Barclays PLC grew its holdings in shares of Mercury Systems, Inc. (NASDAQ:MRCY - Free Report) by 471.3% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 175,562 shares of the technology company's stock after purchasing an additional 144,831 shares during the quarter. Barclays PLC owned approximately 0.29% of Mercury Systems worth $6,496,000 at the end of the most recent reporting period.

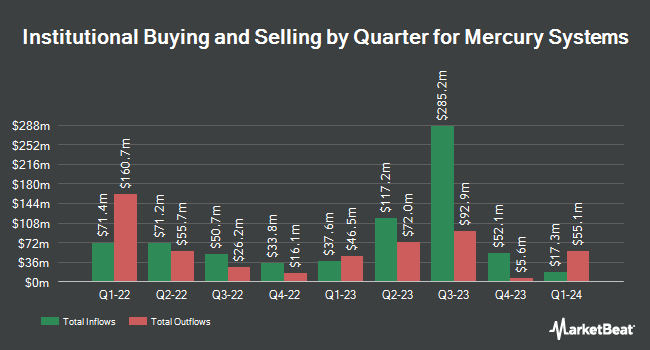

A number of other hedge funds and other institutional investors also recently made changes to their positions in MRCY. Roubaix Capital LLC purchased a new stake in Mercury Systems during the second quarter valued at about $3,684,000. Healthcare of Ontario Pension Plan Trust Fund purchased a new stake in shares of Mercury Systems in the 2nd quarter valued at about $3,079,000. Clearline Capital LP boosted its position in shares of Mercury Systems by 18.4% during the 2nd quarter. Clearline Capital LP now owns 526,611 shares of the technology company's stock valued at $14,213,000 after acquiring an additional 81,826 shares during the last quarter. B. Metzler seel. Sohn & Co. Holding AG purchased a new position in shares of Mercury Systems during the third quarter worth about $2,831,000. Finally, Sei Investments Co. grew its holdings in shares of Mercury Systems by 28.7% during the second quarter. Sei Investments Co. now owns 279,327 shares of the technology company's stock worth $7,539,000 after purchasing an additional 62,371 shares in the last quarter. 95.99% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

MRCY has been the topic of a number of recent analyst reports. Jefferies Financial Group raised shares of Mercury Systems from an "underperform" rating to a "hold" rating and raised their target price for the company from $30.00 to $42.00 in a research note on Monday, November 11th. StockNews.com upgraded shares of Mercury Systems from a "sell" rating to a "hold" rating in a research report on Thursday, December 5th. Finally, JPMorgan Chase & Co. upped their target price on shares of Mercury Systems from $36.00 to $40.00 and gave the stock a "neutral" rating in a research report on Thursday, November 7th. One investment analyst has rated the stock with a sell rating, six have assigned a hold rating and one has assigned a buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus target price of $36.29.

View Our Latest Stock Analysis on MRCY

Mercury Systems Trading Up 1.7 %

Shares of MRCY traded up $0.68 during mid-day trading on Friday, reaching $39.70. The company's stock had a trading volume of 1,694,664 shares, compared to its average volume of 579,764. Mercury Systems, Inc. has a 52 week low of $25.31 and a 52 week high of $44.63. The stock has a market cap of $2.37 billion, a PE ratio of -19.37 and a beta of 0.78. The company's fifty day moving average price is $38.04 and its two-hundred day moving average price is $35.40. The company has a current ratio of 4.10, a quick ratio of 2.59 and a debt-to-equity ratio of 0.41.

Insiders Place Their Bets

In other news, COO Charles Roger Iv Wells sold 1,527 shares of the stock in a transaction that occurred on Monday, November 18th. The stock was sold at an average price of $38.80, for a total transaction of $59,247.60. Following the completion of the sale, the chief operating officer now owns 113,488 shares of the company's stock, valued at approximately $4,403,334.40. This represents a 1.33 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. 1.60% of the stock is currently owned by insiders.

About Mercury Systems

(

Free Report)

Mercury Systems, Inc, a technology company, manufactures and sells components, products, modules, and subsystems for aerospace and defense industries in the United States, Europe, and the Asia Pacific. Its products and solutions are deployed in approximately 300 programs with 25 defense contractors and commercial aviation customers.

Featured Stories

Before you consider Mercury Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mercury Systems wasn't on the list.

While Mercury Systems currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.