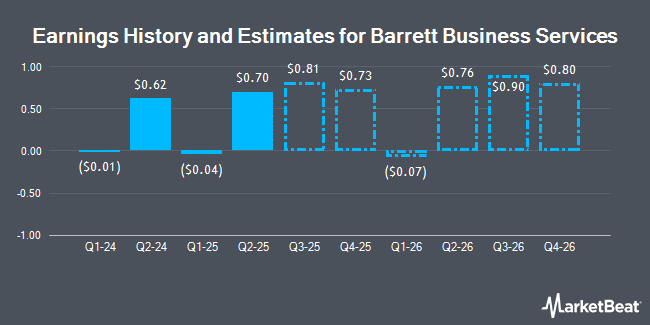

Barrett Business Services, Inc. (NASDAQ:BBSI - Free Report) - Equities researchers at Barrington Research raised their FY2024 earnings estimates for Barrett Business Services in a report released on Thursday, November 7th. Barrington Research analyst V. Colicchio now expects that the business services provider will post earnings per share of $1.97 for the year, up from their previous forecast of $1.95. Barrington Research has a "Outperform" rating and a $45.00 price objective on the stock. The consensus estimate for Barrett Business Services' current full-year earnings is $1.99 per share.

Separately, Roth Mkm raised their target price on Barrett Business Services from $43.00 to $45.00 and gave the company a "buy" rating in a research note on Thursday.

Check Out Our Latest Stock Analysis on Barrett Business Services

Barrett Business Services Price Performance

BBSI traded up $1.67 during trading hours on Monday, reaching $43.04. 87,069 shares of the stock traded hands, compared to its average volume of 135,980. Barrett Business Services has a fifty-two week low of $26.06 and a fifty-two week high of $43.05. The company has a market cap of $1.13 billion, a price-to-earnings ratio of 21.83, a PEG ratio of 1.35 and a beta of 1.39. The firm's fifty day simple moving average is $36.91 and its two-hundred day simple moving average is $34.59.

Hedge Funds Weigh In On Barrett Business Services

Several hedge funds and other institutional investors have recently made changes to their positions in the business. Foundry Partners LLC lifted its stake in shares of Barrett Business Services by 1.0% in the 3rd quarter. Foundry Partners LLC now owns 180,995 shares of the business services provider's stock worth $6,789,000 after acquiring an additional 1,735 shares during the period. Pathstone Holdings LLC lifted its position in Barrett Business Services by 3.1% in the third quarter. Pathstone Holdings LLC now owns 53,174 shares of the business services provider's stock worth $1,995,000 after purchasing an additional 1,595 shares during the period. Mawer Investment Management Ltd. boosted its stake in Barrett Business Services by 236.4% during the 3rd quarter. Mawer Investment Management Ltd. now owns 1,834,452 shares of the business services provider's stock valued at $68,810,000 after purchasing an additional 1,289,147 shares in the last quarter. Quest Partners LLC increased its position in shares of Barrett Business Services by 5.6% during the 3rd quarter. Quest Partners LLC now owns 18,998 shares of the business services provider's stock valued at $713,000 after purchasing an additional 1,012 shares during the period. Finally, Thrivent Financial for Lutherans purchased a new stake in shares of Barrett Business Services during the third quarter valued at $16,422,000. 86.76% of the stock is currently owned by institutional investors and hedge funds.

Insider Transactions at Barrett Business Services

In related news, CEO Gary Kramer sold 34,288 shares of the business's stock in a transaction that occurred on Wednesday, August 21st. The stock was sold at an average price of $35.05, for a total transaction of $1,201,794.40. Following the completion of the transaction, the chief executive officer now owns 242,543 shares in the company, valued at $8,501,132.15. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Insiders own 3.70% of the company's stock.

Barrett Business Services Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 6th. Shareholders of record on Friday, November 22nd will be issued a dividend of $0.08 per share. The ex-dividend date is Friday, November 22nd. This represents a $0.32 dividend on an annualized basis and a dividend yield of 0.74%. Barrett Business Services's dividend payout ratio (DPR) is 16.89%.

Barrett Business Services Company Profile

(

Get Free Report)

Barrett Business Services, Inc provides business management solutions for small and mid-sized companies in the United States. The company develops a management platform that integrates a knowledge-based approach from the management consulting industry with tools from the human resource outsourcing industry.

See Also

Before you consider Barrett Business Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Barrett Business Services wasn't on the list.

While Barrett Business Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.