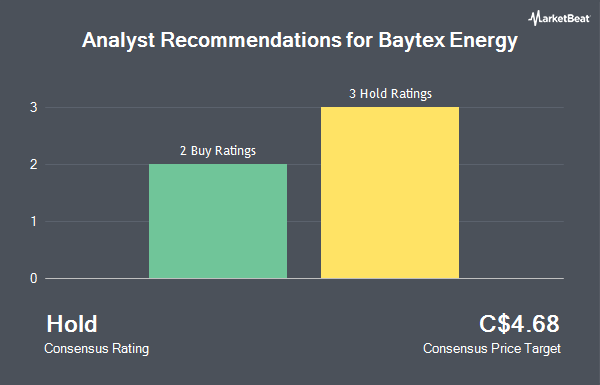

Baytex Energy Corp. (TSE:BTE - Get Free Report) NYSE: BTE has received a consensus recommendation of "Moderate Buy" from the eight ratings firms that are currently covering the stock, Marketbeat.com reports. Three analysts have rated the stock with a hold recommendation and five have given a buy recommendation to the company. The average 1-year target price among analysts that have issued a report on the stock in the last year is C$5.97.

BTE has been the topic of a number of recent research reports. Royal Bank of Canada decreased their price target on shares of Baytex Energy from C$6.50 to C$5.50 in a research note on Tuesday, September 17th. Raymond James raised shares of Baytex Energy to a "hold" rating in a report on Thursday, October 17th. ATB Capital lowered their target price on shares of Baytex Energy from C$5.50 to C$5.20 in a research note on Wednesday, December 4th. Canaccord Genuity Group cut their price target on shares of Baytex Energy from C$6.50 to C$6.00 in a research note on Tuesday, October 22nd. Finally, National Bankshares decreased their price objective on Baytex Energy from C$8.00 to C$7.50 in a report on Friday, September 27th.

Get Our Latest Stock Report on BTE

Baytex Energy Stock Performance

Shares of TSE:BTE traded up C$0.06 during trading on Wednesday, hitting C$3.48. 1,595,312 shares of the stock were exchanged, compared to its average volume of 4,710,687. The company has a market capitalization of C$2.80 billion, a price-to-earnings ratio of -5.04, a price-to-earnings-growth ratio of 0.12 and a beta of 2.61. The company has a debt-to-equity ratio of 62.33, a quick ratio of 0.77 and a current ratio of 0.72. Baytex Energy has a 1-year low of C$3.15 and a 1-year high of C$5.55. The company's fifty day simple moving average is C$3.92 and its 200-day simple moving average is C$4.39.

Baytex Energy Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Thursday, January 2nd. Investors of record on Thursday, January 2nd will be given a dividend of $0.023 per share. The ex-dividend date of this dividend is Friday, December 13th. This represents a $0.09 dividend on an annualized basis and a yield of 2.64%. Baytex Energy's dividend payout ratio (DPR) is presently -13.04%.

Insider Activity at Baytex Energy

In related news, Senior Officer Nicole Marie Frechette bought 8,200 shares of the company's stock in a transaction on Monday, December 9th. The stock was bought at an average cost of C$3.67 per share, with a total value of C$30,094.00. Insiders own 0.83% of the company's stock.

About Baytex Energy

(

Get Free ReportBaytex Energy Corp., an energy company, engages in the acquisition, development, and production of crude oil and natural gas in the Western Canadian Sedimentary Basin and in the Eagle Ford, the United States. The company offers light oil and condensate, heavy oil, natural gas liquids, and natural gas.

Read More

Before you consider Baytex Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Baytex Energy wasn't on the list.

While Baytex Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.