Charles Schwab Investment Management Inc. boosted its position in BellRing Brands, Inc. (NYSE:BRBR - Free Report) by 35.7% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 1,267,283 shares of the company's stock after buying an additional 333,287 shares during the period. Charles Schwab Investment Management Inc. owned approximately 0.98% of BellRing Brands worth $76,949,000 at the end of the most recent quarter.

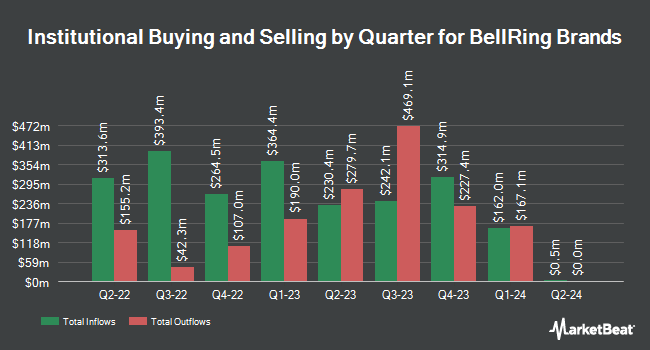

A number of other institutional investors have also bought and sold shares of BRBR. BOKF NA boosted its holdings in shares of BellRing Brands by 229.2% during the 1st quarter. BOKF NA now owns 2,189 shares of the company's stock worth $130,000 after buying an additional 1,524 shares in the last quarter. GAMMA Investing LLC raised its holdings in shares of BellRing Brands by 165.3% during the second quarter. GAMMA Investing LLC now owns 987 shares of the company's stock valued at $56,000 after purchasing an additional 615 shares during the period. First Hawaiian Bank boosted its position in shares of BellRing Brands by 129.9% during the 2nd quarter. First Hawaiian Bank now owns 14,613 shares of the company's stock worth $835,000 after purchasing an additional 8,256 shares in the last quarter. Opal Wealth Advisors LLC acquired a new stake in shares of BellRing Brands in the 2nd quarter valued at about $28,000. Finally, M&G Plc increased its position in BellRing Brands by 12.4% in the 2nd quarter. M&G Plc now owns 157,181 shares of the company's stock valued at $8,959,000 after buying an additional 17,383 shares in the last quarter. Institutional investors own 94.97% of the company's stock.

Analysts Set New Price Targets

Several brokerages have issued reports on BRBR. Jefferies Financial Group increased their price target on BellRing Brands from $61.00 to $84.00 and gave the stock a "buy" rating in a report on Thursday, November 14th. Deutsche Bank Aktiengesellschaft increased their target price on BellRing Brands from $73.00 to $77.00 and gave the stock a "buy" rating in a report on Wednesday, November 20th. Mizuho upped their price objective on shares of BellRing Brands from $72.00 to $80.00 and gave the stock an "outperform" rating in a report on Wednesday, November 20th. Barclays lifted their price objective on shares of BellRing Brands from $74.00 to $79.00 and gave the company an "overweight" rating in a report on Thursday, November 21st. Finally, Citigroup upped their target price on shares of BellRing Brands from $72.00 to $83.00 and gave the stock a "buy" rating in a report on Wednesday, November 20th. Three research analysts have rated the stock with a hold rating and twelve have given a buy rating to the stock. According to MarketBeat.com, BellRing Brands has a consensus rating of "Moderate Buy" and an average target price of $75.60.

Get Our Latest Stock Report on BellRing Brands

BellRing Brands Stock Performance

NYSE:BRBR traded down $1.63 during trading on Thursday, reaching $77.16. The company's stock had a trading volume of 847,711 shares, compared to its average volume of 1,210,803. BellRing Brands, Inc. has a 12 month low of $48.06 and a 12 month high of $79.90. The firm has a market cap of $9.97 billion, a price-to-earnings ratio of 41.26, a price-to-earnings-growth ratio of 2.58 and a beta of 0.84. The firm has a 50 day moving average of $67.10 and a 200-day moving average of $59.85.

BellRing Brands (NYSE:BRBR - Get Free Report) last posted its quarterly earnings results on Monday, November 18th. The company reported $0.51 earnings per share for the quarter, beating the consensus estimate of $0.50 by $0.01. The company had revenue of $555.80 million during the quarter, compared to analyst estimates of $545.00 million. BellRing Brands had a net margin of 12.35% and a negative return on equity of 103.89%. The firm's revenue for the quarter was up 17.6% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.41 earnings per share. Equities research analysts forecast that BellRing Brands, Inc. will post 2.16 earnings per share for the current fiscal year.

BellRing Brands Company Profile

(

Free Report)

BellRing Brands, Inc, together with its subsidiaries, provides various nutrition products in the United States. The company offers ready-to-drink (RTD) protein shakes, other RTD beverages, powders, nutrition bars, and other products primarily under the Premier Protein and Dymatize brands. It distributes its products through club, food, drug, mass, eCommerce, specialty, and convenience channels.

Recommended Stories

Before you consider BellRing Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BellRing Brands wasn't on the list.

While BellRing Brands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.