Bard Financial Services Inc. cut its stake in AT&T Inc. (NYSE:T - Free Report) by 16.3% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 234,425 shares of the technology company's stock after selling 45,520 shares during the period. Bard Financial Services Inc.'s holdings in AT&T were worth $5,157,000 at the end of the most recent reporting period.

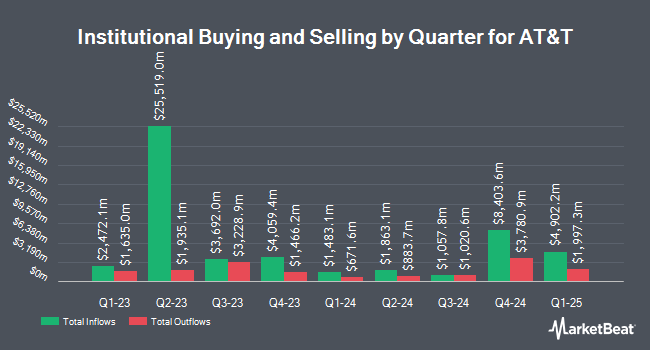

A number of other institutional investors have also added to or reduced their stakes in T. Strategic Financial Concepts LLC increased its holdings in shares of AT&T by 227.6% during the second quarter. Strategic Financial Concepts LLC now owns 131,813 shares of the technology company's stock valued at $25,000 after acquiring an additional 91,578 shares in the last quarter. Legacy Investment Solutions LLC bought a new stake in shares of AT&T during the third quarter valued at approximately $25,000. Riggs Asset Managment Co. Inc. raised its holdings in AT&T by 356.5% in the 2nd quarter. Riggs Asset Managment Co. Inc. now owns 1,429 shares of the technology company's stock worth $27,000 after acquiring an additional 1,116 shares during the last quarter. Ritter Daniher Financial Advisory LLC DE boosted its stake in AT&T by 169.2% during the 3rd quarter. Ritter Daniher Financial Advisory LLC DE now owns 1,338 shares of the technology company's stock valued at $29,000 after purchasing an additional 841 shares during the last quarter. Finally, American Capital Advisory LLC increased its holdings in shares of AT&T by 107.5% in the 2nd quarter. American Capital Advisory LLC now owns 1,558 shares of the technology company's stock worth $30,000 after purchasing an additional 807 shares in the last quarter. Institutional investors own 57.10% of the company's stock.

AT&T Stock Down 0.1 %

Shares of NYSE T traded down $0.03 during mid-day trading on Wednesday, reaching $23.48. 38,513,626 shares of the company were exchanged, compared to its average volume of 35,583,934. The stock has a market cap of $168.48 billion, a price-to-earnings ratio of 19.08, a P/E/G ratio of 3.63 and a beta of 0.59. The company has a quick ratio of 0.67, a current ratio of 0.73 and a debt-to-equity ratio of 1.09. The firm has a 50-day moving average of $22.41 and a 200 day moving average of $20.47. AT&T Inc. has a 1 year low of $15.94 and a 1 year high of $24.03.

AT&T (NYSE:T - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The technology company reported $0.60 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.57 by $0.03. AT&T had a return on equity of 13.97% and a net margin of 7.42%. The business had revenue of $30.20 billion for the quarter, compared to the consensus estimate of $30.50 billion. During the same period in the prior year, the firm posted $0.64 earnings per share. The business's quarterly revenue was down .5% on a year-over-year basis. On average, research analysts expect that AT&T Inc. will post 2.19 earnings per share for the current year.

AT&T Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, November 1st. Stockholders of record on Thursday, October 10th were issued a dividend of $0.2775 per share. This represents a $1.11 dividend on an annualized basis and a dividend yield of 4.73%. The ex-dividend date was Thursday, October 10th. AT&T's dividend payout ratio (DPR) is presently 90.24%.

Wall Street Analysts Forecast Growth

T has been the subject of several research analyst reports. Sanford C. Bernstein began coverage on AT&T in a report on Tuesday. They issued an "outperform" rating and a $28.00 price objective for the company. Barclays increased their price objective on shares of AT&T from $24.00 to $27.00 and gave the stock an "overweight" rating in a research note on Wednesday, December 4th. The Goldman Sachs Group upped their target price on shares of AT&T from $25.00 to $28.00 and gave the company a "buy" rating in a report on Thursday, December 5th. JPMorgan Chase & Co. lifted their price target on shares of AT&T from $25.00 to $28.00 and gave the stock an "overweight" rating in a research note on Wednesday, December 4th. Finally, Oppenheimer initiated coverage on AT&T in a research note on Tuesday. They issued an "outperform" rating and a $28.00 price objective for the company. One research analyst has rated the stock with a sell rating, eight have assigned a hold rating, eleven have given a buy rating and two have assigned a strong buy rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $25.00.

View Our Latest Stock Analysis on T

AT&T Profile

(

Free Report)

AT&T Inc provides telecommunications and technology services worldwide. The company operates through two segments, Communications and Latin America. The Communications segment offers wireless voice and data communications services; and sells handsets, wireless data cards, wireless computing devices, carrying cases/protective covers, and wireless chargers through its own company-owned stores, agents, and third-party retail stores.

Read More

Before you consider AT&T, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AT&T wasn't on the list.

While AT&T currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.