Beach Investment Counsel Inc. PA cut its holdings in Healthpeak Properties, Inc. (NYSE:DOC - Free Report) by 52.6% during the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 21,215 shares of the real estate investment trust's stock after selling 23,530 shares during the period. Beach Investment Counsel Inc. PA's holdings in Healthpeak Properties were worth $430,000 at the end of the most recent quarter.

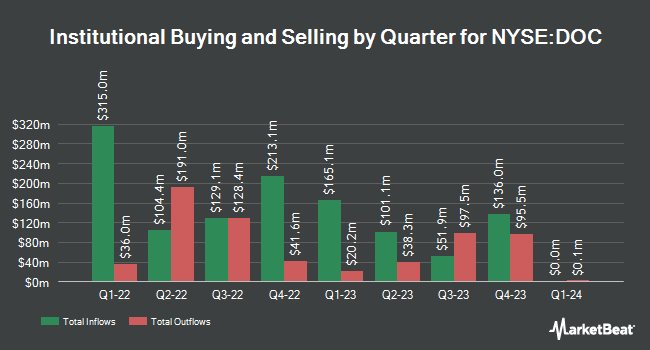

Other institutional investors have also made changes to their positions in the company. State Street Corp bought a new stake in Healthpeak Properties during the 3rd quarter worth about $1,093,576,000. Geode Capital Management LLC bought a new stake in Healthpeak Properties during the third quarter worth about $403,898,000. Charles Schwab Investment Management Inc. acquired a new position in Healthpeak Properties during the third quarter valued at approximately $230,988,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC bought a new position in Healthpeak Properties in the third quarter valued at approximately $175,697,000. Finally, Sumitomo Mitsui Trust Group Inc. acquired a new position in shares of Healthpeak Properties during the 3rd quarter worth approximately $102,615,000. Institutional investors own 93.57% of the company's stock.

Healthpeak Properties Stock Performance

Shares of DOC traded down $0.27 during midday trading on Friday, reaching $19.85. 4,360,823 shares of the stock were exchanged, compared to its average volume of 4,682,965. The stock's 50 day simple moving average is $20.59 and its 200 day simple moving average is $21.52. The company has a market cap of $13.88 billion, a P/E ratio of 42.23, a PEG ratio of 2.22 and a beta of 1.15. Healthpeak Properties, Inc. has a twelve month low of $16.01 and a twelve month high of $23.26. The company has a quick ratio of 1.31, a current ratio of 1.31 and a debt-to-equity ratio of 0.93.

Healthpeak Properties Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, February 26th. Shareholders of record on Friday, February 14th will be given a dividend of $0.305 per share. This represents a $1.22 dividend on an annualized basis and a dividend yield of 6.15%. The ex-dividend date is Friday, February 14th. This is a positive change from Healthpeak Properties's previous quarterly dividend of $0.30. Healthpeak Properties's dividend payout ratio is presently 255.32%.

Analyst Upgrades and Downgrades

Several equities research analysts have recently commented on the company. Robert W. Baird increased their price objective on Healthpeak Properties from $24.00 to $25.00 and gave the company an "outperform" rating in a report on Wednesday, October 30th. StockNews.com cut shares of Healthpeak Properties from a "hold" rating to a "sell" rating in a research note on Wednesday, October 30th. Morgan Stanley upgraded shares of Healthpeak Properties from an "equal weight" rating to an "overweight" rating and set a $25.00 price objective on the stock in a research note on Wednesday, January 15th. Royal Bank of Canada raised their target price on shares of Healthpeak Properties from $25.00 to $26.00 and gave the company an "outperform" rating in a research note on Monday, November 4th. Finally, Deutsche Bank Aktiengesellschaft raised Healthpeak Properties from a "hold" rating to a "buy" rating and boosted their price target for the stock from $20.00 to $28.00 in a research report on Monday, October 21st. One investment analyst has rated the stock with a sell rating, three have issued a hold rating, ten have issued a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $24.15.

View Our Latest Research Report on DOC

Healthpeak Properties Company Profile

(

Free Report)

Healthpeak Properties, Inc is a fully integrated real estate investment trust (REIT) and S&P 500 company. Healthpeak owns, operates, and develops high-quality real estate for healthcare discovery and delivery.

See Also

Before you consider Healthpeak Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Healthpeak Properties wasn't on the list.

While Healthpeak Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.