Alphatec (NASDAQ:ATEC - Free Report) had its target price increased by Barclays from $19.00 to $20.00 in a research note released on Tuesday morning,Benzinga reports. They currently have an overweight rating on the medical technology company's stock.

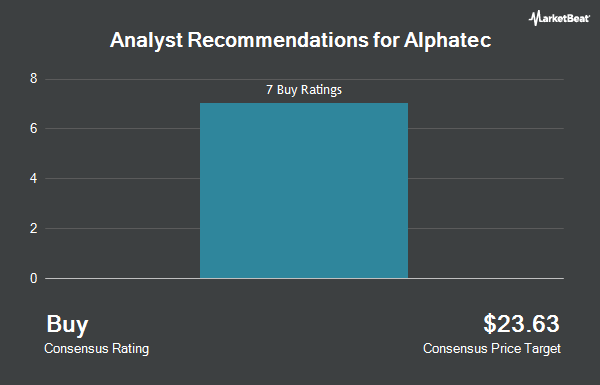

A number of other equities research analysts have also weighed in on ATEC. Needham & Company LLC restated a "buy" rating and issued a $13.00 price objective on shares of Alphatec in a report on Thursday, October 31st. Wells Fargo & Company cut their price target on shares of Alphatec from $26.00 to $19.00 and set an "overweight" rating for the company in a research report on Thursday, August 1st. Lake Street Capital decreased their price objective on Alphatec from $32.00 to $18.00 and set a "buy" rating on the stock in a report on Tuesday, September 3rd. Piper Sandler dropped their target price on Alphatec from $17.00 to $12.00 and set an "overweight" rating for the company in a report on Thursday, August 1st. Finally, Stifel Nicolaus reduced their price target on Alphatec from $19.00 to $16.00 and set a "buy" rating on the stock in a research report on Thursday, August 1st. One equities research analyst has rated the stock with a hold rating and eight have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, Alphatec presently has a consensus rating of "Moderate Buy" and an average target price of $17.11.

View Our Latest Report on Alphatec

Alphatec Price Performance

Shares of NASDAQ ATEC traded up $1.05 during trading hours on Tuesday, reaching $9.57. 1,834,794 shares of the stock traded hands, compared to its average volume of 1,963,407. The company has a market capitalization of $1.36 billion, a P/E ratio of -7.48 and a beta of 1.31. The company's 50-day simple moving average is $6.44 and its two-hundred day simple moving average is $8.27. The company has a quick ratio of 1.15, a current ratio of 2.32 and a debt-to-equity ratio of 30.21. Alphatec has a 52-week low of $4.88 and a 52-week high of $17.34.

Insider Transactions at Alphatec

In related news, Director David M. Demski purchased 50,000 shares of Alphatec stock in a transaction that occurred on Wednesday, August 21st. The shares were bought at an average price of $5.67 per share, for a total transaction of $283,500.00. Following the completion of the transaction, the director now directly owns 288,441 shares of the company's stock, valued at $1,635,460.47. This represents a 20.97 % increase in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Corporate insiders own 22.80% of the company's stock.

Institutional Trading of Alphatec

Several large investors have recently bought and sold shares of the company. Point72 Asset Management L.P. lifted its stake in shares of Alphatec by 65.2% in the 2nd quarter. Point72 Asset Management L.P. now owns 3,192,789 shares of the medical technology company's stock valued at $33,365,000 after purchasing an additional 1,260,137 shares during the period. Magnetar Financial LLC purchased a new position in Alphatec during the second quarter valued at $10,957,000. BNP PARIBAS ASSET MANAGEMENT Holding S.A. boosted its holdings in shares of Alphatec by 23.8% during the 2nd quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 2,630,244 shares of the medical technology company's stock valued at $27,486,000 after buying an additional 505,202 shares in the last quarter. Polar Asset Management Partners Inc. grew its position in shares of Alphatec by 381.9% in the 3rd quarter. Polar Asset Management Partners Inc. now owns 621,224 shares of the medical technology company's stock worth $3,454,000 after buying an additional 492,324 shares during the period. Finally, Granite Investment Partners LLC increased its stake in shares of Alphatec by 130.2% in the 2nd quarter. Granite Investment Partners LLC now owns 664,201 shares of the medical technology company's stock worth $6,941,000 after acquiring an additional 375,621 shares in the last quarter. 66.35% of the stock is owned by institutional investors.

Alphatec Company Profile

(

Get Free Report)

Alphatec Holdings, Inc, a medical technology company, designs, develops, and advances technologies for the surgical treatment of spinal disorders in the United States and internationally. It manufactures and sells implants and instruments through third-party suppliers. The company offers Alpha InformatiX product platform, including EOS imaging system that provides full-body imaging; VEA alignment mobile application, which leverages EOS technology to more quickly quantify alignment parameters on a mobile device; SafeOp Neural InformatiX System that automates electromyographic and somatosensory evoked potential monitoring; and Valence, an intra-operative system that integrates navigation and robotics into spine procedures, as well as Sigma Prone TransPsoas (PTP) Access and PTP Patient Positioning Systems.

Featured Stories

Before you consider Alphatec, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphatec wasn't on the list.

While Alphatec currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.