Barclays PLC lifted its stake in shares of The Williams Companies, Inc. (NYSE:WMB - Free Report) by 3.4% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 3,271,141 shares of the pipeline company's stock after purchasing an additional 108,675 shares during the quarter. Barclays PLC owned about 0.27% of Williams Companies worth $149,326,000 at the end of the most recent quarter.

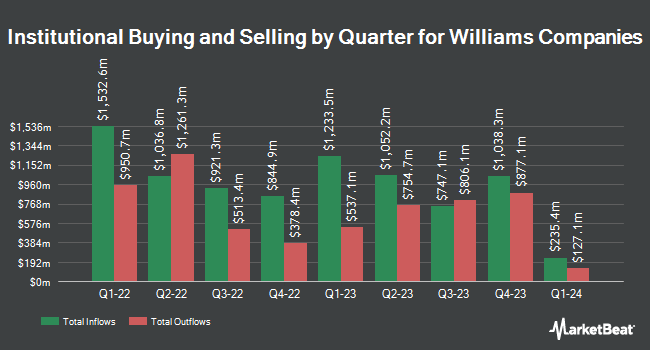

Several other institutional investors and hedge funds also recently added to or reduced their stakes in WMB. Wellington Management Group LLP grew its position in shares of Williams Companies by 19.0% in the third quarter. Wellington Management Group LLP now owns 35,734,666 shares of the pipeline company's stock valued at $1,631,288,000 after purchasing an additional 5,697,605 shares during the last quarter. American Century Companies Inc. grew its position in shares of Williams Companies by 20.1% in the second quarter. American Century Companies Inc. now owns 6,117,298 shares of the pipeline company's stock valued at $259,985,000 after purchasing an additional 1,024,158 shares during the last quarter. National Bank of Canada FI grew its position in shares of Williams Companies by 224.1% in the third quarter. National Bank of Canada FI now owns 1,334,307 shares of the pipeline company's stock valued at $60,909,000 after purchasing an additional 922,550 shares during the last quarter. Castle Hook Partners LP grew its position in shares of Williams Companies by 31.7% in the third quarter. Castle Hook Partners LP now owns 2,989,278 shares of the pipeline company's stock valued at $136,461,000 after purchasing an additional 718,915 shares during the last quarter. Finally, Bahl & Gaynor Inc. grew its position in shares of Williams Companies by 8.8% in the second quarter. Bahl & Gaynor Inc. now owns 7,664,152 shares of the pipeline company's stock valued at $325,726,000 after purchasing an additional 618,056 shares during the last quarter. 86.44% of the stock is currently owned by institutional investors and hedge funds.

Williams Companies Price Performance

Shares of WMB stock traded up $0.84 during midday trading on Wednesday, reaching $55.39. 7,781,411 shares of the company were exchanged, compared to its average volume of 6,343,081. The Williams Companies, Inc. has a 12 month low of $32.65 and a 12 month high of $60.36. The company has a market cap of $67.52 billion, a P/E ratio of 23.32, a PEG ratio of 5.84 and a beta of 1.05. The company's 50 day moving average price is $54.11 and its two-hundred day moving average price is $47.13. The company has a debt-to-equity ratio of 1.67, a quick ratio of 0.51 and a current ratio of 0.57.

Williams Companies (NYSE:WMB - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The pipeline company reported $0.43 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.42 by $0.01. The company had revenue of $2.65 billion for the quarter, compared to analysts' expectations of $2.52 billion. Williams Companies had a net margin of 27.36% and a return on equity of 15.89%. The business's revenue was up 3.7% compared to the same quarter last year. During the same quarter in the previous year, the company posted $0.45 EPS. On average, sell-side analysts expect that The Williams Companies, Inc. will post 1.92 earnings per share for the current year.

Williams Companies Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Monday, December 30th. Investors of record on Friday, December 13th will be issued a dividend of $0.475 per share. This represents a $1.90 annualized dividend and a dividend yield of 3.43%. The ex-dividend date of this dividend is Friday, December 13th. Williams Companies's dividend payout ratio is currently 80.17%.

Insider Buying and Selling

In other Williams Companies news, CAO Mary A. Hausman sold 7,951 shares of Williams Companies stock in a transaction that occurred on Friday, November 8th. The shares were sold at an average price of $56.30, for a total value of $447,641.30. Following the completion of the sale, the chief accounting officer now directly owns 25,858 shares in the company, valued at $1,455,805.40. The trade was a 23.52 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, SVP Terrance Lane Wilson sold 2,000 shares of Williams Companies stock in a transaction that occurred on Tuesday, October 1st. The shares were sold at an average price of $45.29, for a total transaction of $90,580.00. Following the completion of the sale, the senior vice president now owns 304,200 shares of the company's stock, valued at $13,777,218. This trade represents a 0.65 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.44% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

WMB has been the topic of several recent analyst reports. The Goldman Sachs Group increased their price target on shares of Williams Companies from $45.00 to $55.00 and gave the stock a "neutral" rating in a research note on Tuesday, November 26th. Morgan Stanley raised shares of Williams Companies from an "equal weight" rating to an "overweight" rating and increased their price target for the stock from $52.00 to $58.00 in a research note on Friday, October 4th. Citigroup increased their price target on shares of Williams Companies from $45.00 to $52.00 and gave the stock a "buy" rating in a research note on Thursday, October 3rd. Mizuho increased their price objective on shares of Williams Companies from $47.00 to $56.00 and gave the stock an "outperform" rating in a research report on Monday, November 4th. Finally, Royal Bank of Canada increased their price objective on shares of Williams Companies from $47.00 to $56.00 and gave the stock an "outperform" rating in a research report on Wednesday, October 16th. One equities research analyst has rated the stock with a sell rating, eight have assigned a hold rating and nine have given a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $52.07.

Read Our Latest Stock Analysis on Williams Companies

Williams Companies Company Profile

(

Free Report)

The Williams Companies, Inc, together with its subsidiaries, operates as an energy infrastructure company primarily in the United States. It operates through Transmission & Gulf of Mexico, Northeast G&P, West, and Gas & NGL Marketing Services segments. The Transmission & Gulf of Mexico segment comprises natural gas pipelines; Transco, Northwest pipeline, MountainWest, and related natural gas storage facilities; and natural gas gathering and processing, and crude oil production handling and transportation assets in the Gulf Coast region.

Further Reading

Before you consider Williams Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Williams Companies wasn't on the list.

While Williams Companies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here