DENTSPLY SIRONA (NASDAQ:XRAY - Get Free Report) had its target price lowered by research analysts at Barrington Research from $36.00 to $24.00 in a research report issued on Friday,Benzinga reports. The brokerage currently has an "outperform" rating on the medical instruments supplier's stock. Barrington Research's target price would suggest a potential upside of 34.38% from the company's current price.

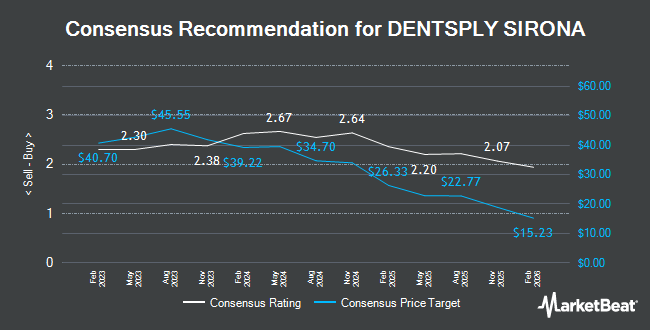

Several other brokerages have also recently issued reports on XRAY. Leerink Partners cut shares of DENTSPLY SIRONA from an "outperform" rating to a "market perform" rating in a report on Thursday. StockNews.com raised DENTSPLY SIRONA from a "hold" rating to a "buy" rating in a research report on Wednesday. Robert W. Baird reduced their target price on shares of DENTSPLY SIRONA from $31.00 to $24.00 and set a "neutral" rating for the company in a report on Friday. Stifel Nicolaus dropped their price target on shares of DENTSPLY SIRONA from $30.00 to $28.00 and set a "hold" rating on the stock in a research note on Thursday, July 18th. Finally, Evercore ISI decreased their target price on DENTSPLY SIRONA from $29.00 to $27.00 and set an "outperform" rating on the stock in a report on Tuesday, October 8th. Five investment analysts have rated the stock with a hold rating and six have issued a buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $29.50.

View Our Latest Report on DENTSPLY SIRONA

DENTSPLY SIRONA Stock Up 3.5 %

Shares of NASDAQ:XRAY traded up $0.60 during trading on Friday, reaching $17.86. 9,699,776 shares of the stock traded hands, compared to its average volume of 3,115,189. DENTSPLY SIRONA has a 52-week low of $17.21 and a 52-week high of $37.60. The stock has a market cap of $3.62 billion, a P/E ratio of -8.63, a price-to-earnings-growth ratio of 1.31 and a beta of 1.02. The stock has a 50-day moving average of $24.82 and a two-hundred day moving average of $25.98. The company has a debt-to-equity ratio of 0.57, a quick ratio of 0.87 and a current ratio of 1.33.

DENTSPLY SIRONA (NASDAQ:XRAY - Get Free Report) last released its quarterly earnings data on Thursday, November 7th. The medical instruments supplier reported $0.50 EPS for the quarter, beating the consensus estimate of $0.48 by $0.02. DENTSPLY SIRONA had a positive return on equity of 11.86% and a negative net margin of 4.75%. The company had revenue of $951.00 million for the quarter, compared to analysts' expectations of $939.10 million. During the same period last year, the firm posted $0.49 earnings per share. DENTSPLY SIRONA's revenue was up .4% compared to the same quarter last year. As a group, sell-side analysts expect that DENTSPLY SIRONA will post 1.98 earnings per share for the current fiscal year.

Institutional Investors Weigh In On DENTSPLY SIRONA

Institutional investors have recently added to or reduced their stakes in the stock. Raymond James Trust N.A. boosted its position in shares of DENTSPLY SIRONA by 4.9% during the second quarter. Raymond James Trust N.A. now owns 9,658 shares of the medical instruments supplier's stock worth $241,000 after acquiring an additional 453 shares during the last quarter. State of Alaska Department of Revenue boosted its holdings in shares of DENTSPLY SIRONA by 2.4% during the 3rd quarter. State of Alaska Department of Revenue now owns 23,545 shares of the medical instruments supplier's stock valued at $637,000 after purchasing an additional 560 shares during the last quarter. LRI Investments LLC grew its position in shares of DENTSPLY SIRONA by 82.7% during the second quarter. LRI Investments LLC now owns 1,246 shares of the medical instruments supplier's stock valued at $31,000 after purchasing an additional 564 shares in the last quarter. Diversified Trust Co increased its holdings in shares of DENTSPLY SIRONA by 3.0% in the second quarter. Diversified Trust Co now owns 19,637 shares of the medical instruments supplier's stock worth $489,000 after purchasing an additional 566 shares during the last quarter. Finally, Allworth Financial LP lifted its position in shares of DENTSPLY SIRONA by 40.2% in the third quarter. Allworth Financial LP now owns 2,179 shares of the medical instruments supplier's stock worth $59,000 after buying an additional 625 shares in the last quarter. 95.70% of the stock is owned by hedge funds and other institutional investors.

DENTSPLY SIRONA Company Profile

(

Get Free Report)

DENTSPLY SIRONA Inc manufactures and sells various dental products and technologies worldwide. It operates in four segments: Connected Technology Solutions, Essential Dental Solutions, Orthodontic and Implant Solutions, and Wellspect Healthcare. The company offers dental equipment comprising imaging equipment, motorized dental handpieces, treatment centers, other instruments, amalgamators, mixing machines, and porcelain furnaces; and dental CAD/CAM technologies to support dental restorations, such as intraoral scanners, 3-D printers, mills, other software and services, and a full-chairside economical restoration of esthetic ceramic dentistry, as well as DS Core, its cloud-based platform.

Featured Stories

Before you consider DENTSPLY SIRONA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DENTSPLY SIRONA wasn't on the list.

While DENTSPLY SIRONA currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.