Vestcor Inc trimmed its stake in shares of Becton, Dickinson and Company (NYSE:BDX - Free Report) by 31.3% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 5,740 shares of the medical instruments supplier's stock after selling 2,613 shares during the quarter. Vestcor Inc's holdings in Becton, Dickinson and Company were worth $1,384,000 as of its most recent filing with the Securities and Exchange Commission.

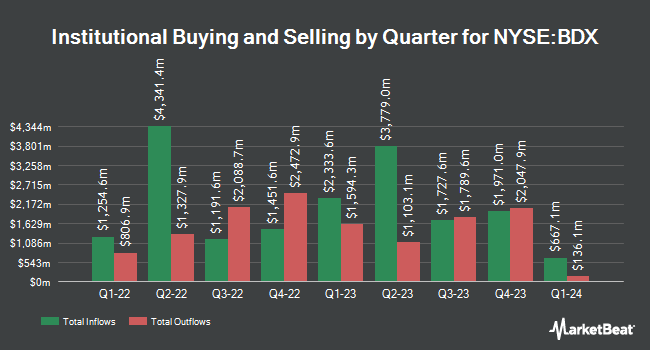

Other hedge funds have also made changes to their positions in the company. Charles Schwab Investment Management Inc. raised its stake in Becton, Dickinson and Company by 79.0% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 2,986,543 shares of the medical instruments supplier's stock valued at $720,089,000 after acquiring an additional 1,317,723 shares in the last quarter. Benson Investment Management Company Inc. raised its stake in shares of Becton, Dickinson and Company by 13.2% during the third quarter. Benson Investment Management Company Inc. now owns 22,315 shares of the medical instruments supplier's stock valued at $5,380,000 after purchasing an additional 2,602 shares in the last quarter. Swedbank AB lifted its holdings in Becton, Dickinson and Company by 1.8% in the third quarter. Swedbank AB now owns 150,838 shares of the medical instruments supplier's stock worth $36,367,000 after purchasing an additional 2,729 shares during the period. Nomura Asset Management Co. Ltd. grew its position in Becton, Dickinson and Company by 2.3% in the 3rd quarter. Nomura Asset Management Co. Ltd. now owns 561,040 shares of the medical instruments supplier's stock valued at $135,267,000 after buying an additional 12,845 shares in the last quarter. Finally, Curi RMB Capital LLC increased its stake in Becton, Dickinson and Company by 18.1% during the 3rd quarter. Curi RMB Capital LLC now owns 84,873 shares of the medical instruments supplier's stock valued at $20,463,000 after buying an additional 13,030 shares during the period. Institutional investors own 86.97% of the company's stock.

Insider Activity at Becton, Dickinson and Company

In related news, EVP Roland Goette sold 4,483 shares of the firm's stock in a transaction on Friday, December 6th. The stock was sold at an average price of $221.01, for a total transaction of $990,787.83. Following the sale, the executive vice president now owns 24,345 shares of the company's stock, valued at approximately $5,380,488.45. This trade represents a 15.55 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this link. 0.31% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

Several equities research analysts have recently commented on the company. Citigroup raised Becton, Dickinson and Company from a "neutral" rating to a "buy" rating and upped their target price for the company from $255.00 to $275.00 in a report on Tuesday, October 1st. Evercore ISI upped their price target on shares of Becton, Dickinson and Company from $286.00 to $290.00 and gave the company an "outperform" rating in a research report on Tuesday, October 1st. Seven research analysts have rated the stock with a buy rating, According to MarketBeat, Becton, Dickinson and Company currently has an average rating of "Buy" and an average price target of $283.50.

View Our Latest Analysis on BDX

Becton, Dickinson and Company Price Performance

Shares of BDX stock traded up $6.13 during trading hours on Thursday, hitting $227.17. The company had a trading volume of 3,489,563 shares, compared to its average volume of 1,454,273. The company has a debt-to-equity ratio of 0.69, a quick ratio of 0.74 and a current ratio of 1.17. The firm has a market capitalization of $65.68 billion, a price-to-earnings ratio of 37.21, a PEG ratio of 1.64 and a beta of 0.41. Becton, Dickinson and Company has a 12 month low of $218.75 and a 12 month high of $249.89. The firm's fifty day moving average is $231.46 and its 200 day moving average is $233.40.

Becton, Dickinson and Company (NYSE:BDX - Get Free Report) last issued its quarterly earnings data on Thursday, November 7th. The medical instruments supplier reported $3.81 earnings per share (EPS) for the quarter, beating the consensus estimate of $3.77 by $0.04. Becton, Dickinson and Company had a return on equity of 14.89% and a net margin of 8.55%. The firm had revenue of $5.44 billion during the quarter, compared to the consensus estimate of $5.38 billion. During the same quarter in the previous year, the company posted $3.42 EPS. The business's revenue for the quarter was up 6.9% compared to the same quarter last year. On average, sell-side analysts predict that Becton, Dickinson and Company will post 14.43 EPS for the current fiscal year.

Becton, Dickinson and Company Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Monday, December 9th will be paid a dividend of $1.04 per share. The ex-dividend date of this dividend is Monday, December 9th. This is a boost from Becton, Dickinson and Company's previous quarterly dividend of $0.95. This represents a $4.16 dividend on an annualized basis and a dividend yield of 1.83%. Becton, Dickinson and Company's payout ratio is 70.03%.

About Becton, Dickinson and Company

(

Free Report)

Becton, Dickinson and Company develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide. The company operates in three segments: BD Medical, BD Life Sciences, and BD Interventional.

See Also

Before you consider Becton, Dickinson and Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Becton, Dickinson and Company wasn't on the list.

While Becton, Dickinson and Company currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report