Barington Capital Group L.P. raised its holdings in Rambus Inc. (NASDAQ:RMBS - Free Report) by 11.5% during the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 145,100 shares of the semiconductor company's stock after acquiring an additional 15,000 shares during the quarter. Rambus makes up 6.5% of Barington Capital Group L.P.'s holdings, making the stock its 7th largest holding. Barington Capital Group L.P. owned about 0.14% of Rambus worth $6,126,000 as of its most recent SEC filing.

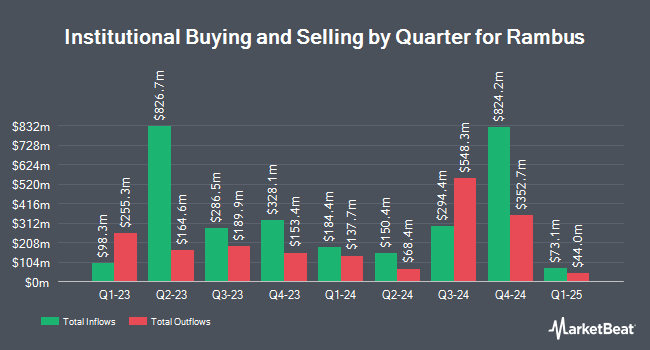

Several other hedge funds also recently bought and sold shares of RMBS. Quarry LP acquired a new position in Rambus during the 2nd quarter valued at about $38,000. Fifth Third Bancorp lifted its position in shares of Rambus by 68.7% in the second quarter. Fifth Third Bancorp now owns 727 shares of the semiconductor company's stock valued at $43,000 after acquiring an additional 296 shares in the last quarter. Blue Trust Inc. lifted its position in shares of Rambus by 240.6% in the second quarter. Blue Trust Inc. now owns 1,141 shares of the semiconductor company's stock valued at $71,000 after acquiring an additional 806 shares in the last quarter. Migdal Insurance & Financial Holdings Ltd. purchased a new position in Rambus during the second quarter worth approximately $87,000. Finally, GAMMA Investing LLC lifted its position in Rambus by 207.1% during the third quarter. GAMMA Investing LLC now owns 2,623 shares of the semiconductor company's stock worth $111,000 after buying an additional 1,769 shares in the last quarter. Institutional investors own 88.54% of the company's stock.

Rambus Stock Performance

Shares of NASDAQ RMBS traded up $1.13 during trading on Monday, hitting $58.94. The company had a trading volume of 495,962 shares, compared to its average volume of 1,519,654. The business's 50-day moving average is $47.52 and its 200 day moving average is $50.31. Rambus Inc. has a 52 week low of $37.42 and a 52 week high of $76.38. The company has a market cap of $6.28 billion, a P/E ratio of 36.03 and a beta of 1.17.

Analyst Upgrades and Downgrades

Several equities research analysts have issued reports on RMBS shares. Rosenblatt Securities reissued a "buy" rating and set a $85.00 target price on shares of Rambus in a research note on Tuesday, October 29th. Baird R W raised Rambus to a "strong-buy" rating in a report on Monday, November 25th. Loop Capital initiated coverage on Rambus in a report on Monday, November 11th. They set a "buy" rating and a $70.00 price target for the company. Wells Fargo & Company assumed coverage on Rambus in a report on Wednesday, November 6th. They issued an "overweight" rating and a $62.00 target price for the company. Finally, Robert W. Baird began coverage on Rambus in a research report on Monday, November 25th. They issued an "outperform" rating and a $90.00 price target on the stock. Six research analysts have rated the stock with a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Buy" and an average target price of $74.67.

Get Our Latest Stock Report on RMBS

Rambus Profile

(

Free Report)

Rambus Inc provides semiconductor products in the United States, South Korea, Singapore, and internationally. The company offers DDR memory interface chips, including DDR5 and DDR4 memory interface chips to module manufacturers, OEMs, and hyperscalers; silicon IP, such as interface and security IP solutions that move and protect data in advanced data center, government, and automotive applications; and interface IP solutions for high-speed memory and chip-to-chip digital controller IP.

Recommended Stories

Before you consider Rambus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rambus wasn't on the list.

While Rambus currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.