HC Wainwright reiterated their buy rating on shares of Bausch + Lomb (NYSE:BLCO - Free Report) in a report published on Thursday,Benzinga reports. The brokerage currently has a $23.00 price target on the stock.

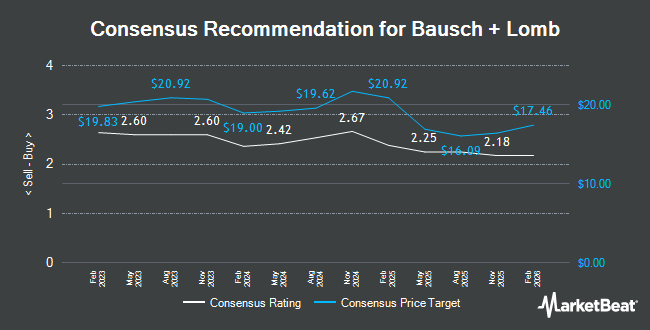

A number of other brokerages also recently issued reports on BLCO. Royal Bank of Canada raised their price target on Bausch + Lomb from $20.00 to $23.00 and gave the stock an "outperform" rating in a research report on Tuesday, October 22nd. Citigroup lowered shares of Bausch + Lomb from a "buy" rating to a "neutral" rating and lowered their target price for the stock from $24.00 to $22.00 in a report on Wednesday. Needham & Company LLC reiterated a "hold" rating on shares of Bausch + Lomb in a report on Thursday, October 31st. Morgan Stanley lowered shares of Bausch + Lomb from an "overweight" rating to an "equal weight" rating and set a $19.00 price objective on the stock. in a research report on Monday, December 2nd. Finally, Evercore ISI upgraded Bausch + Lomb from an "in-line" rating to an "outperform" rating and boosted their target price for the company from $19.00 to $25.00 in a research report on Tuesday, October 15th. One investment analyst has rated the stock with a sell rating, seven have given a hold rating and five have issued a buy rating to the company. According to MarketBeat, Bausch + Lomb presently has an average rating of "Hold" and a consensus price target of $20.58.

View Our Latest Report on Bausch + Lomb

Bausch + Lomb Price Performance

Shares of Bausch + Lomb stock traded up $0.46 during trading hours on Thursday, reaching $18.62. The company's stock had a trading volume of 923,228 shares, compared to its average volume of 561,198. The firm has a 50 day moving average price of $19.89 and a 200-day moving average price of $17.47. The company has a debt-to-equity ratio of 0.69, a current ratio of 1.57 and a quick ratio of 0.95. The stock has a market cap of $6.56 billion, a P/E ratio of -17.58, a P/E/G ratio of 1.93 and a beta of 0.43. Bausch + Lomb has a one year low of $13.16 and a one year high of $21.69.

Bausch + Lomb (NYSE:BLCO - Get Free Report) last issued its quarterly earnings data on Wednesday, October 30th. The company reported $0.17 earnings per share for the quarter, topping the consensus estimate of $0.16 by $0.01. The company had revenue of $1.20 billion for the quarter, compared to analysts' expectations of $1.17 billion. Bausch + Lomb had a positive return on equity of 3.17% and a negative net margin of 7.86%. The firm's revenue for the quarter was up 18.8% on a year-over-year basis. During the same period in the previous year, the firm posted $0.22 earnings per share. On average, analysts predict that Bausch + Lomb will post 0.6 EPS for the current year.

Hedge Funds Weigh In On Bausch + Lomb

A number of hedge funds and other institutional investors have recently made changes to their positions in the company. Blue Trust Inc. raised its holdings in shares of Bausch + Lomb by 14,052.2% in the second quarter. Blue Trust Inc. now owns 3,255 shares of the company's stock valued at $47,000 after acquiring an additional 3,232 shares in the last quarter. Squarepoint Ops LLC purchased a new stake in shares of Bausch + Lomb in the 2nd quarter worth approximately $173,000. Polar Asset Management Partners Inc. bought a new position in shares of Bausch + Lomb during the third quarter valued at approximately $289,000. Gordian Capital Singapore Pte Ltd purchased a new position in Bausch + Lomb during the third quarter valued at approximately $289,000. Finally, Verition Fund Management LLC bought a new position in Bausch + Lomb in the third quarter worth approximately $302,000. Institutional investors own 11.07% of the company's stock.

About Bausch + Lomb

(

Get Free Report)

Bausch + Lomb Corporation operates as an eye health company in the United States, Puerto Rico, China, France, Japan, Germany, the United Kingdom, Canada, Russia, Spain, Italy, Mexico, Poland, South Korea, and internationally. It operates in three segments: Vision Care, Pharmaceuticals, and Surgical. The Vision Care segment provides contact lens that covers the spectrum of wearing modalities, including daily disposable and frequently replaced contact lenses; and contact lens care products comprising over-the-counter eye drops, eye vitamins, and mineral supplements that address various conditions, such as eye allergies, conjunctivitis, dry eye, and redness relief.

Further Reading

Before you consider Bausch + Lomb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bausch + Lomb wasn't on the list.

While Bausch + Lomb currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.