Basswood Capital Management L.L.C. raised its position in shares of OneMain Holdings, Inc. (NYSE:OMF - Free Report) by 12.3% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 1,030,423 shares of the financial services provider's stock after purchasing an additional 113,018 shares during the quarter. OneMain accounts for 2.5% of Basswood Capital Management L.L.C.'s investment portfolio, making the stock its 9th biggest holding. Basswood Capital Management L.L.C. owned about 0.86% of OneMain worth $48,502,000 at the end of the most recent quarter.

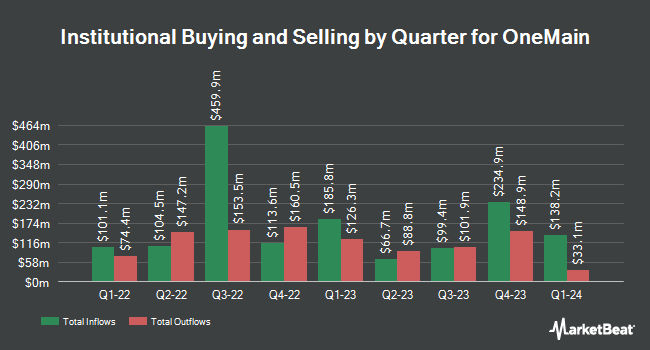

Several other hedge funds and other institutional investors have also modified their holdings of OMF. B. Riley Wealth Advisors Inc. boosted its position in OneMain by 11.1% during the first quarter. B. Riley Wealth Advisors Inc. now owns 5,421 shares of the financial services provider's stock valued at $277,000 after purchasing an additional 543 shares during the last quarter. Swedbank AB acquired a new position in OneMain during the 1st quarter worth $817,000. Cetera Advisors LLC acquired a new stake in shares of OneMain in the first quarter valued at about $493,000. DekaBank Deutsche Girozentrale lifted its holdings in shares of OneMain by 7.4% during the first quarter. DekaBank Deutsche Girozentrale now owns 6,287 shares of the financial services provider's stock worth $315,000 after buying an additional 431 shares during the last quarter. Finally, QRG Capital Management Inc. boosted its position in shares of OneMain by 8.2% in the second quarter. QRG Capital Management Inc. now owns 60,057 shares of the financial services provider's stock valued at $2,912,000 after acquiring an additional 4,534 shares during the period. Institutional investors and hedge funds own 85.82% of the company's stock.

Analyst Upgrades and Downgrades

OMF has been the topic of several research reports. Wells Fargo & Company boosted their price objective on shares of OneMain from $49.00 to $52.00 and gave the stock an "equal weight" rating in a report on Thursday, October 31st. Stephens started coverage on OneMain in a research report on Wednesday, November 13th. They issued an "overweight" rating and a $62.00 price objective for the company. StockNews.com downgraded shares of OneMain from a "buy" rating to a "hold" rating in a research report on Tuesday, November 5th. Barclays lowered shares of OneMain from an "overweight" rating to an "equal weight" rating and lowered their price target for the company from $52.00 to $46.00 in a report on Tuesday, October 8th. Finally, Royal Bank of Canada reaffirmed an "outperform" rating and set a $58.00 price objective on shares of OneMain in a report on Wednesday, October 16th. Seven investment analysts have rated the stock with a hold rating and eight have given a buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $55.46.

Get Our Latest Stock Analysis on OMF

OneMain Stock Down 0.5 %

Shares of NYSE:OMF traded down $0.27 during mid-day trading on Monday, reaching $57.08. 435,755 shares of the stock were exchanged, compared to its average volume of 1,006,213. The company has a market cap of $6.81 billion, a P/E ratio of 12.55, a P/E/G ratio of 0.71 and a beta of 1.54. The stock's 50 day simple moving average is $50.24 and its 200-day simple moving average is $48.99. OneMain Holdings, Inc. has a one year low of $41.70 and a one year high of $57.97.

OneMain Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Monday, November 18th. Stockholders of record on Tuesday, November 12th were given a $1.04 dividend. This represents a $4.16 dividend on an annualized basis and a dividend yield of 7.29%. The ex-dividend date of this dividend was Tuesday, November 12th. OneMain's dividend payout ratio is presently 91.03%.

Insider Buying and Selling

In related news, SVP Michael A. Hedlund sold 2,400 shares of OneMain stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $46.00, for a total transaction of $110,400.00. Following the completion of the transaction, the senior vice president now owns 25,747 shares in the company, valued at approximately $1,184,362. This trade represents a 8.53 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CEO Douglas H. Shulman sold 5,000 shares of OneMain stock in a transaction dated Thursday, September 19th. The stock was sold at an average price of $50.00, for a total transaction of $250,000.00. Following the completion of the sale, the chief executive officer now owns 417,474 shares of the company's stock, valued at $20,873,700. This trade represents a 1.18 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 40,178 shares of company stock worth $2,107,084. 0.45% of the stock is owned by insiders.

OneMain Profile

(

Free Report)

OneMain Holdings, Inc, a financial service holding company, engages in the consumer finance and insurance businesses in the United States. It originates, underwrites, and services personal loans secured by automobiles, other titled collateral, or unsecured. The company also offers credit cards; optional credit insurance products, including life, disability, and involuntary unemployment insurance; optional non-credit insurance; guaranteed asset protection coverage as a waiver product or insurance; and membership plans.

Featured Articles

Before you consider OneMain, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OneMain wasn't on the list.

While OneMain currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.