Benjamin Edwards Inc. lifted its position in Intercontinental Exchange, Inc. (NYSE:ICE - Free Report) by 150.4% in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 7,191 shares of the financial services provider's stock after purchasing an additional 4,319 shares during the quarter. Benjamin Edwards Inc.'s holdings in Intercontinental Exchange were worth $1,155,000 as of its most recent SEC filing.

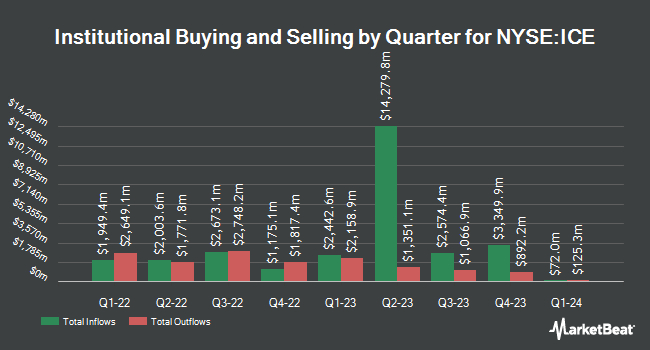

Other institutional investors have also recently modified their holdings of the company. FMR LLC boosted its holdings in Intercontinental Exchange by 44.1% in the third quarter. FMR LLC now owns 7,846,421 shares of the financial services provider's stock valued at $1,260,449,000 after purchasing an additional 2,401,630 shares during the last quarter. Parnassus Investments LLC lifted its holdings in shares of Intercontinental Exchange by 4.0% in the 3rd quarter. Parnassus Investments LLC now owns 7,838,727 shares of the financial services provider's stock valued at $1,259,213,000 after buying an additional 299,037 shares during the period. Legal & General Group Plc boosted its stake in shares of Intercontinental Exchange by 4.5% in the second quarter. Legal & General Group Plc now owns 4,453,286 shares of the financial services provider's stock worth $609,609,000 after buying an additional 191,763 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its stake in shares of Intercontinental Exchange by 9.1% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 3,648,437 shares of the financial services provider's stock worth $586,085,000 after buying an additional 305,220 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. grew its holdings in Intercontinental Exchange by 0.7% during the third quarter. Charles Schwab Investment Management Inc. now owns 3,142,092 shares of the financial services provider's stock worth $504,746,000 after acquiring an additional 21,615 shares during the period. 89.30% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling at Intercontinental Exchange

In other Intercontinental Exchange news, insider Christopher Scott Edmonds sold 602 shares of the company's stock in a transaction on Wednesday, September 18th. The stock was sold at an average price of $162.81, for a total value of $98,011.62. Following the completion of the sale, the insider now directly owns 14,034 shares in the company, valued at $2,284,875.54. This represents a 4.11 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, President Benjamin Jackson sold 5,828 shares of the firm's stock in a transaction on Monday, November 25th. The stock was sold at an average price of $160.00, for a total value of $932,480.00. Following the completion of the sale, the president now directly owns 156,163 shares of the company's stock, valued at $24,986,080. This trade represents a 3.60 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 9,696 shares of company stock worth $1,554,559. Insiders own 1.10% of the company's stock.

Wall Street Analyst Weigh In

ICE has been the topic of several recent research reports. Bank of America upped their price objective on Intercontinental Exchange from $168.00 to $175.00 and gave the stock a "buy" rating in a research report on Thursday, October 3rd. Raymond James downgraded shares of Intercontinental Exchange from a "strong-buy" rating to an "outperform" rating and set a $185.00 price target on the stock. in a report on Monday, October 14th. Piper Sandler raised their price target on shares of Intercontinental Exchange from $170.00 to $180.00 and gave the company an "overweight" rating in a research report on Tuesday, October 8th. Morgan Stanley upped their price objective on shares of Intercontinental Exchange from $160.00 to $174.00 and gave the stock an "equal weight" rating in a research report on Thursday, October 17th. Finally, The Goldman Sachs Group raised their target price on Intercontinental Exchange from $171.00 to $185.00 and gave the company a "buy" rating in a research report on Thursday, October 3rd. Three research analysts have rated the stock with a hold rating and thirteen have assigned a buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $174.13.

Read Our Latest Analysis on ICE

Intercontinental Exchange Price Performance

NYSE ICE traded down $0.44 during mid-day trading on Friday, hitting $155.93. The stock had a trading volume of 3,274,872 shares, compared to its average volume of 2,696,783. The firm's 50 day moving average is $160.38 and its 200 day moving average is $152.63. The company has a debt-to-equity ratio of 0.68, a current ratio of 1.00 and a quick ratio of 1.00. The stock has a market capitalization of $89.53 billion, a price-to-earnings ratio of 36.95, a PEG ratio of 2.58 and a beta of 1.08. Intercontinental Exchange, Inc. has a twelve month low of $111.82 and a twelve month high of $167.99.

Intercontinental Exchange (NYSE:ICE - Get Free Report) last released its earnings results on Thursday, October 31st. The financial services provider reported $1.55 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $1.55. The business had revenue of $2.35 billion during the quarter, compared to analyst estimates of $2.35 billion. Intercontinental Exchange had a net margin of 21.31% and a return on equity of 12.75%. The company's revenue for the quarter was up 17.3% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $1.46 earnings per share. Equities research analysts forecast that Intercontinental Exchange, Inc. will post 6.07 earnings per share for the current fiscal year.

About Intercontinental Exchange

(

Free Report)

Intercontinental Exchange, Inc, together with its subsidiaries, engages in the provision of market infrastructure, data services, and technology solutions for financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, Singapore, India, Abu Dhabi, Israel, and Canada.

Featured Stories

Before you consider Intercontinental Exchange, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intercontinental Exchange wasn't on the list.

While Intercontinental Exchange currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report