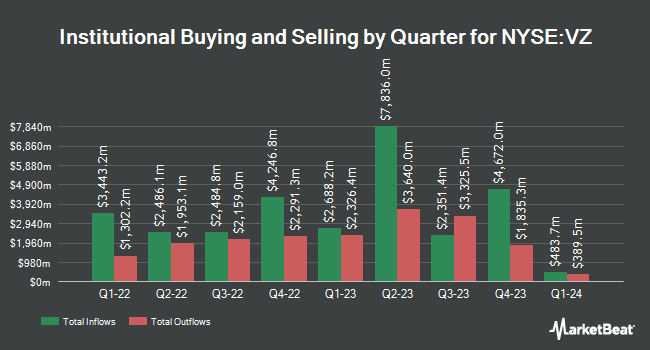

A number of other hedge funds and other institutional investors have also recently bought and sold shares of VZ. Gateway Investment Advisers LLC increased its position in shares of Verizon Communications by 15.4% during the 2nd quarter. Gateway Investment Advisers LLC now owns 283,160 shares of the cell phone carrier's stock valued at $11,678,000 after purchasing an additional 37,732 shares during the last quarter. Cyndeo Wealth Partners LLC increased its stake in Verizon Communications by 9.7% in the 3rd quarter. Cyndeo Wealth Partners LLC now owns 202,521 shares of the cell phone carrier's stock worth $9,095,000 after purchasing an additional 17,855 shares during the period. Janney Montgomery Scott LLC increased its stake in shares of Verizon Communications by 2.9% during the third quarter. Janney Montgomery Scott LLC now owns 2,058,443 shares of the cell phone carrier's stock valued at $92,445,000 after buying an additional 57,583 shares during the period. Principal Financial Group Inc. increased its stake in shares of Verizon Communications by 2.7% during the third quarter. Principal Financial Group Inc. now owns 4,954,357 shares of the cell phone carrier's stock valued at $222,500,000 after buying an additional 129,171 shares during the period. Finally, Harvest Portfolios Group Inc. grew its stake in Verizon Communications by 3.3% in the third quarter. Harvest Portfolios Group Inc. now owns 579,713 shares of the cell phone carrier's stock worth $26,035,000 after purchasing an additional 18,346 shares during the period. Institutional investors own 62.06% of the company's stock.

Verizon Communications Stock Down 0.8 %

Verizon Communications stock traded down $0.32 during trading on Tuesday, reaching $41.93. 9,794,479 shares of the company's stock were exchanged, compared to its average volume of 18,551,691. The company's 50-day moving average is $43.02 and its two-hundred day moving average is $41.47. The company has a debt-to-equity ratio of 1.32, a quick ratio of 0.62 and a current ratio of 0.66. Verizon Communications Inc. has a 52-week low of $36.20 and a 52-week high of $45.36. The firm has a market cap of $176.51 billion, a price-to-earnings ratio of 18.10, a PEG ratio of 3.03 and a beta of 0.43.

Verizon Communications (NYSE:VZ - Get Free Report) last posted its quarterly earnings data on Tuesday, October 22nd. The cell phone carrier reported $1.19 earnings per share for the quarter, beating analysts' consensus estimates of $1.18 by $0.01. Verizon Communications had a net margin of 7.30% and a return on equity of 20.05%. The company had revenue of $33.30 billion during the quarter, compared to analysts' expectations of $33.42 billion. During the same period in the prior year, the company posted $1.22 EPS. The firm's revenue for the quarter was up .9% on a year-over-year basis. On average, analysts predict that Verizon Communications Inc. will post 4.61 earnings per share for the current year.

Verizon Communications Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, November 1st. Investors of record on Thursday, October 10th were issued a dividend of $0.678 per share. This represents a $2.71 dividend on an annualized basis and a yield of 6.47%. This is a boost from Verizon Communications's previous quarterly dividend of $0.67. The ex-dividend date of this dividend was Thursday, October 10th. Verizon Communications's dividend payout ratio (DPR) is presently 116.81%.

Analyst Upgrades and Downgrades

A number of analysts have commented on VZ shares. JPMorgan Chase & Co. reduced their price target on Verizon Communications from $46.00 to $45.00 and set a "neutral" rating for the company in a research report on Tuesday, July 23rd. Tigress Financial raised their price target on Verizon Communications from $52.00 to $55.00 and gave the stock a "buy" rating in a research note on Tuesday, October 1st. KeyCorp downgraded Verizon Communications from an "overweight" rating to a "sector weight" rating in a report on Thursday, October 24th. UBS Group boosted their target price on Verizon Communications from $43.00 to $44.00 and gave the stock a "neutral" rating in a research note on Wednesday, October 23rd. Finally, TD Cowen lifted their price target on Verizon Communications from $48.00 to $51.00 and gave the stock a "buy" rating in a research report on Tuesday, July 23rd. Nine analysts have rated the stock with a hold rating and nine have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $46.37.

Read Our Latest Stock Report on Verizon Communications

Verizon Communications Company Profile

(

Free Report)

Verizon Communications Inc, through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide. It operates in two segments, Verizon Consumer Group (Consumer) and Verizon Business Group (Business).

See Also

Before you consider Verizon Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verizon Communications wasn't on the list.

While Verizon Communications currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.