AllianceBernstein (NYSE:AB - Get Free Report) had its target price lowered by Barclays from $39.00 to $36.00 in a report released on Monday,Benzinga reports. The firm currently has an "equal weight" rating on the asset manager's stock. Barclays's price target indicates a potential downside of 0.83% from the stock's previous close.

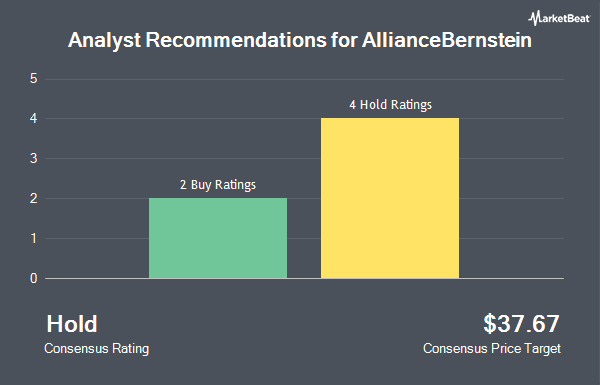

Several other equities analysts have also recently commented on AB. The Goldman Sachs Group increased their price target on shares of AllianceBernstein from $40.75 to $41.00 and gave the stock a "buy" rating in a research report on Thursday, October 3rd. Evercore ISI increased their price target on shares of AllianceBernstein from $43.00 to $45.00 and gave the stock an "outperform" rating in a research report on Thursday, November 7th. One equities research analyst has rated the stock with a hold rating and four have issued a buy rating to the stock. According to MarketBeat, AllianceBernstein currently has an average rating of "Moderate Buy" and a consensus target price of $42.40.

View Our Latest Report on AllianceBernstein

AllianceBernstein Trading Up 2.0 %

NYSE:AB traded up $0.70 on Monday, reaching $36.30. The stock had a trading volume of 864,623 shares, compared to its average volume of 300,115. The company has a 50-day moving average of $36.47 and a 200 day moving average of $34.84. The stock has a market cap of $4.18 billion, a P/E ratio of 10.20, a price-to-earnings-growth ratio of 0.82 and a beta of 1.21. AllianceBernstein has a 12-month low of $28.68 and a 12-month high of $38.96.

Insider Buying and Selling

In other AllianceBernstein news, insider Equitable Holdings, Inc. acquired 500,000 shares of the company's stock in a transaction that occurred on Friday, September 20th. The shares were purchased at an average price of $34.18 per share, for a total transaction of $17,090,000.00. Following the completion of the purchase, the insider now directly owns 3,066,838 shares in the company, valued at $104,824,522.84. The trade was a 19.48 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which is accessible through this link. 2.70% of the stock is owned by company insiders.

Institutional Investors Weigh In On AllianceBernstein

Several large investors have recently made changes to their positions in the company. American Century Companies Inc. increased its stake in shares of AllianceBernstein by 8.9% in the second quarter. American Century Companies Inc. now owns 2,873,324 shares of the asset manager's stock valued at $97,090,000 after purchasing an additional 234,253 shares during the period. FMR LLC increased its stake in shares of AllianceBernstein by 6.3% in the third quarter. FMR LLC now owns 2,613,381 shares of the asset manager's stock valued at $91,181,000 after purchasing an additional 154,039 shares during the period. Jennison Associates LLC increased its stake in shares of AllianceBernstein by 12.2% in the third quarter. Jennison Associates LLC now owns 878,323 shares of the asset manager's stock valued at $30,645,000 after purchasing an additional 95,847 shares during the period. Citigroup Inc. boosted its holdings in shares of AllianceBernstein by 59.1% in the third quarter. Citigroup Inc. now owns 645,685 shares of the asset manager's stock valued at $22,528,000 after acquiring an additional 239,941 shares in the last quarter. Finally, Franklin Resources Inc. boosted its holdings in shares of AllianceBernstein by 0.5% in the third quarter. Franklin Resources Inc. now owns 413,165 shares of the asset manager's stock valued at $14,919,000 after acquiring an additional 2,000 shares in the last quarter. Institutional investors and hedge funds own 19.25% of the company's stock.

AllianceBernstein Company Profile

(

Get Free Report)

AllianceBernstein Holding L.P. is a publicly owned investment manager. The firm is a related adviser The firm manages separate client focused portfolios for its clients. The firm primarily invests in common and preferred stocks, warrants and convertible securities, government and corporate fxed-income securities, commodities, currencies, real estate-related assets and infation-protected securities.

Read More

Before you consider AllianceBernstein, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AllianceBernstein wasn't on the list.

While AllianceBernstein currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.