Barclays PLC raised its stake in shares of Cavco Industries, Inc. (NASDAQ:CVCO - Free Report) by 162.0% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 17,234 shares of the construction company's stock after purchasing an additional 10,656 shares during the quarter. Barclays PLC owned 0.21% of Cavco Industries worth $7,381,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

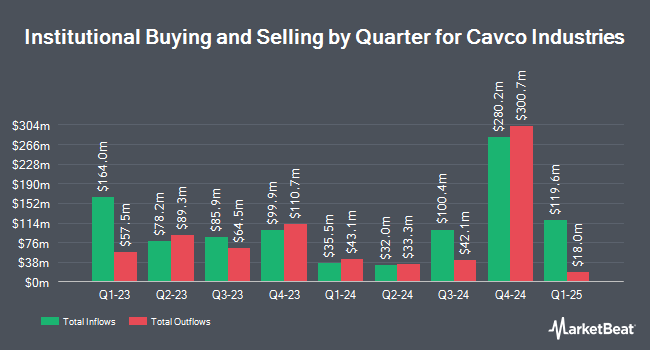

A number of other hedge funds and other institutional investors have also bought and sold shares of CVCO. XTX Topco Ltd grew its position in Cavco Industries by 20.5% during the third quarter. XTX Topco Ltd now owns 1,430 shares of the construction company's stock valued at $612,000 after acquiring an additional 243 shares during the last quarter. iSAM Funds UK Ltd purchased a new position in shares of Cavco Industries during the third quarter valued at approximately $208,000. Quadrature Capital Ltd bought a new position in shares of Cavco Industries during the third quarter valued at $410,000. Jacobs Levy Equity Management Inc. lifted its holdings in shares of Cavco Industries by 7.5% during the third quarter. Jacobs Levy Equity Management Inc. now owns 51,572 shares of the construction company's stock valued at $22,085,000 after purchasing an additional 3,615 shares in the last quarter. Finally, HighTower Advisors LLC boosted its holdings in shares of Cavco Industries by 5.1% during the 3rd quarter. HighTower Advisors LLC now owns 1,518 shares of the construction company's stock valued at $649,000 after acquiring an additional 73 shares during the last quarter. Hedge funds and other institutional investors own 95.56% of the company's stock.

Insiders Place Their Bets

In related news, CAO Paul Bigbee sold 100 shares of the stock in a transaction on Friday, November 22nd. The shares were sold at an average price of $512.23, for a total transaction of $51,223.00. Following the sale, the chief accounting officer now directly owns 981 shares of the company's stock, valued at approximately $502,497.63. This represents a 9.25 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this hyperlink. Also, Director Julia Sze sold 125 shares of Cavco Industries stock in a transaction on Friday, November 8th. The shares were sold at an average price of $458.68, for a total transaction of $57,335.00. Following the completion of the transaction, the director now directly owns 2,861 shares of the company's stock, valued at $1,312,283.48. The trade was a 4.19 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 1,100 shares of company stock valued at $535,642. 1.60% of the stock is owned by company insiders.

Cavco Industries Stock Performance

NASDAQ:CVCO traded down $9.90 during midday trading on Thursday, reaching $442.22. 69,574 shares of the stock traded hands, compared to its average volume of 63,986. The stock has a market capitalization of $3.59 billion, a PE ratio of 25.00 and a beta of 1.29. Cavco Industries, Inc. has a 12-month low of $304.10 and a 12-month high of $544.08. The business has a 50-day moving average of $466.66 and a two-hundred day moving average of $415.17.

Cavco Industries (NASDAQ:CVCO - Get Free Report) last issued its quarterly earnings results on Thursday, October 31st. The construction company reported $5.28 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $4.70 by $0.58. Cavco Industries had a net margin of 8.00% and a return on equity of 14.38%. The business had revenue of $507.46 million for the quarter, compared to analyst estimates of $480.10 million. During the same quarter in the prior year, the business posted $4.76 EPS. Research analysts anticipate that Cavco Industries, Inc. will post 18 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of equities research analysts have issued reports on CVCO shares. StockNews.com downgraded Cavco Industries from a "buy" rating to a "hold" rating in a research note on Wednesday, December 11th. Craig Hallum lifted their price objective on Cavco Industries from $422.00 to $495.00 and gave the stock a "buy" rating in a research note on Monday, November 4th. Finally, Wedbush downgraded shares of Cavco Industries from an "outperform" rating to a "neutral" rating and set a $480.00 price target on the stock. in a report on Tuesday, December 3rd.

View Our Latest Research Report on Cavco Industries

Cavco Industries Profile

(

Free Report)

Cavco Industries, Inc designs, produces, and retails factory-built homes primarily in the United States. It operates in two segments, Factory-Built Housing and Financial Services. The company markets its factory-built homes under the Cavco, Fleetwood, Palm Harbor, Nationwide, Fairmont, Friendship, Chariot Eagle, Destiny, Commodore, Colony, Pennwest, R-Anell, Manorwood, MidCountry, and Solitaire brands.

Featured Articles

Before you consider Cavco Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cavco Industries wasn't on the list.

While Cavco Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.