Barclays (LON:BARC - Get Free Report) had its price target hoisted by Citigroup from GBX 320 ($4.12) to GBX 350 ($4.51) in a report released on Thursday, Marketbeat reports. The firm presently has a "buy" rating on the financial services provider's stock. Citigroup's price target points to a potential upside of 23.00% from the stock's previous close.

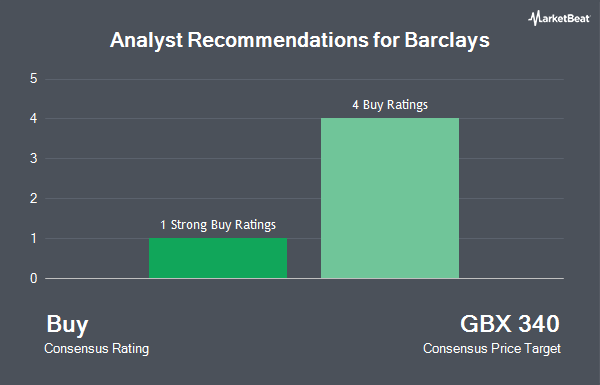

A number of other research analysts also recently commented on the company. JPMorgan Chase & Co. boosted their target price on Barclays from GBX 360 ($4.63) to GBX 370 ($4.76) and gave the company an "overweight" rating in a research note on Tuesday, February 18th. Deutsche Bank Aktiengesellschaft reaffirmed a "buy" rating and set a GBX 350 ($4.51) price objective on shares of Barclays in a research report on Monday, February 24th. Finally, Shore Capital restated a "buy" rating on shares of Barclays in a report on Thursday, January 30th. Eight analysts have rated the stock with a buy rating, Based on data from MarketBeat, the company has an average rating of "Buy" and an average price target of GBX 311.43 ($4.01).

Get Our Latest Research Report on Barclays

Barclays Price Performance

Shares of Barclays stock traded down GBX 18.36 ($0.24) during trading on Thursday, hitting GBX 284.55 ($3.66). The stock had a trading volume of 85,292,531 shares, compared to its average volume of 50,793,105. The business has a fifty day moving average of GBX 290.57 and a two-hundred day moving average of GBX 259.87. Barclays has a fifty-two week low of GBX 169.06 ($2.18) and a fifty-two week high of GBX 316 ($4.07). The firm has a market cap of £40.86 billion, a P/E ratio of 8.36, a PEG ratio of 1.15 and a beta of 1.36.

Barclays (LON:BARC - Get Free Report) last released its earnings results on Thursday, February 13th. The financial services provider reported GBX 36 ($0.46) EPS for the quarter. Barclays had a net margin of 19.54% and a return on equity of 6.97%. As a group, research analysts forecast that Barclays will post 39.1062802 earnings per share for the current year.

Insiders Place Their Bets

In other Barclays news, insider Anna Cross sold 40,197 shares of the firm's stock in a transaction dated Thursday, December 12th. The shares were sold at an average price of GBX 270 ($3.48), for a total transaction of £108,531.90 ($139,734.65). Also, insider Robert Berry bought 3,028 shares of the company's stock in a transaction dated Friday, February 14th. The stock was bought at an average cost of GBX 294 ($3.79) per share, with a total value of £8,902.32 ($11,461.72). Company insiders own 1.47% of the company's stock.

Barclays Company Profile

(

Get Free Report)

Barclays PLC provides various financial services in the United Kingdom, Europe, the Americas, Africa, the Middle East, and Asia. The company operates through Barclays UK and Barclays International division segments. It offers financial services, such as retail banking, credit cards, wholesale banking, investment banking, wealth management, and investment management services.

See Also

Before you consider Barclays, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Barclays wasn't on the list.

While Barclays currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 best stocks to own in Spring 2025, carefully selected for their growth potential amid market volatility. This exclusive report highlights top companies poised to thrive in uncertain economic conditions—download now to gain an investing edge.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.