Bellevue Asset Management LLC increased its position in shares of Eli Lilly and Company (NYSE:LLY - Free Report) by 183.5% during the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 567 shares of the company's stock after acquiring an additional 367 shares during the quarter. Bellevue Asset Management LLC's holdings in Eli Lilly and Company were worth $438,000 at the end of the most recent quarter.

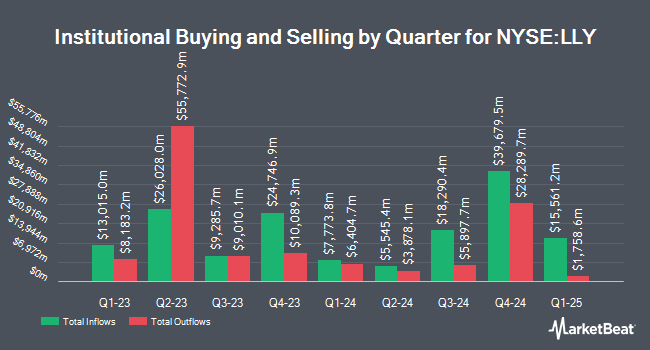

Several other large investors have also made changes to their positions in the company. Geode Capital Management LLC lifted its stake in shares of Eli Lilly and Company by 0.5% during the third quarter. Geode Capital Management LLC now owns 17,090,971 shares of the company's stock valued at $15,089,563,000 after acquiring an additional 85,823 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its stake in shares of Eli Lilly and Company by 2.6% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 6,115,504 shares of the company's stock valued at $5,417,970,000 after acquiring an additional 157,741 shares during the period. Fisher Asset Management LLC lifted its stake in shares of Eli Lilly and Company by 3.5% during the fourth quarter. Fisher Asset Management LLC now owns 5,236,108 shares of the company's stock valued at $4,042,276,000 after acquiring an additional 178,007 shares during the period. Proficio Capital Partners LLC lifted its stake in shares of Eli Lilly and Company by 100,387.1% during the fourth quarter. Proficio Capital Partners LLC now owns 5,202,215 shares of the company's stock valued at $4,016,110,000 after acquiring an additional 5,197,038 shares during the period. Finally, Charles Schwab Investment Management Inc. lifted its stake in shares of Eli Lilly and Company by 4.1% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 5,035,084 shares of the company's stock valued at $3,887,085,000 after acquiring an additional 199,864 shares during the period. Institutional investors and hedge funds own 82.53% of the company's stock.

Eli Lilly and Company Stock Up 2.1 %

LLY stock opened at $930.12 on Thursday. The company has a debt-to-equity ratio of 2.00, a current ratio of 1.15 and a quick ratio of 0.97. The stock has a market capitalization of $881.91 billion, a P/E ratio of 79.43, a P/E/G ratio of 1.40 and a beta of 0.42. The business has a 50-day moving average of $822.55 and a 200-day moving average of $848.61. Eli Lilly and Company has a fifty-two week low of $711.40 and a fifty-two week high of $972.53.

Eli Lilly and Company (NYSE:LLY - Get Free Report) last posted its quarterly earnings data on Thursday, February 6th. The company reported $5.32 earnings per share for the quarter, missing the consensus estimate of $5.45 by ($0.13). Eli Lilly and Company had a return on equity of 85.24% and a net margin of 23.51%. On average, sell-side analysts anticipate that Eli Lilly and Company will post 23.48 earnings per share for the current fiscal year.

Eli Lilly and Company declared that its Board of Directors has approved a stock repurchase plan on Monday, December 9th that authorizes the company to buyback $15.00 billion in shares. This buyback authorization authorizes the company to purchase up to 2% of its shares through open market purchases. Shares buyback plans are usually a sign that the company's board believes its stock is undervalued.

Eli Lilly and Company Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Monday, March 10th. Investors of record on Friday, February 14th will be given a dividend of $1.50 per share. The ex-dividend date is Friday, February 14th. This is a boost from Eli Lilly and Company's previous quarterly dividend of $1.30. This represents a $6.00 annualized dividend and a yield of 0.65%. Eli Lilly and Company's dividend payout ratio is 51.24%.

Analyst Ratings Changes

LLY has been the subject of a number of recent analyst reports. Berenberg Bank set a $970.00 price objective on Eli Lilly and Company in a report on Thursday, January 16th. Citigroup dropped their price objective on Eli Lilly and Company from $1,250.00 to $1,190.00 and set a "buy" rating for the company in a report on Tuesday, January 28th. Truist Financial upped their price objective on Eli Lilly and Company from $1,029.00 to $1,038.00 and gave the company a "buy" rating in a report on Monday, February 3rd. Bank of America reiterated a "buy" rating and issued a $997.00 price objective on shares of Eli Lilly and Company in a report on Tuesday, December 10th. Finally, Wolfe Research initiated coverage on Eli Lilly and Company in a report on Friday, November 15th. They issued an "outperform" rating and a $1,000.00 price objective for the company. Three analysts have rated the stock with a hold rating and eighteen have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $1,007.50.

Get Our Latest Report on LLY

Eli Lilly and Company Company Profile

(

Free Report)

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals worldwide. The company offers Basaglar, Humalog, Humalog Mix 75/25, Humalog U-100, Humalog U-200, Humalog Mix 50/50, insulin lispro, insulin lispro protamine, insulin lispro mix 75/25, Humulin, Humulin 70/30, Humulin N, Humulin R, and Humulin U-500 for diabetes; Jardiance, Mounjaro, and Trulicity for type 2 diabetes; and Zepbound for obesity.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Eli Lilly and Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eli Lilly and Company wasn't on the list.

While Eli Lilly and Company currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report