Tenaris (NYSE:TS - Get Free Report) had its price target boosted by research analysts at Barclays from $48.00 to $50.00 in a research report issued to clients and investors on Monday,Benzinga reports. The brokerage currently has an "overweight" rating on the industrial products company's stock. Barclays's price target would indicate a potential upside of 33.10% from the company's previous close.

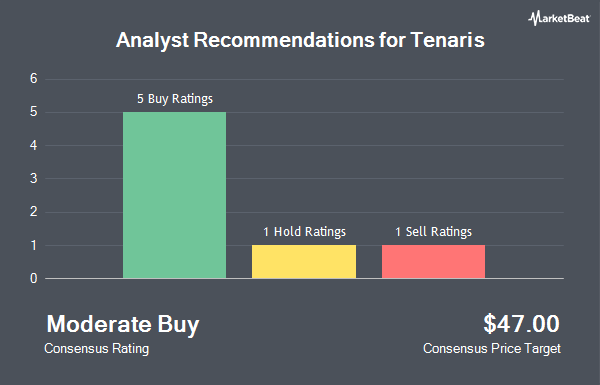

Several other research firms have also commented on TS. Piper Sandler started coverage on shares of Tenaris in a research note on Thursday, December 19th. They set an "overweight" rating and a $48.00 price objective for the company. Jefferies Financial Group raised shares of Tenaris from a "hold" rating to a "buy" rating and lifted their price target for the stock from $35.00 to $47.00 in a research note on Monday, December 9th. Kepler Capital Markets lowered shares of Tenaris from a "buy" rating to a "hold" rating in a research report on Friday, January 17th. StockNews.com upgraded Tenaris from a "hold" rating to a "buy" rating in a research report on Thursday, February 20th. Finally, Stifel Nicolaus upped their target price on Tenaris from $40.00 to $43.00 and gave the company a "buy" rating in a research note on Friday, February 21st. Two research analysts have rated the stock with a sell rating, one has issued a hold rating and five have given a buy rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Hold" and an average target price of $46.00.

Check Out Our Latest Stock Analysis on Tenaris

Tenaris Stock Performance

TS stock traded up $0.06 during trading on Monday, hitting $37.57. 1,377,200 shares of the company's stock traded hands, compared to its average volume of 1,513,713. The business has a fifty day simple moving average of $38.29 and a 200 day simple moving average of $34.73. Tenaris has a 52 week low of $27.24 and a 52 week high of $40.72. The stock has a market capitalization of $21.84 billion, a price-to-earnings ratio of 10.41 and a beta of 1.44.

Tenaris (NYSE:TS - Get Free Report) last announced its quarterly earnings results on Wednesday, February 19th. The industrial products company reported $0.94 EPS for the quarter, beating analysts' consensus estimates of $0.63 by $0.31. Tenaris had a net margin of 16.26% and a return on equity of 11.76%. The firm had revenue of $2.85 billion during the quarter, compared to the consensus estimate of $2.71 billion. Research analysts forecast that Tenaris will post 3.14 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently bought and sold shares of TS. Crossmark Global Holdings Inc. grew its position in shares of Tenaris by 61.5% during the 4th quarter. Crossmark Global Holdings Inc. now owns 35,111 shares of the industrial products company's stock worth $1,327,000 after buying an additional 13,374 shares in the last quarter. GAMMA Investing LLC lifted its stake in Tenaris by 140.2% in the fourth quarter. GAMMA Investing LLC now owns 939 shares of the industrial products company's stock worth $35,000 after acquiring an additional 548 shares during the period. ABC Arbitrage SA bought a new position in Tenaris during the 4th quarter worth about $31,581,000. Concentric Capital Strategies LP purchased a new position in Tenaris during the 3rd quarter valued at about $1,163,000. Finally, International Assets Investment Management LLC bought a new stake in shares of Tenaris in the 3rd quarter valued at about $380,000. Institutional investors own 10.45% of the company's stock.

About Tenaris

(

Get Free Report)

Tenaris SA, together with its subsidiaries, produces and sells seamless and welded steel tubular products and related services for the oil and gas industry, and other industrial applications. The company offers steel casings, tubing products, mechanical and structural pipes, line pipes, cold-drawn pipes, and premium joints and couplings; and coiled tubing products for oil and gas drilling and workovers, and subsea pipelines.

See Also

Before you consider Tenaris, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tenaris wasn't on the list.

While Tenaris currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.