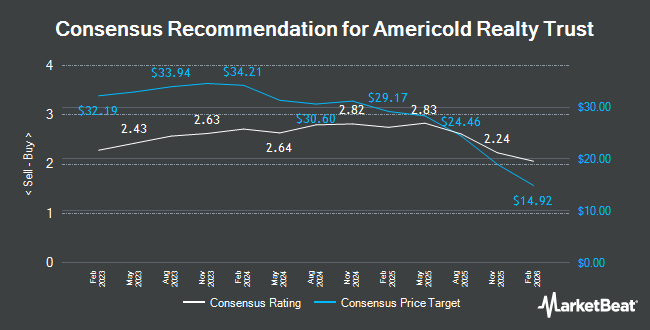

Americold Realty Trust (NYSE:COLD - Get Free Report) had its price target decreased by stock analysts at Barclays from $28.00 to $26.00 in a note issued to investors on Monday,Benzinga reports. The firm presently has an "equal weight" rating on the stock. Barclays's target price suggests a potential upside of 19.54% from the stock's previous close.

Several other analysts also recently commented on the stock. Evercore ISI raised their price objective on shares of Americold Realty Trust from $33.00 to $34.00 and gave the company an "outperform" rating in a research report on Wednesday, August 28th. Wells Fargo & Company raised their price target on Americold Realty Trust from $24.00 to $30.00 and gave the company an "equal weight" rating in a report on Wednesday, August 28th. Truist Financial upped their price objective on Americold Realty Trust from $31.00 to $33.00 and gave the stock a "buy" rating in a research note on Friday, August 16th. Royal Bank of Canada cut their target price on Americold Realty Trust from $33.00 to $30.00 and set an "outperform" rating for the company in a research report on Wednesday, November 13th. Finally, Robert W. Baird dropped their price target on Americold Realty Trust from $31.00 to $28.00 and set an "outperform" rating for the company in a research note on Friday, November 8th. Two equities research analysts have rated the stock with a hold rating and nine have issued a buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $30.55.

View Our Latest Analysis on Americold Realty Trust

Americold Realty Trust Stock Performance

Shares of NYSE:COLD traded down $0.07 during midday trading on Monday, hitting $21.75. The company had a trading volume of 2,722,290 shares, compared to its average volume of 2,194,742. The company has a market cap of $6.18 billion, a price-to-earnings ratio of -21.53, a PEG ratio of 1.72 and a beta of 0.61. The company has a debt-to-equity ratio of 0.11, a current ratio of 0.15 and a quick ratio of 0.16. The company has a fifty day moving average of $26.67 and a two-hundred day moving average of $26.88. Americold Realty Trust has a 12-month low of $21.53 and a 12-month high of $30.92.

Americold Realty Trust (NYSE:COLD - Get Free Report) last posted its quarterly earnings data on Thursday, November 7th. The company reported ($0.01) EPS for the quarter, missing the consensus estimate of $0.34 by ($0.35). The company had revenue of $674.17 million during the quarter, compared to the consensus estimate of $663.87 million. Americold Realty Trust had a negative return on equity of 8.08% and a negative net margin of 10.63%. The firm's quarterly revenue was up .9% compared to the same quarter last year. During the same period last year, the business earned $0.32 EPS. On average, equities research analysts expect that Americold Realty Trust will post 1.39 EPS for the current fiscal year.

Institutional Trading of Americold Realty Trust

Hedge funds have recently made changes to their positions in the business. Assetmark Inc. raised its position in Americold Realty Trust by 2,288.1% during the third quarter. Assetmark Inc. now owns 1,003 shares of the company's stock valued at $28,000 after purchasing an additional 961 shares during the period. GAMMA Investing LLC increased its position in Americold Realty Trust by 189.9% during the third quarter. GAMMA Investing LLC now owns 1,122 shares of the company's stock valued at $32,000 after acquiring an additional 735 shares during the last quarter. Loomis Sayles & Co. L P purchased a new stake in shares of Americold Realty Trust in the third quarter valued at $55,000. Blue Trust Inc. raised its position in Americold Realty Trust by 2,727.4% in the 2nd quarter. Blue Trust Inc. now owns 2,997 shares of the company's stock worth $75,000 after purchasing an additional 2,891 shares during the period. Finally, Thurston Springer Miller Herd & Titak Inc. bought a new stake in shares of Americold Realty Trust during the second quarter worth $85,000. 98.14% of the stock is currently owned by hedge funds and other institutional investors.

About Americold Realty Trust

(

Get Free Report)

Americold is a global leader in temperature-controlled logistics real estate and value added services. Focused on the ownership, operation, acquisition and development of temperature-controlled warehouses, Americold owns and/or operates 245 temperature-controlled warehouses, with approximately 1.5 billion refrigerated cubic feet of storage, in North America, Europe, Asia-Pacific, and South America.

Further Reading

Before you consider Americold Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Americold Realty Trust wasn't on the list.

While Americold Realty Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.