Benjamin Edwards Inc. lifted its position in Teradyne, Inc. (NASDAQ:TER - Free Report) by 1,509.0% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 9,300 shares of the company's stock after acquiring an additional 8,722 shares during the quarter. Benjamin Edwards Inc.'s holdings in Teradyne were worth $1,245,000 at the end of the most recent reporting period.

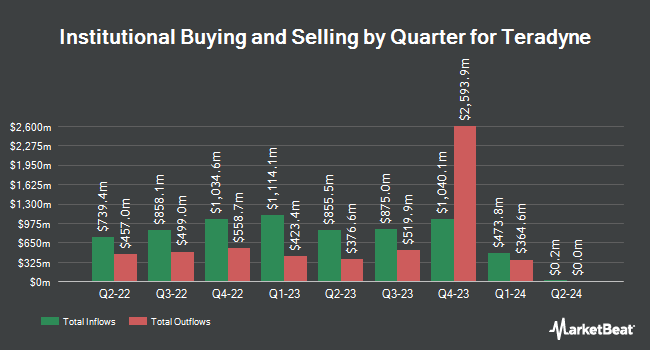

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Cetera Investment Advisers increased its position in shares of Teradyne by 161.6% during the first quarter. Cetera Investment Advisers now owns 19,075 shares of the company's stock valued at $2,152,000 after acquiring an additional 11,782 shares during the last quarter. Cetera Advisors LLC bought a new stake in shares of Teradyne during the 1st quarter worth $427,000. CWM LLC boosted its holdings in shares of Teradyne by 19.7% in the 2nd quarter. CWM LLC now owns 3,621 shares of the company's stock worth $537,000 after buying an additional 595 shares during the last quarter. OLD National Bancorp IN bought a new position in Teradyne during the second quarter valued at about $608,000. Finally, SG Americas Securities LLC increased its holdings in Teradyne by 65.1% during the second quarter. SG Americas Securities LLC now owns 36,515 shares of the company's stock worth $5,415,000 after buying an additional 14,395 shares during the last quarter. Hedge funds and other institutional investors own 99.77% of the company's stock.

Analysts Set New Price Targets

A number of research analysts have weighed in on TER shares. Stifel Nicolaus dropped their target price on shares of Teradyne from $140.00 to $125.00 and set a "hold" rating on the stock in a research note on Friday, October 25th. Craig Hallum reduced their price objective on Teradyne from $124.00 to $111.00 and set a "hold" rating for the company in a report on Friday, October 25th. Evercore ISI boosted their target price on Teradyne from $130.00 to $145.00 and gave the company an "overweight" rating in a research note on Wednesday, October 9th. Northland Securities cut their price target on Teradyne from $126.00 to $117.00 and set a "market perform" rating for the company in a research note on Friday, October 25th. Finally, StockNews.com upgraded Teradyne from a "sell" rating to a "hold" rating in a research note on Sunday, October 27th. One analyst has rated the stock with a sell rating, six have given a hold rating and eight have assigned a buy rating to the company. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $142.62.

Read Our Latest Report on Teradyne

Insider Activity at Teradyne

In other news, CEO Gregory Stephen Smith sold 3,080 shares of the company's stock in a transaction dated Wednesday, September 11th. The stock was sold at an average price of $130.00, for a total value of $400,400.00. Following the completion of the transaction, the chief executive officer now directly owns 83,816 shares in the company, valued at approximately $10,896,080. This represents a 3.54 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, insider Richard John Burns sold 789 shares of the firm's stock in a transaction dated Tuesday, October 1st. The shares were sold at an average price of $132.80, for a total value of $104,779.20. Following the transaction, the insider now directly owns 21,864 shares in the company, valued at approximately $2,903,539.20. This represents a 3.48 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 7,574 shares of company stock valued at $997,203 over the last three months. 0.36% of the stock is owned by corporate insiders.

Teradyne Stock Performance

NASDAQ TER traded up $4.79 on Friday, hitting $118.51. The stock had a trading volume of 3,466,780 shares, compared to its average volume of 2,015,536. The firm has a 50-day moving average of $116.24 and a 200-day moving average of $130.51. The company has a market capitalization of $19.30 billion, a price-to-earnings ratio of 37.62, a price-to-earnings-growth ratio of 2.53 and a beta of 1.51. Teradyne, Inc. has a 52-week low of $91.11 and a 52-week high of $163.21.

Teradyne (NASDAQ:TER - Get Free Report) last posted its quarterly earnings data on Wednesday, October 23rd. The company reported $0.90 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.78 by $0.12. The company had revenue of $737.30 million during the quarter, compared to analyst estimates of $716.40 million. Teradyne had a return on equity of 18.56% and a net margin of 18.75%. The firm's quarterly revenue was up 4.8% on a year-over-year basis. During the same quarter last year, the company earned $0.80 earnings per share. As a group, research analysts anticipate that Teradyne, Inc. will post 3.17 earnings per share for the current fiscal year.

Teradyne Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, December 18th. Investors of record on Monday, November 25th will be given a $0.12 dividend. This represents a $0.48 annualized dividend and a dividend yield of 0.41%. The ex-dividend date is Monday, November 25th. Teradyne's dividend payout ratio (DPR) is 15.24%.

Teradyne declared that its board has approved a stock buyback plan on Monday, November 11th that allows the company to buyback $100.00 million in outstanding shares. This buyback authorization allows the company to reacquire up to 0.6% of its shares through open market purchases. Shares buyback plans are often an indication that the company's board believes its shares are undervalued.

Teradyne Profile

(

Free Report)

Teradyne, Inc designs, develops, manufactures, and sells automated test systems and robotics products worldwide. It operates through four segments; Semiconductor Test, System Test, Robotics, and Wireless Test. The Semiconductor Test segment offers products and services for wafer level and device package testing of semiconductor devices in automotive, industrial, communications, consumer, smartphones, cloud, computer and electronic game, and other applications.

Read More

Before you consider Teradyne, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teradyne wasn't on the list.

While Teradyne currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report