Banque Cantonale Vaudoise reduced its stake in 3M (NYSE:MMM - Free Report) by 11.8% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 54,179 shares of the conglomerate's stock after selling 7,239 shares during the period. Banque Cantonale Vaudoise's holdings in 3M were worth $7,406,000 as of its most recent SEC filing.

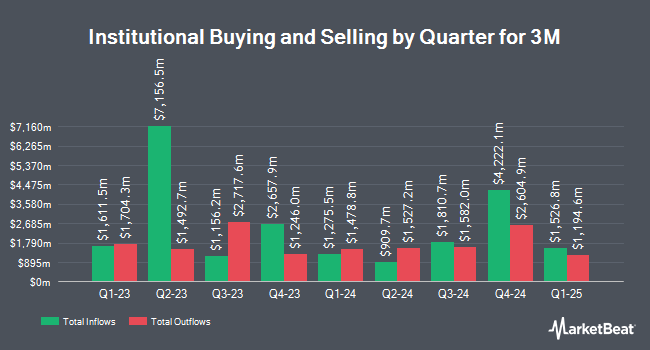

Several other institutional investors have also recently made changes to their positions in the stock. Ballentine Partners LLC grew its holdings in shares of 3M by 40.1% during the third quarter. Ballentine Partners LLC now owns 18,217 shares of the conglomerate's stock valued at $2,490,000 after buying an additional 5,210 shares during the last quarter. Stonegate Investment Group LLC boosted its stake in 3M by 5.6% during the 3rd quarter. Stonegate Investment Group LLC now owns 252,847 shares of the conglomerate's stock valued at $34,564,000 after purchasing an additional 13,473 shares during the last quarter. Ausdal Financial Partners Inc. increased its holdings in 3M by 6.7% during the 2nd quarter. Ausdal Financial Partners Inc. now owns 3,991 shares of the conglomerate's stock worth $408,000 after purchasing an additional 249 shares in the last quarter. Candriam S.C.A. increased its holdings in 3M by 19.2% during the 2nd quarter. Candriam S.C.A. now owns 38,469 shares of the conglomerate's stock worth $3,931,000 after purchasing an additional 6,185 shares in the last quarter. Finally, True Vision MN LLC bought a new position in shares of 3M in the second quarter valued at approximately $512,000. Institutional investors and hedge funds own 65.25% of the company's stock.

Analysts Set New Price Targets

Several brokerages have weighed in on MMM. JPMorgan Chase & Co. raised their price objective on 3M from $160.00 to $165.00 and gave the company an "overweight" rating in a research note on Monday, October 28th. StockNews.com downgraded shares of 3M from a "buy" rating to a "hold" rating in a research note on Monday, July 29th. Bank of America raised their target price on 3M from $143.00 to $160.00 and gave the stock a "buy" rating in a research note on Wednesday, October 23rd. Barclays increased their price target on shares of 3M from $160.00 to $165.00 and gave the stock an "overweight" rating in a report on Wednesday, October 23rd. Finally, Royal Bank of Canada boosted their price objective on shares of 3M from $99.00 to $100.00 and gave the company an "underperform" rating in a research note on Wednesday, October 23rd. Two research analysts have rated the stock with a sell rating, four have issued a hold rating and eleven have given a buy rating to the company. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $144.87.

Check Out Our Latest Analysis on MMM

3M Price Performance

Shares of NYSE MMM traded down $1.98 during trading hours on Tuesday, reaching $128.19. 2,600,464 shares of the stock traded hands, compared to its average volume of 4,823,272. The company's 50-day simple moving average is $132.84 and its two-hundred day simple moving average is $118.39. The company has a market capitalization of $69.81 billion, a P/E ratio of 16.44, a price-to-earnings-growth ratio of 2.15 and a beta of 0.95. 3M has a 52-week low of $75.40 and a 52-week high of $141.34. The company has a quick ratio of 1.08, a current ratio of 1.43 and a debt-to-equity ratio of 2.41.

3M (NYSE:MMM - Get Free Report) last posted its quarterly earnings results on Tuesday, October 22nd. The conglomerate reported $1.98 EPS for the quarter, topping the consensus estimate of $1.93 by $0.05. 3M had a net margin of 15.37% and a return on equity of 104.66%. The firm had revenue of $6.29 billion for the quarter, compared to the consensus estimate of $6.06 billion. During the same period last year, the firm posted $2.68 earnings per share. The business's revenue was down 24.3% compared to the same quarter last year. Equities research analysts forecast that 3M will post 7.27 EPS for the current year.

3M Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, December 12th. Shareholders of record on Friday, November 15th will be given a $0.70 dividend. The ex-dividend date is Friday, November 15th. This represents a $2.80 annualized dividend and a yield of 2.18%. 3M's payout ratio is currently 35.35%.

3M Profile

(

Free Report)

3M Company provides diversified technology services in the United States and internationally. The company's Safety and Industrial segment offers industrial abrasives and finishing for metalworking applications; autobody repair solutions; closure systems for personal hygiene products, masking, and packaging materials; electrical products and materials for construction and maintenance, power distribution, and electrical original equipment manufacturers; structural adhesives and tapes; respiratory, hearing, eye, and fall protection solutions; and natural and color-coated mineral granules for shingles.

Read More

Before you consider 3M, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 3M wasn't on the list.

While 3M currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.