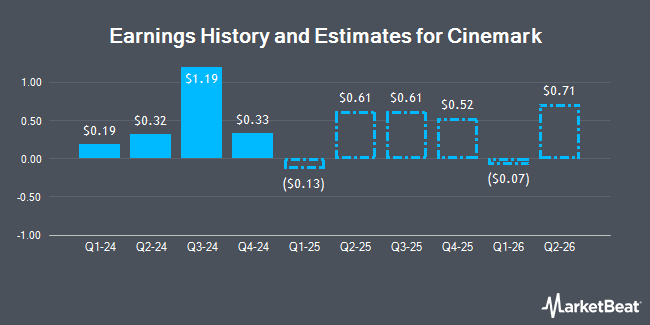

Cinemark Holdings, Inc. (NYSE:CNK - Free Report) - Investment analysts at Barrington Research lifted their Q1 2025 earnings estimates for Cinemark in a research report issued to clients and investors on Monday, November 4th. Barrington Research analyst J. Goss now expects that the company will post earnings per share of $0.06 for the quarter, up from their prior estimate of $0.04. Barrington Research currently has a "Outperform" rating and a $36.00 price target on the stock. The consensus estimate for Cinemark's current full-year earnings is $1.50 per share. Barrington Research also issued estimates for Cinemark's Q2 2025 earnings at $0.67 EPS, Q4 2025 earnings at $0.47 EPS and Q1 2026 earnings at $0.23 EPS.

A number of other research firms have also recently commented on CNK. Macquarie raised their target price on shares of Cinemark from $32.00 to $34.00 and gave the stock an "outperform" rating in a research note on Friday, November 1st. Wedbush downgraded shares of Cinemark from a "strong-buy" rating to a "hold" rating in a report on Friday, November 1st. B. Riley cut Cinemark from a "buy" rating to a "neutral" rating and set a $31.00 price target on the stock. in a report on Tuesday, August 27th. JPMorgan Chase & Co. lifted their price target on shares of Cinemark from $25.00 to $29.00 and gave the company a "neutral" rating in a report on Monday, October 14th. Finally, The Goldman Sachs Group raised their price objective on Cinemark from $16.00 to $20.00 and gave the company a "sell" rating in a research report on Thursday, September 19th. Two research analysts have rated the stock with a sell rating, three have issued a hold rating, six have issued a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $30.80.

Read Our Latest Stock Report on Cinemark

Cinemark Stock Performance

Shares of NYSE CNK traded up $1.06 during trading on Wednesday, hitting $30.75. The company had a trading volume of 3,672,477 shares, compared to its average volume of 2,860,639. The stock has a 50 day simple moving average of $28.36 and a 200 day simple moving average of $23.44. The firm has a market capitalization of $3.76 billion, a P/E ratio of 19.84, a price-to-earnings-growth ratio of 2.00 and a beta of 2.35. The company has a debt-to-equity ratio of 3.46, a quick ratio of 0.96 and a current ratio of 0.98. Cinemark has a 12 month low of $13.19 and a 12 month high of $31.09.

Cinemark (NYSE:CNK - Get Free Report) last posted its quarterly earnings data on Thursday, October 31st. The company reported $1.19 EPS for the quarter, topping the consensus estimate of $0.58 by $0.61. The firm had revenue of $921.80 million during the quarter, compared to analyst estimates of $894.90 million. Cinemark had a return on equity of 60.21% and a net margin of 8.36%. Cinemark's revenue was up 5.4% on a year-over-year basis. During the same period in the prior year, the business posted $0.61 EPS.

Institutional Trading of Cinemark

Several institutional investors and hedge funds have recently modified their holdings of the stock. GAMMA Investing LLC lifted its holdings in shares of Cinemark by 106.1% in the 3rd quarter. GAMMA Investing LLC now owns 2,020 shares of the company's stock worth $56,000 after buying an additional 1,040 shares during the period. Point72 Asia Singapore Pte. Ltd. increased its holdings in Cinemark by 38.7% during the second quarter. Point72 Asia Singapore Pte. Ltd. now owns 3,145 shares of the company's stock valued at $68,000 after buying an additional 877 shares during the period. USA Financial Formulas purchased a new position in shares of Cinemark in the 3rd quarter valued at $77,000. 1620 Investment Advisors Inc. purchased a new position in Cinemark in the second quarter valued at about $79,000. Finally, CWM LLC raised its holdings in Cinemark by 134.4% in the third quarter. CWM LLC now owns 2,993 shares of the company's stock worth $83,000 after purchasing an additional 1,716 shares in the last quarter.

Insider Buying and Selling at Cinemark

In other Cinemark news, insider Valmir Fernandes sold 25,000 shares of the company's stock in a transaction on Monday, August 19th. The stock was sold at an average price of $27.19, for a total value of $679,750.00. Following the transaction, the insider now owns 204,729 shares of the company's stock, valued at $5,566,581.51. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Company insiders own 2.30% of the company's stock.

Cinemark Company Profile

(

Get Free Report)

Cinemark Holdings, Inc, together with its subsidiaries, engages in the motion picture exhibition business. As of February 16, 2024, it operated 501 theatres with 5,719 screens in 42 states and 13 countries in South and Central America. Cinemark Holdings, Inc was founded in 1984 and is headquartered in Plano, Texas.

Further Reading

Before you consider Cinemark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cinemark wasn't on the list.

While Cinemark currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.