Barclays lowered shares of Bunge Global (NYSE:BG - Free Report) from an overweight rating to an equal weight rating in a report issued on Tuesday morning, Marketbeat reports. The brokerage currently has $95.00 price target on the basic materials company's stock, down from their prior price target of $115.00.

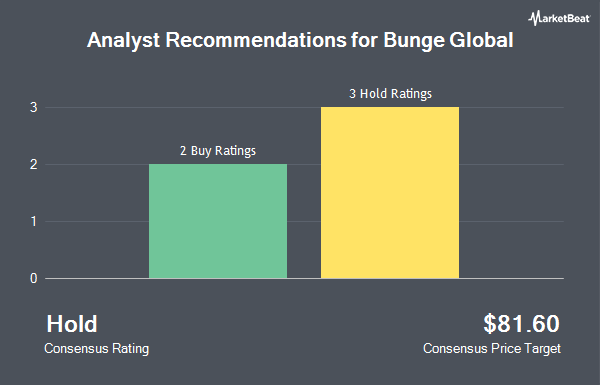

Separately, Stephens raised shares of Bunge Global to a "strong-buy" rating in a research note on Monday, December 2nd. Four equities research analysts have rated the stock with a hold rating, four have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, Bunge Global currently has an average rating of "Moderate Buy" and an average target price of $115.14.

Read Our Latest Analysis on Bunge Global

Bunge Global Price Performance

NYSE:BG traded down $0.90 during mid-day trading on Tuesday, reaching $78.64. 1,601,221 shares of the stock were exchanged, compared to its average volume of 1,447,293. Bunge Global has a 1-year low of $75.75 and a 1-year high of $114.92. The company has a current ratio of 2.07, a quick ratio of 1.10 and a debt-to-equity ratio of 0.43. The firm has a market capitalization of $10.98 billion, a PE ratio of 9.95 and a beta of 0.70. The business has a fifty day moving average price of $82.85 and a 200 day moving average price of $92.84.

Institutional Investors Weigh In On Bunge Global

Several hedge funds have recently bought and sold shares of the business. Wilmington Savings Fund Society FSB purchased a new position in Bunge Global during the third quarter valued at approximately $34,000. Farther Finance Advisors LLC grew its holdings in shares of Bunge Global by 40.1% during the 3rd quarter. Farther Finance Advisors LLC now owns 433 shares of the basic materials company's stock valued at $42,000 after acquiring an additional 124 shares in the last quarter. UMB Bank n.a. increased its stake in shares of Bunge Global by 145.1% in the third quarter. UMB Bank n.a. now owns 652 shares of the basic materials company's stock worth $63,000 after acquiring an additional 386 shares during the last quarter. Blue Trust Inc. raised its holdings in shares of Bunge Global by 121.5% during the third quarter. Blue Trust Inc. now owns 658 shares of the basic materials company's stock worth $70,000 after acquiring an additional 361 shares in the last quarter. Finally, Deseret Mutual Benefit Administrators lifted its holdings in shares of Bunge Global by 31.0% during the 3rd quarter. Deseret Mutual Benefit Administrators now owns 702 shares of the basic materials company's stock valued at $68,000 after buying an additional 166 shares during the last quarter. 86.23% of the stock is owned by hedge funds and other institutional investors.

Bunge Global Company Profile

(

Get Free Report)

Bunge Global SA operates as an agribusiness and food company worldwide. It operates through four segments: Agribusiness, Refined and Specialty Oils, Milling, and Sugar and Bioenergy. The Agribusiness segment purchases, stores, transports, processes, and sells agricultural commodities and commodity products, including oilseeds primarily soybeans, rapeseed, canola, and sunflower seeds, as well as grains comprising wheat and corn; and processes oilseeds into vegetable oils and protein meals.

Featured Stories

Before you consider Bunge Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bunge Global wasn't on the list.

While Bunge Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.