Bardin Hill Management Partners LP purchased a new stake in HashiCorp, Inc. (NASDAQ:HCP - Free Report) during the third quarter, according to the company in its most recent disclosure with the SEC. The firm purchased 440,278 shares of the company's stock, valued at approximately $14,908,000. HashiCorp makes up approximately 6.9% of Bardin Hill Management Partners LP's investment portfolio, making the stock its 3rd largest holding. Bardin Hill Management Partners LP owned about 0.22% of HashiCorp as of its most recent filing with the SEC.

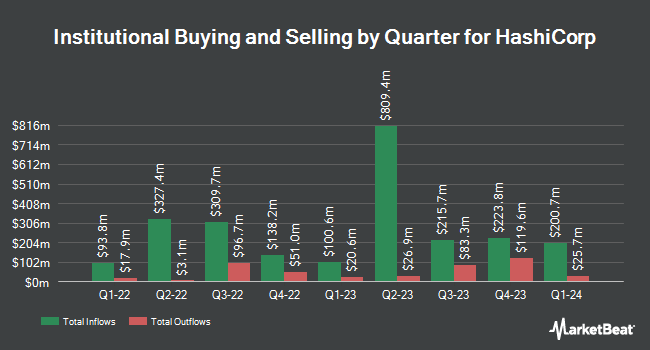

Other hedge funds have also made changes to their positions in the company. Pentwater Capital Management LP purchased a new position in HashiCorp during the second quarter worth $91,654,000. Magnetar Financial LLC acquired a new stake in shares of HashiCorp in the second quarter valued at about $71,490,000. ING Groep NV boosted its stake in shares of HashiCorp by 851.2% in the third quarter. ING Groep NV now owns 1,671,200 shares of the company's stock valued at $56,587,000 after purchasing an additional 1,495,500 shares during the period. Alpine Associates Management Inc. acquired a new stake in shares of HashiCorp during the second quarter valued at about $48,541,000. Finally, Westchester Capital Management LLC increased its holdings in HashiCorp by 60.5% during the 3rd quarter. Westchester Capital Management LLC now owns 3,200,322 shares of the company's stock worth $108,363,000 after purchasing an additional 1,206,073 shares during the last quarter. Hedge funds and other institutional investors own 87.83% of the company's stock.

Insider Activity at HashiCorp

In other HashiCorp news, CEO David Mcjannet sold 48,055 shares of the firm's stock in a transaction that occurred on Friday, September 20th. The stock was sold at an average price of $33.84, for a total transaction of $1,626,181.20. Following the completion of the transaction, the chief executive officer now owns 419,531 shares in the company, valued at $14,196,929.04. This trade represents a 10.28 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, CTO Armon Dadgar sold 35,904 shares of the business's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $33.83, for a total value of $1,214,632.32. Following the transaction, the chief technology officer now owns 1,520,000 shares of the company's stock, valued at approximately $51,421,600. The trade was a 2.31 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 366,208 shares of company stock valued at $12,391,868 over the last ninety days. Insiders own 22.49% of the company's stock.

HashiCorp Stock Performance

NASDAQ HCP traded down $0.06 on Monday, hitting $33.56. The stock had a trading volume of 1,007,355 shares, compared to its average volume of 2,965,985. HashiCorp, Inc. has a 52-week low of $19.26 and a 52-week high of $34.21. The company has a market capitalization of $6.81 billion, a price-to-earnings ratio of -44.83 and a beta of 1.24. The firm has a 50-day moving average of $33.85 and a 200-day moving average of $33.71.

HashiCorp (NASDAQ:HCP - Get Free Report) last announced its quarterly earnings results on Thursday, August 29th. The company reported $0.08 earnings per share for the quarter. The business had revenue of $165.14 million during the quarter, compared to analysts' expectations of $157.22 million. HashiCorp had a negative net margin of 23.69% and a negative return on equity of 10.54%. The firm's revenue for the quarter was up 15.3% compared to the same quarter last year. During the same quarter in the prior year, the company posted ($0.34) EPS. As a group, research analysts anticipate that HashiCorp, Inc. will post -0.48 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several research firms have weighed in on HCP. Piper Sandler reiterated a "neutral" rating and set a $35.00 target price on shares of HashiCorp in a research note on Friday, August 30th. JMP Securities reiterated a "market perform" rating on shares of HashiCorp in a research report on Monday, September 16th. StockNews.com started coverage on HashiCorp in a report on Friday. They issued a "hold" rating on the stock. Finally, Citigroup assumed coverage on HashiCorp in a research report on Tuesday, September 3rd. They issued a "neutral" rating and a $35.00 target price for the company. Twelve analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus target price of $32.08.

Read Our Latest Report on HashiCorp

HashiCorp Company Profile

(

Free Report)

HashiCorp, Inc engages in the provision of multi-cloud infrastructure automation solutions worldwide. The company offers infrastructure provisioning products, including Terraform, that enables IT operations teams to apply an Infrastructure-as-Code approach, where processes and configuration required to support applications are codified and automated instead of being manual and ticket-based; Packer, that provides a consistent way to define the process of transforming the raw source inputs into a production worthy artifact, across any environment or packaging format; and Vagrant, that allows teams to define how development environments are set up.

Recommended Stories

Before you consider HashiCorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HashiCorp wasn't on the list.

While HashiCorp currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.