Advanced Drainage Systems (NYSE:WMS - Get Free Report) had its price objective cut by Barclays from $194.00 to $172.00 in a research report issued to clients and investors on Monday,Benzinga reports. The brokerage presently has an "overweight" rating on the construction company's stock. Barclays's price objective would indicate a potential upside of 26.77% from the company's previous close.

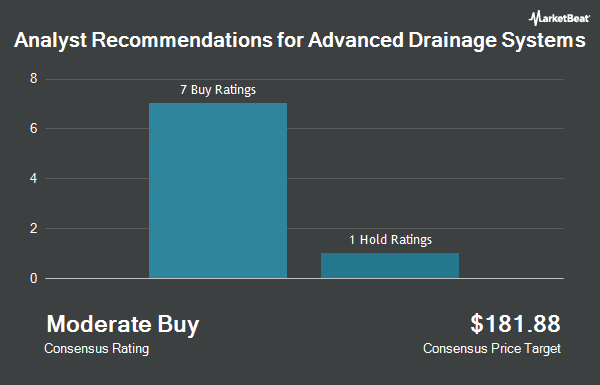

A number of other equities analysts have also issued reports on WMS. StockNews.com lowered shares of Advanced Drainage Systems from a "buy" rating to a "hold" rating in a research report on Wednesday, July 17th. Loop Capital dropped their target price on shares of Advanced Drainage Systems from $188.00 to $180.00 and set a "buy" rating on the stock in a research report on Monday, August 12th. KeyCorp dropped their target price on shares of Advanced Drainage Systems from $195.00 to $180.00 and set an "overweight" rating on the stock in a research report on Monday. Robert W. Baird dropped their target price on shares of Advanced Drainage Systems from $174.00 to $161.00 and set an "outperform" rating on the stock in a research report on Monday. Finally, Oppenheimer dropped their target price on shares of Advanced Drainage Systems from $192.00 to $184.00 and set an "outperform" rating on the stock in a research report on Monday. One analyst has rated the stock with a hold rating and seven have assigned a buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $178.57.

Get Our Latest Stock Analysis on Advanced Drainage Systems

Advanced Drainage Systems Stock Performance

Shares of NYSE:WMS traded down $0.48 during trading on Monday, reaching $135.68. The stock had a trading volume of 1,376,273 shares, compared to its average volume of 497,456. Advanced Drainage Systems has a 52 week low of $112.11 and a 52 week high of $184.27. The firm has a market capitalization of $10.52 billion, a price-to-earnings ratio of 21.77, a P/E/G ratio of 1.15 and a beta of 1.53. The company has a quick ratio of 1.90, a current ratio of 2.89 and a debt-to-equity ratio of 1.04. The stock has a fifty day simple moving average of $151.62 and a two-hundred day simple moving average of $159.75.

Advanced Drainage Systems (NYSE:WMS - Get Free Report) last released its quarterly earnings results on Friday, November 8th. The construction company reported $1.70 EPS for the quarter, missing analysts' consensus estimates of $1.93 by ($0.23). Advanced Drainage Systems had a net margin of 17.09% and a return on equity of 43.60%. The firm had revenue of $782.60 million during the quarter, compared to the consensus estimate of $819.41 million. During the same period in the prior year, the business earned $1.71 EPS. The company's revenue for the quarter was up .3% compared to the same quarter last year. As a group, analysts anticipate that Advanced Drainage Systems will post 6.95 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Several hedge funds have recently added to or reduced their stakes in the business. Swedbank AB bought a new stake in Advanced Drainage Systems during the first quarter worth about $220,853,000. Vanguard Group Inc. grew its stake in Advanced Drainage Systems by 5.8% during the first quarter. Vanguard Group Inc. now owns 7,265,169 shares of the construction company's stock worth $1,251,353,000 after buying an additional 395,099 shares during the last quarter. Boston Partners grew its stake in Advanced Drainage Systems by 16.9% during the first quarter. Boston Partners now owns 1,519,118 shares of the construction company's stock worth $261,609,000 after buying an additional 219,629 shares during the last quarter. Millennium Management LLC grew its stake in Advanced Drainage Systems by 136.2% during the second quarter. Millennium Management LLC now owns 312,393 shares of the construction company's stock worth $50,105,000 after buying an additional 180,154 shares during the last quarter. Finally, Lazard Freres Gestion S.A.S. bought a new stake in Advanced Drainage Systems during the second quarter worth about $28,870,000. Institutional investors and hedge funds own 89.83% of the company's stock.

About Advanced Drainage Systems

(

Get Free Report)

Advanced Drainage Systems, Inc designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in North America and internationally. The company operates through Pipe, International, Infiltrator, and Allied Products & Other segments. It offers single, double, and triple wall corrugated polypropylene and polyethylene pipes; plastic leachfield chambers and systems; EZflow synthetic aggregate bundles; wastewater purification through mechanical aeration wastewater for residential and commercial systems; septic tanks and accessories; combined treatment and dispersal systems, including advanced enviro-septic and advanced treatment leachfield systems; and allied products, including storm retention/detention and septic chambers, polyvinyl chloride drainage structures, fittings, and water quality filters and separators.

Further Reading

Before you consider Advanced Drainage Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Drainage Systems wasn't on the list.

While Advanced Drainage Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.