Wasatch Advisors LP raised its position in shares of Benchmark Electronics, Inc. (NYSE:BHE - Free Report) by 19.5% in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 820,493 shares of the technology company's stock after buying an additional 133,602 shares during the period. Wasatch Advisors LP owned about 2.28% of Benchmark Electronics worth $36,364,000 as of its most recent filing with the Securities & Exchange Commission.

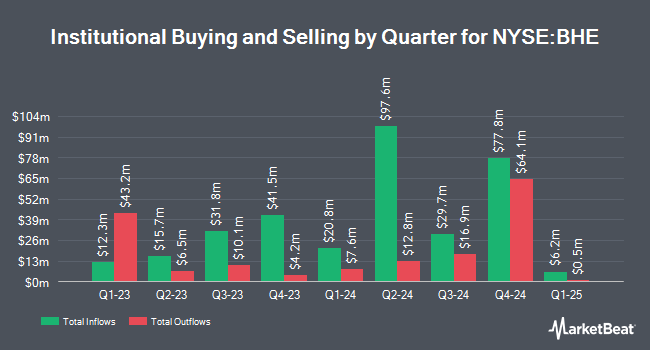

Other institutional investors have also modified their holdings of the company. Pacer Advisors Inc. acquired a new stake in Benchmark Electronics during the 2nd quarter worth approximately $70,424,000. American Century Companies Inc. boosted its holdings in Benchmark Electronics by 176.6% in the second quarter. American Century Companies Inc. now owns 615,036 shares of the technology company's stock valued at $24,269,000 after purchasing an additional 392,699 shares during the period. Millennium Management LLC grew its stake in Benchmark Electronics by 85.9% during the 2nd quarter. Millennium Management LLC now owns 446,176 shares of the technology company's stock worth $17,606,000 after purchasing an additional 206,114 shares in the last quarter. Vanguard Group Inc. increased its holdings in Benchmark Electronics by 3.4% during the 1st quarter. Vanguard Group Inc. now owns 4,845,204 shares of the technology company's stock worth $145,405,000 after purchasing an additional 159,716 shares during the period. Finally, Segall Bryant & Hamill LLC acquired a new stake in Benchmark Electronics in the 3rd quarter valued at about $3,334,000. 92.29% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of research firms recently weighed in on BHE. Needham & Company LLC upped their target price on shares of Benchmark Electronics from $45.00 to $48.00 and gave the stock a "buy" rating in a research note on Friday, November 1st. StockNews.com upgraded shares of Benchmark Electronics from a "hold" rating to a "buy" rating in a report on Tuesday, November 26th. Two investment analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $42.33.

Check Out Our Latest Report on Benchmark Electronics

Benchmark Electronics Stock Up 0.9 %

BHE traded up $0.44 on Friday, reaching $48.49. The company's stock had a trading volume of 97,217 shares, compared to its average volume of 252,310. The company has a quick ratio of 1.45, a current ratio of 2.36 and a debt-to-equity ratio of 0.25. Benchmark Electronics, Inc. has a fifty-two week low of $24.75 and a fifty-two week high of $52.57. The stock has a 50 day moving average of $45.80 and a two-hundred day moving average of $42.93. The company has a market capitalization of $1.75 billion, a price-to-earnings ratio of 28.19 and a beta of 0.97.

Benchmark Electronics (NYSE:BHE - Get Free Report) last posted its earnings results on Wednesday, October 30th. The technology company reported $0.57 EPS for the quarter, beating analysts' consensus estimates of $0.54 by $0.03. Benchmark Electronics had a net margin of 2.32% and a return on equity of 6.81%. The firm had revenue of $658.00 million for the quarter, compared to the consensus estimate of $650.00 million. During the same period last year, the firm posted $0.57 EPS. The company's revenue was down 8.6% on a year-over-year basis.

Benchmark Electronics Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, October 11th. Investors of record on Monday, September 30th were given a $0.17 dividend. The ex-dividend date of this dividend was Monday, September 30th. This is a boost from Benchmark Electronics's previous quarterly dividend of $0.17. This represents a $0.68 dividend on an annualized basis and a dividend yield of 1.40%. Benchmark Electronics's dividend payout ratio is 39.53%.

Insider Buying and Selling

In other Benchmark Electronics news, SVP Rhonda R. Turner sold 6,000 shares of the firm's stock in a transaction on Tuesday, November 19th. The shares were sold at an average price of $46.98, for a total transaction of $281,880.00. Following the transaction, the senior vice president now directly owns 47,991 shares of the company's stock, valued at approximately $2,254,617.18. This trade represents a 11.11 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. Also, CEO Jeff Benck sold 24,000 shares of the company's stock in a transaction dated Tuesday, November 5th. The shares were sold at an average price of $45.90, for a total transaction of $1,101,600.00. Following the completion of the sale, the chief executive officer now directly owns 424,173 shares of the company's stock, valued at $19,469,540.70. The trade was a 5.36 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 2.10% of the stock is currently owned by company insiders.

Benchmark Electronics Profile

(

Free Report)

Benchmark Electronics, Inc, together with its subsidiaries, offers product design, engineering services, technology solutions, and manufacturing services in the Americas, Asia, and Europe. The company provides engineering services and technology solutions, including new product design, prototype, testing, and related engineering services; and custom testing and technology solutions, as well as automation equipment design and build services.

Recommended Stories

Before you consider Benchmark Electronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Benchmark Electronics wasn't on the list.

While Benchmark Electronics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.