Schneider National (NYSE:SNDR - Get Free Report) had its price objective boosted by equities researchers at Benchmark from $32.00 to $34.00 in a research report issued on Wednesday,Benzinga reports. The firm currently has a "buy" rating on the stock. Benchmark's price target would suggest a potential upside of 2.16% from the company's previous close.

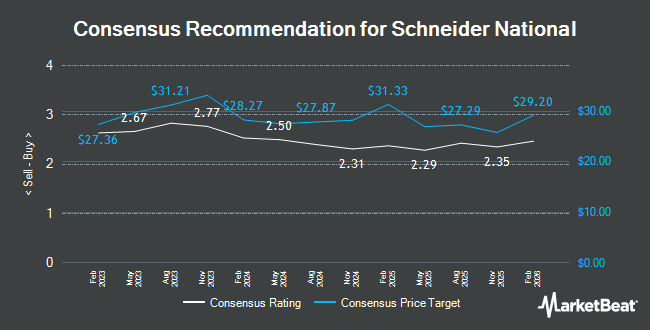

A number of other research firms have also issued reports on SNDR. Stifel Nicolaus boosted their target price on shares of Schneider National from $25.00 to $27.00 and gave the company a "hold" rating in a research note on Monday, November 11th. TD Cowen upped their price target on shares of Schneider National from $32.00 to $34.00 and gave the stock a "buy" rating in a research note on Tuesday. Susquehanna reduced their price target on shares of Schneider National from $29.00 to $26.00 and set a "neutral" rating for the company in a research note on Thursday, November 7th. Bank of America upped their price target on shares of Schneider National from $35.00 to $38.00 and gave the stock a "buy" rating in a research note on Tuesday. Finally, Robert W. Baird upped their price target on shares of Schneider National from $26.00 to $30.00 and gave the stock an "outperform" rating in a research note on Friday, August 2nd. One investment analyst has rated the stock with a sell rating, eight have assigned a hold rating and five have assigned a buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average target price of $29.08.

Get Our Latest Analysis on Schneider National

Schneider National Price Performance

Shares of NYSE:SNDR opened at $33.28 on Wednesday. The company has a quick ratio of 1.53, a current ratio of 1.66 and a debt-to-equity ratio of 0.04. Schneider National has a fifty-two week low of $20.50 and a fifty-two week high of $33.47. The firm has a 50-day simple moving average of $28.87 and a 200 day simple moving average of $26.13. The company has a market cap of $5.83 billion, a PE ratio of 53.68, a P/E/G ratio of 3.88 and a beta of 0.85.

Schneider National (NYSE:SNDR - Get Free Report) last posted its earnings results on Wednesday, November 6th. The company reported $0.18 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.23 by ($0.05). The firm had revenue of $1.32 billion for the quarter, compared to analyst estimates of $1.33 billion. Schneider National had a net margin of 2.10% and a return on equity of 3.92%. On average, sell-side analysts anticipate that Schneider National will post 0.7 EPS for the current year.

Institutional Inflows and Outflows

Several large investors have recently added to or reduced their stakes in SNDR. Vanguard Group Inc. increased its stake in Schneider National by 10.6% in the 1st quarter. Vanguard Group Inc. now owns 4,061,994 shares of the company's stock valued at $91,964,000 after buying an additional 388,913 shares during the period. CANADA LIFE ASSURANCE Co increased its stake in shares of Schneider National by 3.2% during the 1st quarter. CANADA LIFE ASSURANCE Co now owns 19,917 shares of the company's stock worth $451,000 after purchasing an additional 618 shares during the last quarter. Price T Rowe Associates Inc. MD increased its stake in shares of Schneider National by 16.3% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 12,109 shares of the company's stock worth $275,000 after purchasing an additional 1,699 shares during the last quarter. California State Teachers Retirement System increased its stake in shares of Schneider National by 1.7% during the 1st quarter. California State Teachers Retirement System now owns 55,889 shares of the company's stock worth $1,265,000 after purchasing an additional 958 shares during the last quarter. Finally, Tidal Investments LLC acquired a new position in shares of Schneider National during the 1st quarter worth $468,000. Institutional investors and hedge funds own 28.54% of the company's stock.

About Schneider National

(

Get Free Report)

Schneider National, Inc, together with its subsidiaries, provides surface transportation and logistics solutions in the United States, Canada, and Mexico. It operates through three segments: Truckload, Intermodal, and Logistics. The Truckload segment offers over the road freight transportation services primarily through dry van, bulk, temperature-controlled, and flat-bed trailers across either network or dedicated configurations.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Schneider National, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Schneider National wasn't on the list.

While Schneider National currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.