Victory Capital (NASDAQ:VCTR - Free Report) had its target price raised by Barclays from $59.00 to $69.00 in a research report sent to investors on Monday morning,Benzinga reports. Barclays currently has an equal weight rating on the stock.

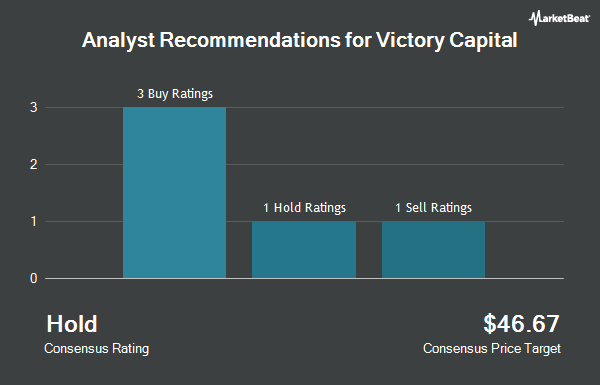

A number of other analysts have also recently weighed in on VCTR. JPMorgan Chase & Co. upped their target price on shares of Victory Capital from $45.00 to $49.00 and gave the company a "neutral" rating in a research note on Monday, August 19th. BMO Capital Markets upped their target price on shares of Victory Capital from $69.00 to $71.00 and gave the company an "outperform" rating in a research note on Monday. The Goldman Sachs Group upped their target price on shares of Victory Capital from $59.50 to $60.00 and gave the company a "buy" rating in a research note on Thursday, October 3rd. Bank of America boosted their price target on shares of Victory Capital from $58.00 to $59.00 and gave the company a "buy" rating in a research report on Monday, August 12th. Finally, Morgan Stanley boosted their price target on shares of Victory Capital from $60.00 to $64.00 and gave the company an "equal weight" rating in a research report on Monday. Four investment analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. According to MarketBeat.com, Victory Capital presently has a consensus rating of "Moderate Buy" and an average price target of $61.56.

Check Out Our Latest Analysis on VCTR

Victory Capital Stock Performance

VCTR traded up $4.09 during trading on Monday, hitting $70.21. The stock had a trading volume of 533,012 shares, compared to its average volume of 376,379. The firm has a market cap of $4.55 billion, a PE ratio of 17.47, a P/E/G ratio of 0.70 and a beta of 0.90. Victory Capital has a 12 month low of $30.60 and a 12 month high of $70.56. The company has a current ratio of 0.91, a quick ratio of 0.91 and a debt-to-equity ratio of 0.87. The company has a 50 day simple moving average of $57.33 and a 200-day simple moving average of $53.07.

Victory Capital (NASDAQ:VCTR - Get Free Report) last posted its quarterly earnings data on Thursday, August 8th. The company reported $1.30 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.26 by $0.04. Victory Capital had a net margin of 30.82% and a return on equity of 30.55%. The company had revenue of $219.62 million for the quarter, compared to the consensus estimate of $220.82 million. Analysts expect that Victory Capital will post 5.22 EPS for the current year.

Victory Capital Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, December 23rd. Stockholders of record on Monday, December 9th will be given a dividend of $0.44 per share. This represents a $1.76 dividend on an annualized basis and a dividend yield of 2.51%. This is a positive change from Victory Capital's previous quarterly dividend of $0.41. The ex-dividend date of this dividend is Monday, December 9th. Victory Capital's dividend payout ratio is presently 43.78%.

Hedge Funds Weigh In On Victory Capital

Large investors have recently bought and sold shares of the business. Capital World Investors lifted its holdings in Victory Capital by 85.8% in the first quarter. Capital World Investors now owns 2,221,954 shares of the company's stock valued at $94,278,000 after buying an additional 1,025,954 shares during the period. Swedbank AB lifted its holdings in Victory Capital by 7.1% in the second quarter. Swedbank AB now owns 750,000 shares of the company's stock valued at $35,798,000 after buying an additional 50,000 shares during the period. Sei Investments Co. lifted its holdings in Victory Capital by 106.7% in the first quarter. Sei Investments Co. now owns 113,254 shares of the company's stock valued at $4,805,000 after buying an additional 58,458 shares during the period. Inspire Investing LLC acquired a new position in Victory Capital in the first quarter valued at approximately $884,000. Finally, Acadian Asset Management LLC lifted its holdings in Victory Capital by 73.0% in the first quarter. Acadian Asset Management LLC now owns 416,120 shares of the company's stock valued at $17,649,000 after buying an additional 175,576 shares during the period. 87.71% of the stock is currently owned by institutional investors and hedge funds.

About Victory Capital

(

Get Free Report)

Victory Capital Holdings, Inc, together with its subsidiaries, operates as an asset management company in the United States and internationally. It offers investment advisory, fund administration, fund compliance, fund transfer agent, fund distribution, and other management services. The company provides specialized investment strategies to institutions, intermediaries, retirement platforms, and individual investors.

Further Reading

Before you consider Victory Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Victory Capital wasn't on the list.

While Victory Capital currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.