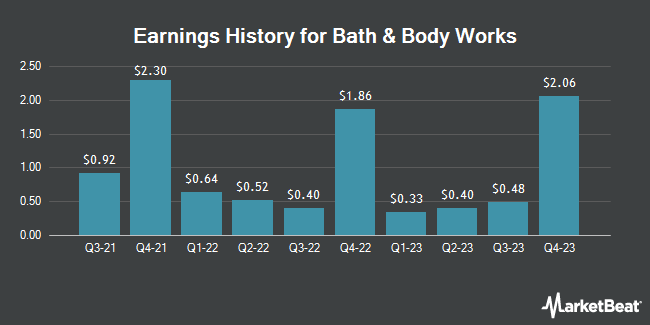

Bath & Body Works (NYSE:BBWI - Get Free Report) is anticipated to issue its quarterly earnings data before the market opens on Thursday, February 27th. Analysts expect the company to announce earnings of $2.04 per share and revenue of $2.78 billion for the quarter. Bath & Body Works has set its Q4 guidance at $1.94-2.07 EPS and its Q4 2024 guidance at 1.940-2.070 EPS.Investors that wish to listen to the company's conference call can do so using this link.

Bath & Body Works (NYSE:BBWI - Get Free Report) last released its quarterly earnings results on Monday, November 25th. The company reported $0.49 EPS for the quarter, topping the consensus estimate of $0.46 by $0.03. The firm had revenue of $1.61 billion for the quarter, compared to analyst estimates of $1.58 billion. Bath & Body Works had a negative return on equity of 44.03% and a net margin of 12.43%. Bath & Body Works's revenue for the quarter was up 3.1% on a year-over-year basis. During the same period in the previous year, the company posted $0.48 EPS. On average, analysts expect Bath & Body Works to post $3 EPS for the current fiscal year and $4 EPS for the next fiscal year.

Bath & Body Works Price Performance

Shares of NYSE:BBWI traded down $1.84 during midday trading on Friday, reaching $38.51. The company had a trading volume of 5,441,380 shares, compared to its average volume of 3,106,371. The stock has a market capitalization of $8.34 billion, a P/E ratio of 9.39, a PEG ratio of 0.96 and a beta of 1.83. The stock's fifty day moving average price is $37.70 and its 200-day moving average price is $33.86. Bath & Body Works has a one year low of $26.20 and a one year high of $52.99.

Bath & Body Works Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Friday, March 7th. Stockholders of record on Friday, February 21st will be given a $0.20 dividend. This represents a $0.80 annualized dividend and a dividend yield of 2.08%. The ex-dividend date of this dividend is Friday, February 21st. Bath & Body Works's payout ratio is currently 19.51%.

Wall Street Analyst Weigh In

BBWI has been the subject of a number of research reports. Argus reiterated a "hold" rating on shares of Bath & Body Works in a research note on Friday, January 10th. Piper Sandler lifted their target price on Bath & Body Works from $36.00 to $39.00 and gave the stock a "neutral" rating in a research report on Monday, January 6th. Morgan Stanley lowered their price target on Bath & Body Works from $51.00 to $48.00 and set an "overweight" rating for the company in a report on Thursday, November 21st. Wells Fargo & Company upgraded Bath & Body Works from an "equal weight" rating to an "overweight" rating and raised their price objective for the stock from $42.00 to $48.00 in a research note on Friday, January 10th. Finally, TD Cowen boosted their target price on shares of Bath & Body Works from $42.00 to $48.00 and gave the company a "buy" rating in a research note on Thursday, December 12th. One research analyst has rated the stock with a sell rating, five have issued a hold rating and eleven have given a buy rating to the stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $43.63.

View Our Latest Stock Analysis on Bath & Body Works

Bath & Body Works Company Profile

(

Get Free Report)

Bath & Body Works, Inc is a specialty retailers and home to America's Favorite Fragrances, offering a breadth of exclusive fragrances for the body and home, including the selling collections for fine fragrance mist, body lotion and body cream, 3-wick candles, home fragrance diffusers and liquid hand soap.

See Also

Before you consider Bath & Body Works, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bath & Body Works wasn't on the list.

While Bath & Body Works currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.