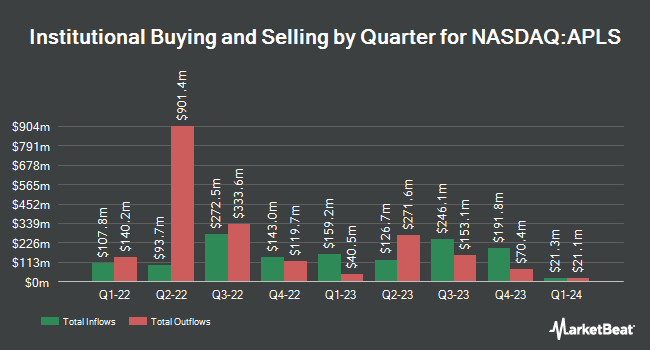

Barclays PLC increased its holdings in shares of Apellis Pharmaceuticals, Inc. (NASDAQ:APLS - Free Report) by 18.0% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 255,897 shares of the company's stock after buying an additional 39,019 shares during the quarter. Barclays PLC owned 0.21% of Apellis Pharmaceuticals worth $7,381,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds have also modified their holdings of APLS. XTX Topco Ltd acquired a new position in Apellis Pharmaceuticals in the 3rd quarter valued at about $206,000. Sphera Funds Management LTD. purchased a new position in Apellis Pharmaceuticals during the 3rd quarter worth approximately $6,226,000. HighVista Strategies LLC raised its holdings in shares of Apellis Pharmaceuticals by 375.5% in the third quarter. HighVista Strategies LLC now owns 35,975 shares of the company's stock valued at $1,038,000 after buying an additional 28,409 shares during the last quarter. Erste Asset Management GmbH acquired a new stake in shares of Apellis Pharmaceuticals during the third quarter worth $1,238,000. Finally, True Wealth Design LLC purchased a new position in shares of Apellis Pharmaceuticals during the 3rd quarter worth approximately $27,000. 96.29% of the stock is owned by institutional investors and hedge funds.

Apellis Pharmaceuticals Stock Performance

NASDAQ APLS traded down $0.88 on Thursday, reaching $33.14. The stock had a trading volume of 3,052,619 shares, compared to its average volume of 2,000,374. The company has a market cap of $4.12 billion, a P/E ratio of -16.33 and a beta of 0.94. Apellis Pharmaceuticals, Inc. has a 1-year low of $24.34 and a 1-year high of $73.80. The company has a debt-to-equity ratio of 1.91, a current ratio of 4.36 and a quick ratio of 3.73. The firm has a fifty day moving average of $30.06 and a two-hundred day moving average of $34.64.

Apellis Pharmaceuticals (NASDAQ:APLS - Get Free Report) last announced its quarterly earnings results on Tuesday, November 5th. The company reported ($0.46) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.32) by ($0.14). The company had revenue of $196.83 million for the quarter, compared to the consensus estimate of $200.00 million. Apellis Pharmaceuticals had a negative net margin of 34.97% and a negative return on equity of 103.11%. The company's revenue for the quarter was up 78.3% compared to the same quarter last year. During the same period last year, the firm posted ($1.17) earnings per share. On average, equities research analysts anticipate that Apellis Pharmaceuticals, Inc. will post -1.72 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of analysts recently commented on APLS shares. Robert W. Baird dropped their price objective on Apellis Pharmaceuticals from $92.00 to $55.00 and set an "outperform" rating for the company in a research report on Thursday, November 7th. Mizuho dropped their target price on Apellis Pharmaceuticals from $39.00 to $38.00 and set a "neutral" rating on the stock in a research report on Thursday, October 24th. Needham & Company LLC decreased their target price on Apellis Pharmaceuticals from $85.00 to $60.00 and set a "buy" rating for the company in a research report on Wednesday, November 6th. William Blair initiated coverage on Apellis Pharmaceuticals in a research report on Wednesday, October 16th. They set an "outperform" rating on the stock. Finally, Scotiabank reduced their target price on shares of Apellis Pharmaceuticals from $35.00 to $30.00 and set a "sector perform" rating for the company in a research note on Wednesday, November 6th. Eight research analysts have rated the stock with a hold rating, ten have issued a buy rating and two have issued a strong buy rating to the company. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $49.94.

Get Our Latest Report on Apellis Pharmaceuticals

Apellis Pharmaceuticals Profile

(

Free Report)

Apellis Pharmaceuticals, Inc, a commercial-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of therapeutic compounds through the inhibition of the complement system for autoimmune and inflammatory diseases. It offers EMPAVELI for the treatment of paroxysmal nocturnal hemoglobinuria, C3 glomerulopathy and immune complex membranoproliferative glomerulonephritis, and hematopoietic stem cell transplantation-associated thrombotic microangiopathy; and SYFOVRE for treating geographic atrophy secondary to age-related macular degeneration and geographic atrophy (GA).

Featured Articles

Before you consider Apellis Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apellis Pharmaceuticals wasn't on the list.

While Apellis Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.