Lecap Asset Management Ltd. lowered its position in shares of BellRing Brands, Inc. (NYSE:BRBR - Free Report) by 86.7% during the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 3,299 shares of the company's stock after selling 21,428 shares during the period. Lecap Asset Management Ltd.'s holdings in BellRing Brands were worth $249,000 as of its most recent SEC filing.

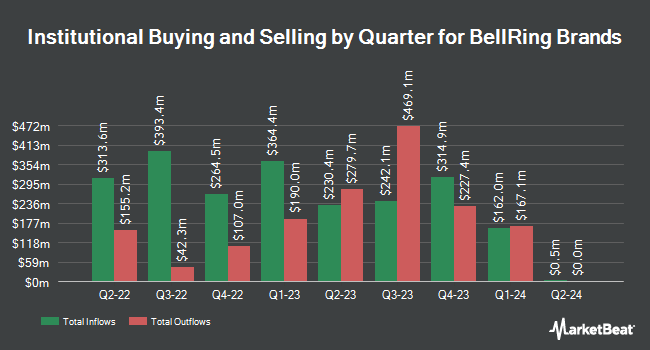

A number of other hedge funds also recently made changes to their positions in BRBR. V Square Quantitative Management LLC bought a new stake in shares of BellRing Brands in the third quarter worth $31,000. UMB Bank n.a. increased its stake in shares of BellRing Brands by 69.4% in the fourth quarter. UMB Bank n.a. now owns 571 shares of the company's stock worth $43,000 after buying an additional 234 shares during the last quarter. Farther Finance Advisors LLC increased its stake in BellRing Brands by 243.1% during the third quarter. Farther Finance Advisors LLC now owns 669 shares of the company's stock valued at $41,000 after purchasing an additional 474 shares during the last quarter. E Fund Management Hong Kong Co. Ltd. bought a new stake in BellRing Brands during the fourth quarter valued at $52,000. Finally, Truvestments Capital LLC bought a new stake in BellRing Brands during the third quarter valued at $44,000. Hedge funds and other institutional investors own 94.97% of the company's stock.

BellRing Brands Price Performance

Shares of BRBR traded up $0.71 on Wednesday, reaching $76.87. 668,784 shares of the stock traded hands, compared to its average volume of 1,173,503. The firm has a market cap of $9.90 billion, a price-to-earnings ratio of 36.09, a P/E/G ratio of 2.34 and a beta of 0.86. BellRing Brands, Inc. has a 12 month low of $48.06 and a 12 month high of $80.67. The stock's 50-day moving average price is $75.85 and its 200-day moving average price is $67.17.

BellRing Brands (NYSE:BRBR - Get Free Report) last announced its quarterly earnings results on Monday, February 3rd. The company reported $0.58 EPS for the quarter, beating the consensus estimate of $0.47 by $0.11. BellRing Brands had a negative return on equity of 130.14% and a net margin of 13.32%. As a group, equities research analysts forecast that BellRing Brands, Inc. will post 2.23 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several analysts have weighed in on BRBR shares. Mizuho boosted their target price on shares of BellRing Brands from $80.00 to $85.00 and gave the company an "outperform" rating in a research note on Thursday, February 6th. Truist Financial boosted their target price on shares of BellRing Brands from $60.00 to $75.00 and gave the company a "hold" rating in a research note on Wednesday, November 20th. DA Davidson reiterated a "neutral" rating and set a $75.00 target price on shares of BellRing Brands in a research note on Tuesday, November 19th. Evercore ISI boosted their price target on shares of BellRing Brands from $70.00 to $78.00 and gave the company an "outperform" rating in a report on Wednesday, November 20th. Finally, Barclays boosted their price target on shares of BellRing Brands from $79.00 to $85.00 and gave the company an "overweight" rating in a report on Tuesday, February 4th. Three analysts have rated the stock with a hold rating and twelve have issued a buy rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus target price of $77.87.

Read Our Latest Report on BRBR

Insider Activity at BellRing Brands

In other BellRing Brands news, Director Robert V. Vitale sold 5,100 shares of the business's stock in a transaction on Monday, February 10th. The stock was sold at an average price of $75.30, for a total value of $384,030.00. Following the transaction, the director now owns 1,166,691 shares of the company's stock, valued at approximately $87,851,832.30. The trade was a 0.44 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. 1.07% of the stock is owned by insiders.

BellRing Brands Company Profile

(

Free Report)

BellRing Brands, Inc, together with its subsidiaries, provides various nutrition products in the United States. The company offers ready-to-drink (RTD) protein shakes, other RTD beverages, powders, nutrition bars, and other products primarily under the Premier Protein and Dymatize brands. It distributes its products through club, food, drug, mass, eCommerce, specialty, and convenience channels.

Recommended Stories

Before you consider BellRing Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BellRing Brands wasn't on the list.

While BellRing Brands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.