NetEase (NASDAQ:NTES - Free Report) had its target price reduced by Benchmark from $120.00 to $105.00 in a research note released on Friday,Benzinga reports. They currently have a buy rating on the technology company's stock.

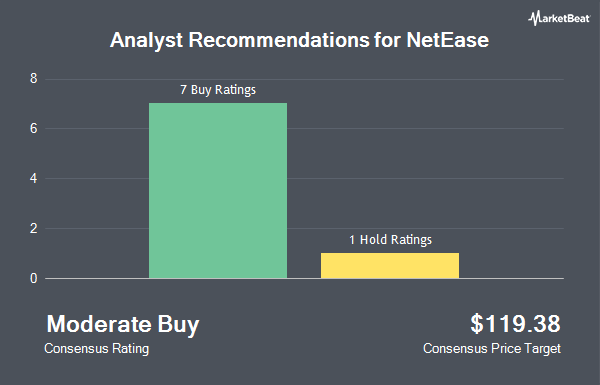

NTES has been the subject of several other research reports. Barclays reduced their price objective on shares of NetEase from $104.00 to $82.00 and set an "equal weight" rating for the company in a report on Monday, August 26th. Bank of America dropped their target price on NetEase from $142.00 to $120.00 and set a "buy" rating on the stock in a report on Friday, August 23rd. Jefferies Financial Group dropped their price objective on NetEase from $126.00 to $103.00 and set a "buy" rating on the stock in a report on Thursday, August 22nd. Finally, StockNews.com downgraded NetEase from a "strong-buy" rating to a "buy" rating in a report on Saturday, July 20th. Two analysts have rated the stock with a hold rating and six have issued a buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $107.29.

Check Out Our Latest Analysis on NetEase

NetEase Stock Up 1.5 %

Shares of NASDAQ NTES traded up $1.27 during trading on Friday, reaching $85.49. 2,038,372 shares of the stock were exchanged, compared to its average volume of 1,748,095. The business's 50-day moving average price is $83.59 and its 200 day moving average price is $89.09. NetEase has a twelve month low of $75.85 and a twelve month high of $118.89. The company has a market capitalization of $54.90 billion, a price-to-earnings ratio of 13.86, a price-to-earnings-growth ratio of 1.69 and a beta of 0.57.

NetEase (NASDAQ:NTES - Get Free Report) last posted its quarterly earnings results on Thursday, August 22nd. The technology company reported $12.05 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.62 by $10.43. The firm had revenue of $25.49 billion for the quarter, compared to analysts' expectations of $26.01 billion. NetEase had a net margin of 26.98% and a return on equity of 22.30%. The firm's quarterly revenue was up 6.1% on a year-over-year basis. During the same period in the prior year, the company posted $1.75 earnings per share. As a group, sell-side analysts expect that NetEase will post 6.02 earnings per share for the current fiscal year.

NetEase Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, December 13th. Stockholders of record on Friday, November 29th will be paid a dividend of $0.435 per share. This represents a $1.74 dividend on an annualized basis and a dividend yield of 2.04%. The ex-dividend date is Friday, November 29th. NetEase's dividend payout ratio is currently 28.22%.

Institutional Investors Weigh In On NetEase

A number of large investors have recently added to or reduced their stakes in the business. Canada Pension Plan Investment Board grew its holdings in shares of NetEase by 12.4% during the 1st quarter. Canada Pension Plan Investment Board now owns 327,400 shares of the technology company's stock worth $33,876,000 after purchasing an additional 36,000 shares in the last quarter. Lazard Asset Management LLC increased its holdings in NetEase by 804.5% in the first quarter. Lazard Asset Management LLC now owns 792,357 shares of the technology company's stock worth $81,983,000 after purchasing an additional 704,753 shares in the last quarter. Mitsubishi UFJ Trust & Banking Corp increased its holdings in NetEase by 4.7% in the first quarter. Mitsubishi UFJ Trust & Banking Corp now owns 134,344 shares of the technology company's stock worth $13,261,000 after purchasing an additional 6,065 shares in the last quarter. Guinness Asset Management LTD increased its holdings in NetEase by 16.7% in the third quarter. Guinness Asset Management LTD now owns 86,741 shares of the technology company's stock worth $8,111,000 after purchasing an additional 12,410 shares in the last quarter. Finally, Orion Portfolio Solutions LLC grew its stake in NetEase by 79.0% in the first quarter. Orion Portfolio Solutions LLC now owns 12,677 shares of the technology company's stock valued at $1,312,000 after acquiring an additional 5,595 shares during the period. Institutional investors own 11.07% of the company's stock.

About NetEase

(

Get Free Report)

NetEase, Inc engages in online games, music streaming, online intelligent learning services, and internet content services businesses in China and internationally . The company operates through Games and Related Value-Added Services, Youdao, Cloud Music, and Innovative Businesses and Others segments.

Featured Stories

Before you consider NetEase, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NetEase wasn't on the list.

While NetEase currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.