Barnett & Company Inc. acquired a new stake in Antero Resources Co. (NYSE:AR - Free Report) in the 3rd quarter, according to the company in its most recent filing with the SEC. The fund acquired 17,800 shares of the oil and natural gas company's stock, valued at approximately $510,000.

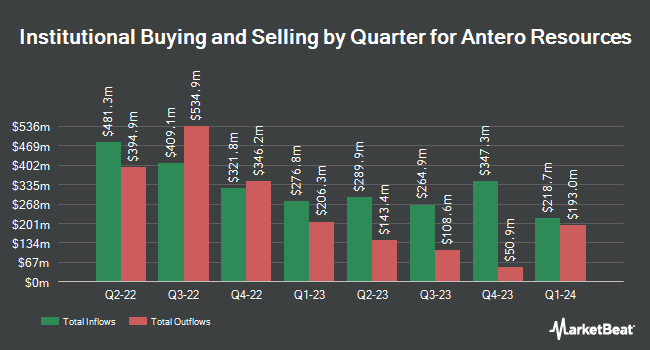

Other institutional investors have also recently bought and sold shares of the company. Diversified Trust Co acquired a new stake in shares of Antero Resources during the second quarter worth $1,154,000. Hood River Capital Management LLC grew its stake in shares of Antero Resources by 81.5% during the first quarter. Hood River Capital Management LLC now owns 117,658 shares of the oil and natural gas company's stock worth $3,412,000 after purchasing an additional 52,843 shares during the period. Vanguard Group Inc. grew its stake in Antero Resources by 1.3% in the first quarter. Vanguard Group Inc. now owns 28,066,610 shares of the oil and natural gas company's stock valued at $813,932,000 after acquiring an additional 372,450 shares during the period. Vaughan Nelson Investment Management L.P. grew its stake in Antero Resources by 269.4% in the second quarter. Vaughan Nelson Investment Management L.P. now owns 3,967,300 shares of the oil and natural gas company's stock valued at $129,453,000 after acquiring an additional 2,893,395 shares during the period. Finally, William Blair Investment Management LLC acquired a new position in Antero Resources in the first quarter valued at about $25,288,000. Institutional investors own 83.04% of the company's stock.

Antero Resources Price Performance

AR stock traded down $0.50 during mid-day trading on Tuesday, hitting $31.17. The company had a trading volume of 3,590,835 shares, compared to its average volume of 4,108,486. The company has a 50-day moving average price of $27.68 and a 200 day moving average price of $30.09. Antero Resources Co. has a 12-month low of $20.10 and a 12-month high of $36.28. The company has a quick ratio of 0.28, a current ratio of 0.28 and a debt-to-equity ratio of 0.23. The company has a market capitalization of $9.70 billion, a price-to-earnings ratio of 222.64 and a beta of 3.36.

Analyst Ratings Changes

Several research firms have recently weighed in on AR. Wolfe Research raised Antero Resources from a "peer perform" rating to an "outperform" rating and set a $37.00 price objective for the company in a research report on Wednesday, September 11th. The Goldman Sachs Group lowered their target price on Antero Resources from $36.00 to $32.00 and set a "buy" rating on the stock in a research note on Friday, September 6th. Roth Mkm started coverage on Antero Resources in a research report on Tuesday, August 27th. They set a "buy" rating and a $32.00 price target on the stock. Barclays reduced their target price on Antero Resources from $32.00 to $30.00 and set an "equal weight" rating on the stock in a report on Thursday, October 3rd. Finally, BMO Capital Markets raised their target price on Antero Resources from $33.00 to $34.00 and gave the stock a "market perform" rating in a research report on Friday, October 4th. Two analysts have rated the stock with a sell rating, seven have assigned a hold rating, nine have issued a buy rating and two have given a strong buy rating to the company. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $32.83.

Read Our Latest Stock Analysis on Antero Resources

About Antero Resources

(

Free Report)

Antero Resources Corporation, an independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States. It operates in three segments: Exploration and Development; Marketing; and Equity Method Investment in Antero Midstream.

See Also

Before you consider Antero Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Antero Resources wasn't on the list.

While Antero Resources currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.