BCE (NYSE:BCE - Get Free Report) TSE: BCE had its price objective reduced by equities researchers at Barclays from $34.00 to $30.00 in a research report issued on Monday,Benzinga reports. The brokerage currently has an "equal weight" rating on the utilities provider's stock. Barclays's price objective would suggest a potential upside of 7.76% from the company's previous close.

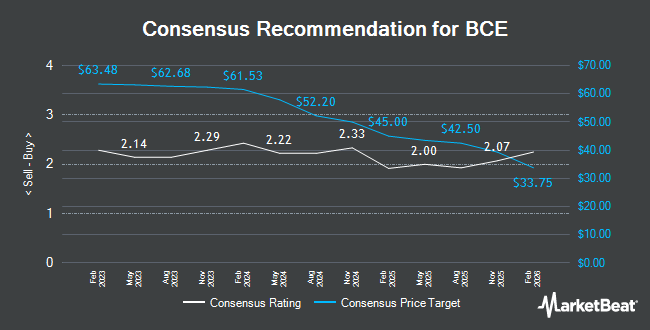

A number of other analysts have also recently weighed in on BCE. Edward Jones cut shares of BCE from a "buy" rating to a "hold" rating in a report on Tuesday, November 5th. BMO Capital Markets raised their price target on shares of BCE from $48.00 to $51.00 and gave the company a "market perform" rating in a report on Thursday, September 19th. Cibc World Mkts upgraded shares of BCE from a "hold" rating to a "strong-buy" rating in a report on Friday, August 2nd. Canaccord Genuity Group cut shares of BCE from a "buy" rating to a "hold" rating in a report on Tuesday, November 5th. Finally, National Bank Financial cut shares of BCE from a "strong-buy" rating to a "hold" rating in a report on Monday, September 30th. Nine analysts have rated the stock with a hold rating, one has issued a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, BCE has a consensus rating of "Hold" and a consensus target price of $45.00.

Read Our Latest Stock Report on BCE

BCE Stock Down 1.9 %

BCE stock traded down $0.53 during midday trading on Monday, hitting $27.84. 3,104,877 shares of the company's stock were exchanged, compared to its average volume of 2,290,720. The company has a debt-to-equity ratio of 2.00, a quick ratio of 0.62 and a current ratio of 0.65. BCE has a 12 month low of $27.29 and a 12 month high of $41.77. The firm has a 50-day moving average of $33.60 and a two-hundred day moving average of $33.58. The company has a market cap of $25.40 billion, a PE ratio of 399.71, a P/E/G ratio of 4.26 and a beta of 0.59.

Institutional Trading of BCE

A number of institutional investors have recently bought and sold shares of the stock. BNP Paribas Financial Markets raised its position in BCE by 20.0% during the 1st quarter. BNP Paribas Financial Markets now owns 20,698 shares of the utilities provider's stock worth $703,000 after buying an additional 3,450 shares during the last quarter. Oppenheimer & Co. Inc. increased its holdings in BCE by 4.5% in the first quarter. Oppenheimer & Co. Inc. now owns 40,564 shares of the utilities provider's stock valued at $1,378,000 after buying an additional 1,733 shares in the last quarter. Bleakley Financial Group LLC raised its position in shares of BCE by 6.7% in the first quarter. Bleakley Financial Group LLC now owns 10,822 shares of the utilities provider's stock worth $368,000 after acquiring an additional 680 shares during the period. Leo Wealth LLC grew its position in shares of BCE by 6.5% during the 1st quarter. Leo Wealth LLC now owns 32,115 shares of the utilities provider's stock valued at $1,091,000 after acquiring an additional 1,973 shares during the period. Finally, Trillium Asset Management LLC increased its stake in shares of BCE by 0.5% in the 1st quarter. Trillium Asset Management LLC now owns 142,974 shares of the utilities provider's stock valued at $4,862,000 after purchasing an additional 670 shares in the last quarter. 41.46% of the stock is currently owned by institutional investors and hedge funds.

BCE Company Profile

(

Get Free Report)

BCE Inc, a communications company, provides wireless, wireline, Internet, and television (TV) services to residential, business, and wholesale customers in Canada. The company operates through two segments, Bell Communication and Technology Services, and Bell Media. The Bell Communication and Technology Services segment provides wireless products and services including mobile data and voice plans and devices; wireline products and services comprising data, including internet access, internet protocol television, cloud-based services, and business solutions, as well as voice, and other communication services and products; and satellite TV and connectivity services for residential, small and medium-sized business, government, and large enterprise customers.

Further Reading

Before you consider BCE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BCE wasn't on the list.

While BCE currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.